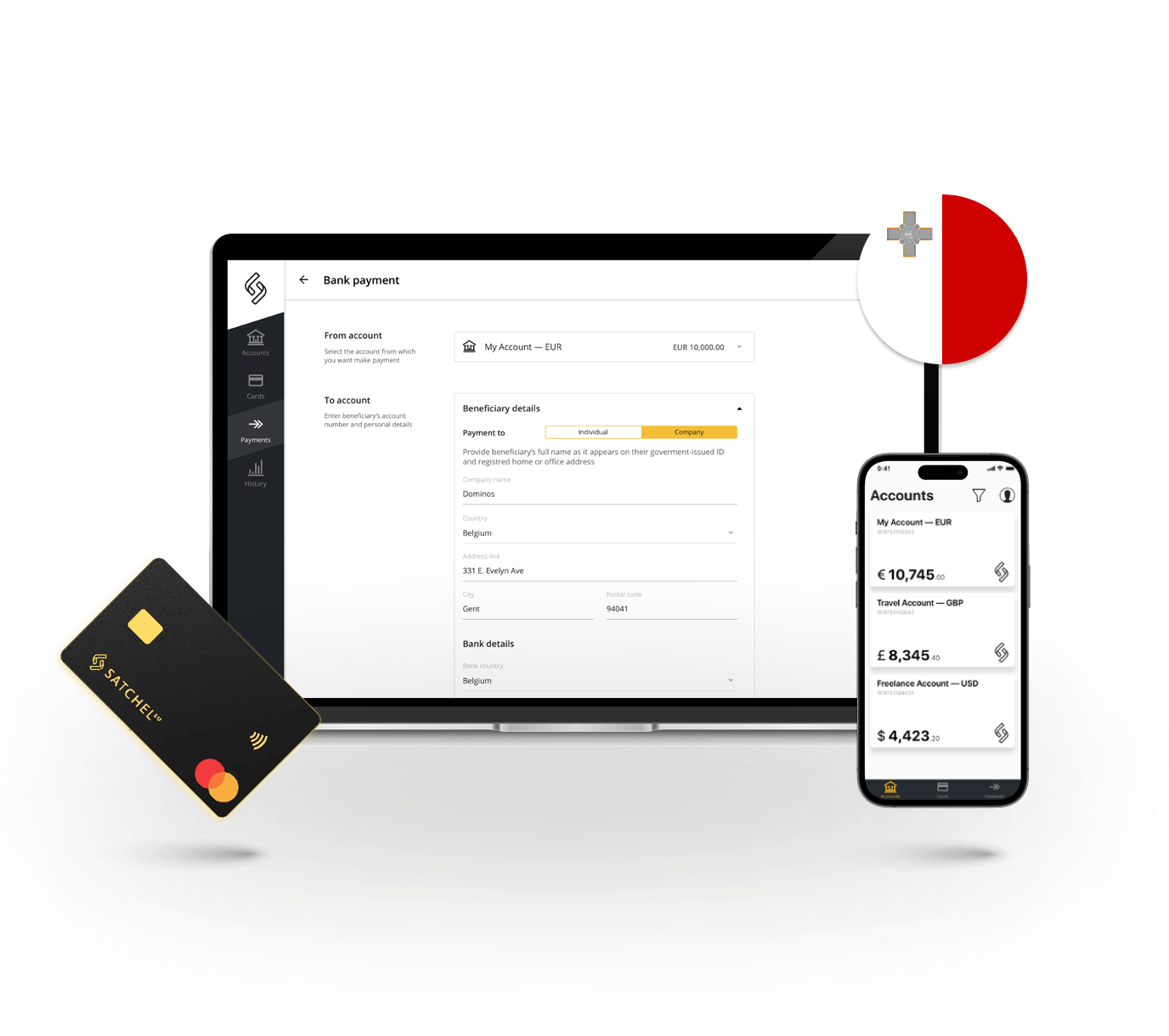

Account opening online in Malta

Open an account in Malta online. Remote accounts for EU and non-EU residents in Malta.

Solutions for a range of industries

Retail & E-commerce

Solutions for companies doing business online, to accept their payments from all over the globe

Small Businesses & Companies

Pay employees, get paid and manage your cash flow overseas in one place

Entrepreneurs & Freelancers

No matter where your clients are located, with Satchel you will get paid in a fast and simple way

