Fintech Risk Management and Regulation in Europe

Fintech and modern banking are out there to make everyone’s financial lives much easier. They allow users to be in precise and instant control over their spendings and plan their financial resources ahead. People benefit from the new comforting features, such as online banking, contactless and recurring payments, card wallet services, and more.

While all these new services provide easy access to people’s money, it is very important to understand that they also increase the room for potential fraudulent actions, money heist, and operational risk for the banking institution. To mitigate the possibilities, banks, local and EU-wide regulators introduce various fintech risk regulation measures at all stages of the government-bank-consumer cooperation.

What is Fintech Risk Management

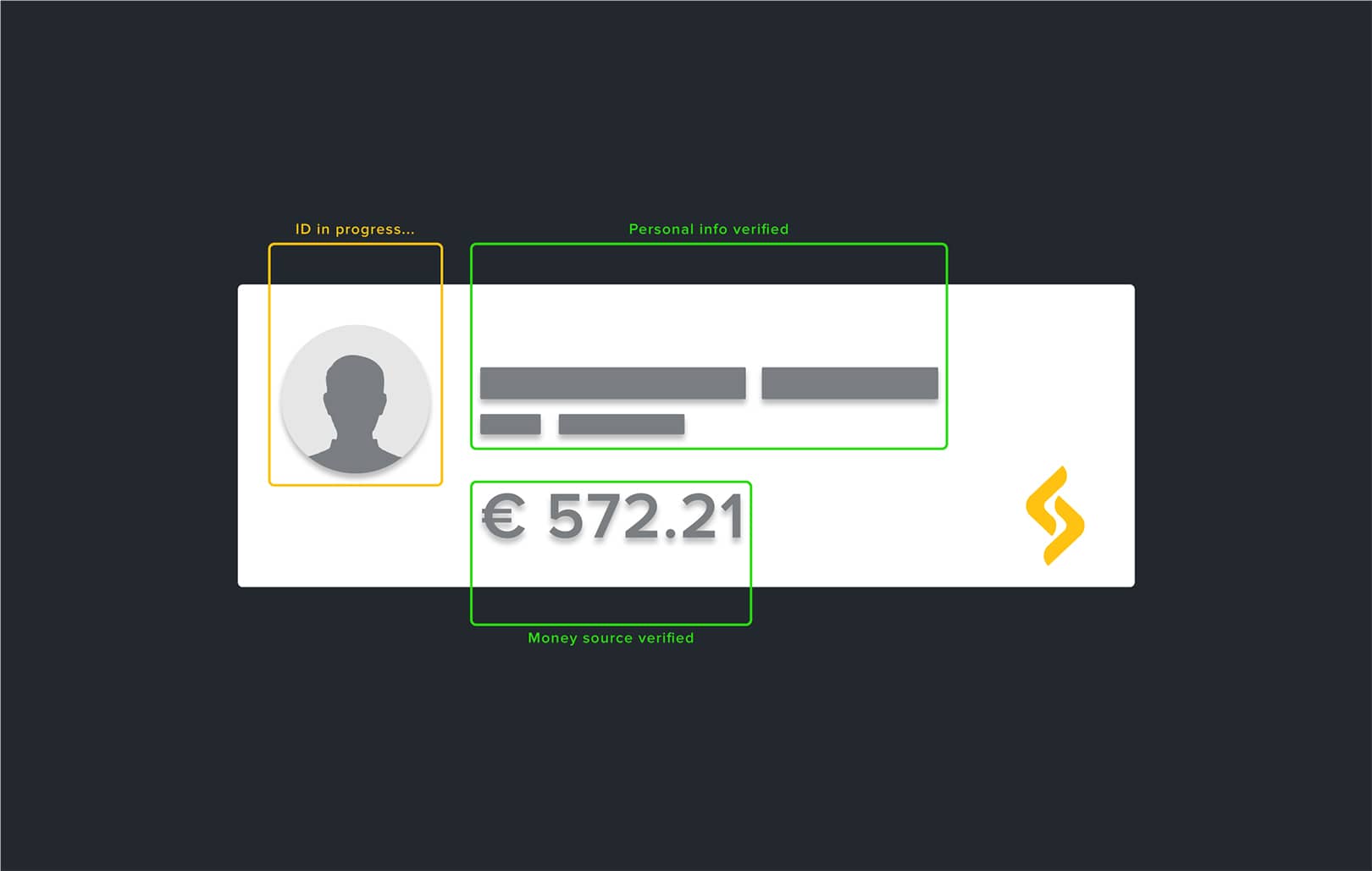

Fintech risk management procedures are introduced to analyze user data and actions, in order to prove their authenticity and real intentions. Information, provided by the customers is also going through a KYC processing to prove both their identity and the financial possibility to use the services they are opting in for.

With correctly set up fintech risk management processes, a bank institution can identify potentially fraudulent registrations and actions, insolvent customers, and cyberattacks in a matter of seconds by means of modern AI neural networks, AML detection algorithms and manual checks of randomly selected actions. All this also allows bank institutions and payment providers to comply with the local Fintech Risk Regulation.

Why Fintech Risk Management is Important for Banks?

By knowing their customers deeper than just the identity, banking institutions understand, for instance, how much funds a customer earns and can deposit, and how much they can really return in case of a credit or loan. Fintech risk assessments allow money institutions to predict the number of funds they would need for sustainable financing of their credit portfolio, and to put the leftovers into work elsewhere, further decreasing the diversification risk.

Why Fintech Risk Regulations are Enforced by European Countries?

Although banks are interested in running their operations problems-free and are quite free in selecting their respective fintech risk management measures, their ability to give back all funds they owe to customers is still ensured by the local central bank, and, respectively, the Central Bank of the EU. To be certain that any major fraud action doesn’t make a bank fall and put the whole country’s financial system under greater load, the EU jurisdictions impose fintech risk regulation schemes.

These make sure that all the banks are securing sustainable financing for everyday operational activities, manage their operational risks, while not going too deep into the customers’ insights. For instance, some countries require an in-person visit of a new customer to open a bank account, as having seen the real human being expressing its need and consent to have a new bank account is letting a lot of load from the fintech risk management systems at once.

Why Fintech Risk Management is Essential to You?

Having a developed fintech risk regulation in your country and well-set fintech risk management regulation procedures in your banking institution drastically increase the safety of all your stored funds. Thanks to the digitalization and rapid processing of the actions, you will most probably be safe from losses even if the details of your payment card have leaked.

Fintech risk management algorithms won’t allow anyone to pay from your account in multiple under-limit transactions and will block any attempt to withdraw funds using your credentials from a point in the world other than where you’re currently present. By not giving credits and loans to people who can’t cover them, your bank makes sure that it has all your balance in its entirety, should you ever withdraw it all at once.