Banking-as-a-Service and How it Works

During the last few years, the fintech scene has witnessed the emergence of new digital banking products, created by the so-called neobanks. The latter have grown rapidly thanks to putting all their forces into improving design and promoting technology and innovation, as well as using other institutions’ banking licenses, back-end solutions, and expertise in controlling funds. The model proved itself to be successful to the extent that some of the biggest tech giants, like Apple, started following it.

All these fintech companies rely on Banking-as-a-Service provided by licensed banks with years of experience in financial operations and building banking products that are cost-efficient, fast, and easy to use.

The Capgemini’s World Banking Report shows that the agile neobanks exhibit the following economic benefits:

- New customers acquisition cost for a neobank varies between $1 and $38, whereas old chain banks can spend up to $200 on capturing a new client;

- SaaS-powered products, such as open platforms, launch new products faster and partner with other businesses to achieve critical mass much faster;

- The modular structure of neobanks, where SaaS is a connected module, allows for adding new integrations to implement the Open Banking idea in full.

New challenger banks have pushed the European fintech scene towards the development of Open Banking, where Banking-as-a-Service is a core module in the microservice-based architecture. Particular promotion was given to the OpenX standard, where BaaS providers are an integral core component.

Banking-as-a-Service gradually became a centerpiece in the process of banking and fintech modernization, digitalization, accessibility growth, and user experience improvement.

Why Does BaaS Exist?

Despite quite a few successful neobank stories, there’s still a huge need for innovative banking products for individual customers, as well as for the corporate sector. A large number of people that are currently underserved or not served by banks at all need an efficient, simple and powerful product with excellent usability, for comfortable onboarding. Hence, there’s demand and space for new financial products.

However, starting a new operational financial service in the old way requires a huge investment of time, money, and workforce, and is highly regulated to ensure the desired level of security. Even having a partner bank in mind, a Money Service Business (MSB) registration would take up to two years, followed by more than a year of check-ups and evaluation by the potential partner bank. Moreover, the startup has to design and build subsystems to become launch-worthy.

Banking-as-a-Service deals with the problem by offering an integrated product to future financial service providers. It has been built, tested, licensed, and designed for a fast and easy start. This corporate financial service does not require huge research, design, and marketing and can be launched using a BaaS provider within a few weeks.

How Does Banking-as-a-service Work?

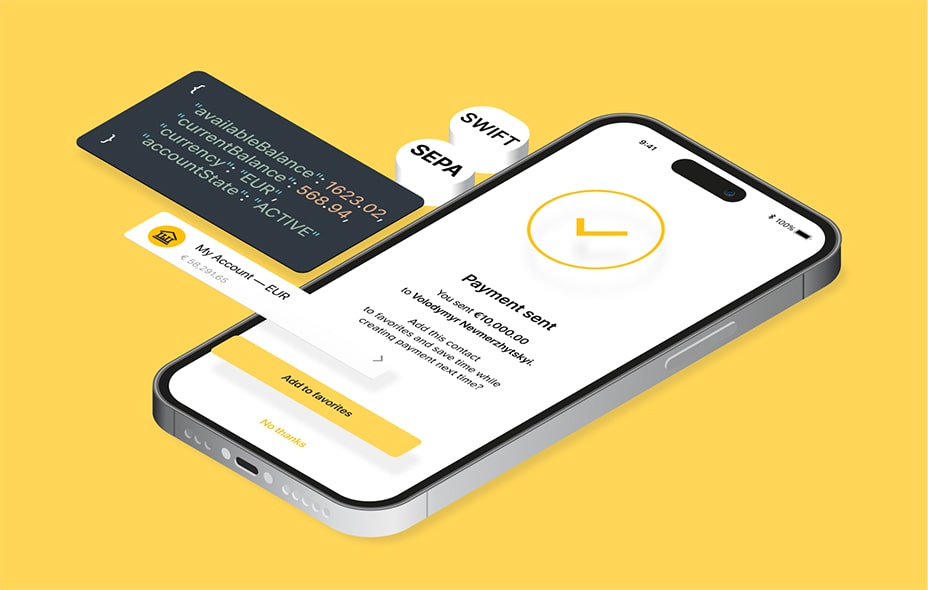

BaaS became a foundation for quick and easy deployment of new financial services by fintech startups or corporate money management systems for large enterprises. Essentially, Banking-as-a-Service providers high-level APIs to build banking products and translate the inputs and outputs into the highly-regulated and strict low-level language of time-proven licensed banking infrastructure providers.

Let’s see how this works in detail, on a daily functionality any banking application has.

- Alex authenticates through his mobile app and requests a transaction of 20 euros to be sent to Anna.

- The mobile app sends a request to the BaaS layer server.

- The Banking-as-a-Service receives the request, matches Anna’s contact with an IBAN, checks Alex’s account on whether it has enough funds, and whether the transaction is within the account’s limits. Nothing too hard. Once it is sure, it sends a request to the back-end, and here the serious business has begun.