Personal finance

Day-to-day simple and secure money management

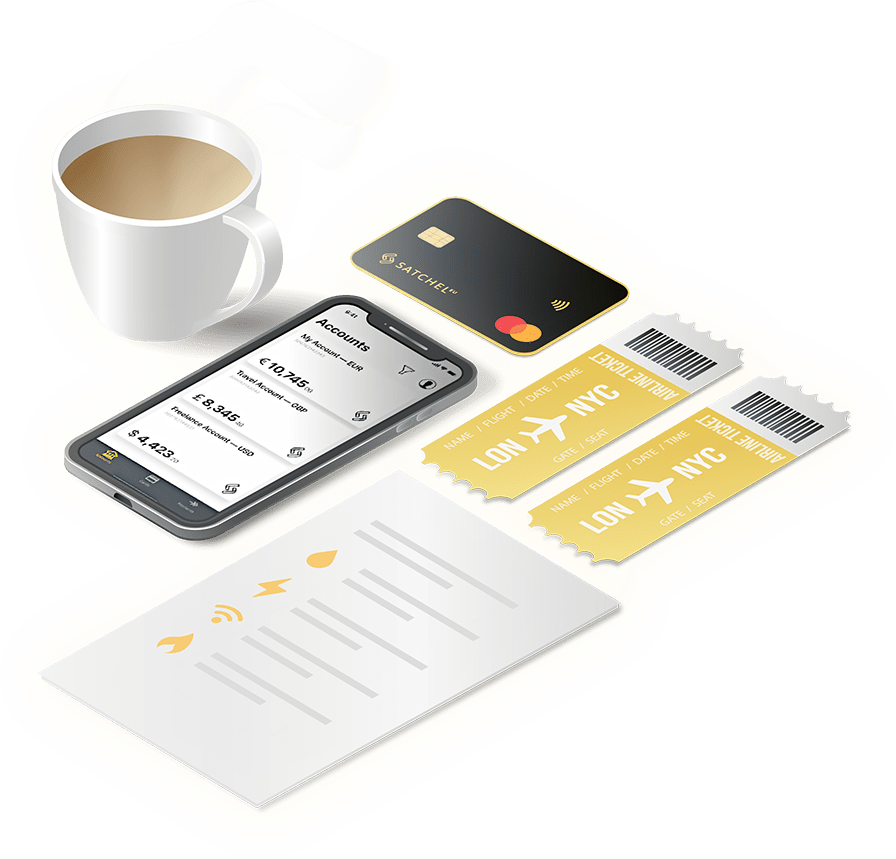

Personal account in Malta online

- Open account remotely with just two personal documents

- Get a unique European IBAN

- Virtual and physical Mastercard tailored to your needs

- No hidden fees and personalized pricing plans

Solutions for any needs

Being an expat is easy

Seamless transfers and conversions from anywhere in the world in 36 currencies

Fast and convenient operations

Pay and withdraw money at any location around the world

An alternative to your local bank

Enjoy a more agile and fully-digital money management

Business account in Malta online

- Open an account online without waiting in line

- Get a unique European IBAN

- Start transacting in 38 currencies through SWIFT and SEPA

- Enjoy personalised customer support

- Cover all business expenses with Satchel payment cards

Solutions for corporate needs

Save funds

Deposit funds for future business purchases and other expenses

Transact with ease

Manage your daily transactions with clients, partners, and suppliers

Invest smartly

Invest your dividends or extra earnings to increase corporate capital

Simplified accounting

Keep track of your account balance and transaction history for efficient and transparent bookkeeping

Open an account online in Malta in 3 steps

Submit your online application with just two personal documents.

We will process the application remotely within 1-3 business days.

Welcome aboard!

With Satchel you can

Collect

A simple way to receive money worldwide

Pay

Convenient transfers internationally

Innovate

A digital banking platform for developing business needs

Convert

Currency exchange without hidden fees

Manage

Useful features for full control over your funds

Get in touch with Satchel

Submit the form and we will reach you on the next business day.

FAQ

Getting an online account in Malta is now hassle-free.

You have two options: traditional banks or neobanks / EMIs, such as Satchel. The accounts provided by either of these choices offer the same features, including a European IBAN for essential financial activities for your company, such as payments and transfers. The most significant distinction between them is in terms of convenience, ease, and speed of account opening.

With an EMI, the whole process can be completed online: filing the form, scanning / uploading documents, and going through onboarding. At Satchel, corporate and private account options are accessible to both EU and non-EU residents. So you do not need to travel overseas to open the account in person.

Each payment account from Satchel has a unique European IBAN, allowing our customers to access the European and global financial ecosystem 24/7. All financial operations are done online through the mobile app or desktop client office. Customers can also order a physical or virtual Mastercard for convenient daily payments.

In practice, the most popular products and services offered by Satchel are the following:

- SEPA payments in Euro;

- SWIFT transactions worldwide;

- Mastercard payment cards;

- The transfer of cryptocurrencies to Euro and vice versa.

This means that, in addition to Europe, Satchel’s financial services can be used in countries where SWIFT transfers are available, or where Mastercard cards are accepted.

The list of documents for account opening at Satchel differs for personal and corporate accounts.

For a corporate account, you must provide:

1. The online application form.

2. Copy of the business owner’s passport or ID (only for citizens or residents of the EU or the EEA).

3. Proof of address.

4. A detailed business description.

5. Corporate documents.

6. Supporting documents on clients/suppliers.

7. Documents with supporting information about initial funding.

8. Verification through the Ondato solution.

For more information, please visit this link.

The list of documents for a personal account:

1. Your passport or national ID.

2. Proof of address or bank statement translated into English or Lithuanian.

3. Verification is carried out through the Ondato solution.

For more details, please refer to this link.

We provide the opportunity to open four different types of accounts:

- Business accounts that meet all corporate needs;

- Merchant accounts for e-commerce;

- Private accounts for daily personal needs;

- Freelancer accounts for self-employed individuals working remotely.

These accounts can be divided into two categories based on the procedures and documents required. Both business and merchant accounts require the same list of documents. Private and freelance accounts also have the same requirements when it comes to account opening.

The procedure for opening a payment account at Satchel is the same for everyone. All clients must submit an online form and provide the required list of documents for corporate and personal accounts.

There is no difference in the number of documents required to open an account for citizens of Europe, the UK, or other non-European countries.

However, there is a list of countries that we do not onboard clients from. You should check our Blacklisted jurisdictions page for complete certainty.

Read more about:

We’re always here for you

For questions and technical support, please visit our FAQ page or contact us via phone, email or app chat.