- The bank’s infrastructure performs all the checks once again, runs an IBAN integrity check, verifies the sender and recipient names against the account information it stores, runs the transaction request through filters to catch potentially malicious transactions, searches for the recipient bank and its correspondent banks if any, builds a routing for a SEPA transfer, forms a SEPA message, shuffles debit and credit table records or fires up arbitrage process with the other bank if there are agreements for that…

You have now taken a glance at just the smallest part of procedures that should be run for a simplest banking task. Banking-as-a-Service simplifies access to banking functionality for developers and allows fast and easy building of new products.

Thanks to its API nature, it can also interact with modules other than the account owner’s banking app, such as credit or insurance agencies, mortgage companies, finance planning applications — anything that can integrate using Open Banking or OpenX standards. These integrations do not only speed up various financial activities of the customer but also make several services, like insurance, cheaper and less risky for the providers.

Most of the banking process participants view Banking-as-a-Service as a single module integrated within their ecosystem. Thus, BaaS is not necessarily provided by a third party or market player. BaaS can be an integral part of either the banking infrastructure, the medium of customer’s interaction, or can be sold or leased to any market player.

For example, the entire ecosystem may belong to a single bank, from the licensing and KYC perspectives, to the banking apps. However, if it is built to the latest modular technology standards, it implements OpenX and re-uses code here and there. Deep within the bank’s system there is an actual BaaS module, built to be used solely by the same bank.

Another example refers to white-label banking providers that have the same integrated infrastructure, which is provided to other companies under their respective trademarks. The customers use banking apps and enjoy easy control over their funds by a company and don’t even realize that it is not the company who builds the products and provides services, but rather the contracted white label banking solution.

What Is Banking-as-a-service Used for?

Naturally, the most popular application of BaaS is the new fintech companies and neobanks that build their highly advantageous offers with the help of APIs and legal infrastructure provided by other financial establishments. But there are quite a few more applications:

- Virtual banks. Big and established banks with a variety of services, build a simplified product for most everyday users while using the main bank’s licenses and credit portfolio. Among such products is Simple by BBVA, RaiMobile by Raiffeisen Group and Monobank by Universal Bank Ukraine;

- Standalone accounts. Some companies provide users with actual banking accounts they can send and receive money from, while not positioning themselves as any kind of banking service provider. Among these are airline and ridesharing co-branded products, student loan refinancing companies and valuable asset management platforms;

- Solidification and upgrade of outdated tech. Lots of old banks are relying on BaaS for internal usage for moving from legacy technology stack to a modern approach. This especially applies to big banks that have acquired smaller banks and have multiple outdated cores, inefficiently connected to each other.

Open Banking Is There Thanks to BaaS

While BaaS is only a module in the integral modern-day banking service, the data it possesses plays a central role in the development of Open Banking and Open X products and services. The ability of BaaS cores to provide granular and conglomerated or statistical data in either personalized or anonymous form, together with the ability to perform minor actions with the account holder with their consent, often makes BaaS a single necessary connection point to build products that have never been possible before:

- Personal budgeting applications gain precise and immediate access to spending data. Not only they allow for a deeper and more correct bookkeeping, but also provide expense planning, where the apps can analyze seasonal and weekly habits and plan the future budget accordingly;

- Banking aggregators allow users to control multiple accounts in different banks and get a single access point to customers’ finances across banks.

- Digital banking apps enable customers to scan a cheque with their smartphone camera, convert it into a digital cheque and cash to any of their banking accounts in a matter of seconds, without visiting the bank personally.

Around the globe, multiple jurisdictions follow Europe with regards to the 2nd Amendment to the Payment Services Directive, and implement their respective vision of the Open Banking concept. Multinational banks and banking apps rely on Banking-as-a-Service as an aggregator level between bank cores in different countries and a single mobile application available in entire regions, such as Africa or Southeast Asia.

The Future of BaaS

The microservice-based architecture of modern digital banking allows for a seamless migration to new updated versions of the modules. Just as the migration from Open Banking to Open X doesn’t disrupt the user experience, BaaS platforms can already add new functions and strengthen security measures.

BaaS also benefits cyber-security, as adding new authentication and anti-fraud measures no longer require redesigning the single core. The integration of new digital fingerprints allowing ID-less strong authentication will be a matter of weeks or even days.

Banks that use BaaS will be able to segment their product offer and satisfy different customer needs with multiple solutions that suit them better, while having a single powerful back-end.

Customers will be able to consolidate their credit portfolio in a single point of access by easily connecting to multiple BaaS-enabled banking platforms.

New AI-based products will reform banking to be instant, eliminate the need for human contact and make it secure as never before, while providing new functions that give customers a high degree of personalization of their everyday banking experience.