Launch Your

Fintech Brand

in 1 Month

Banking as a Service. Payment infrastructure in your

corporate style with Satchel - expert BaaS provider.

No license required.

White Label Cards

Worldwide ATM withdrawals and convenient payments. Offer includes unlimited number of cards, increased spending limits and custom tariffs.

- ATM withdrawals worldwide

- 3D Secure

- Transparent pricing

- Contactless payments

- Virtual cards for online purchases

- Metal cards for a premium experience

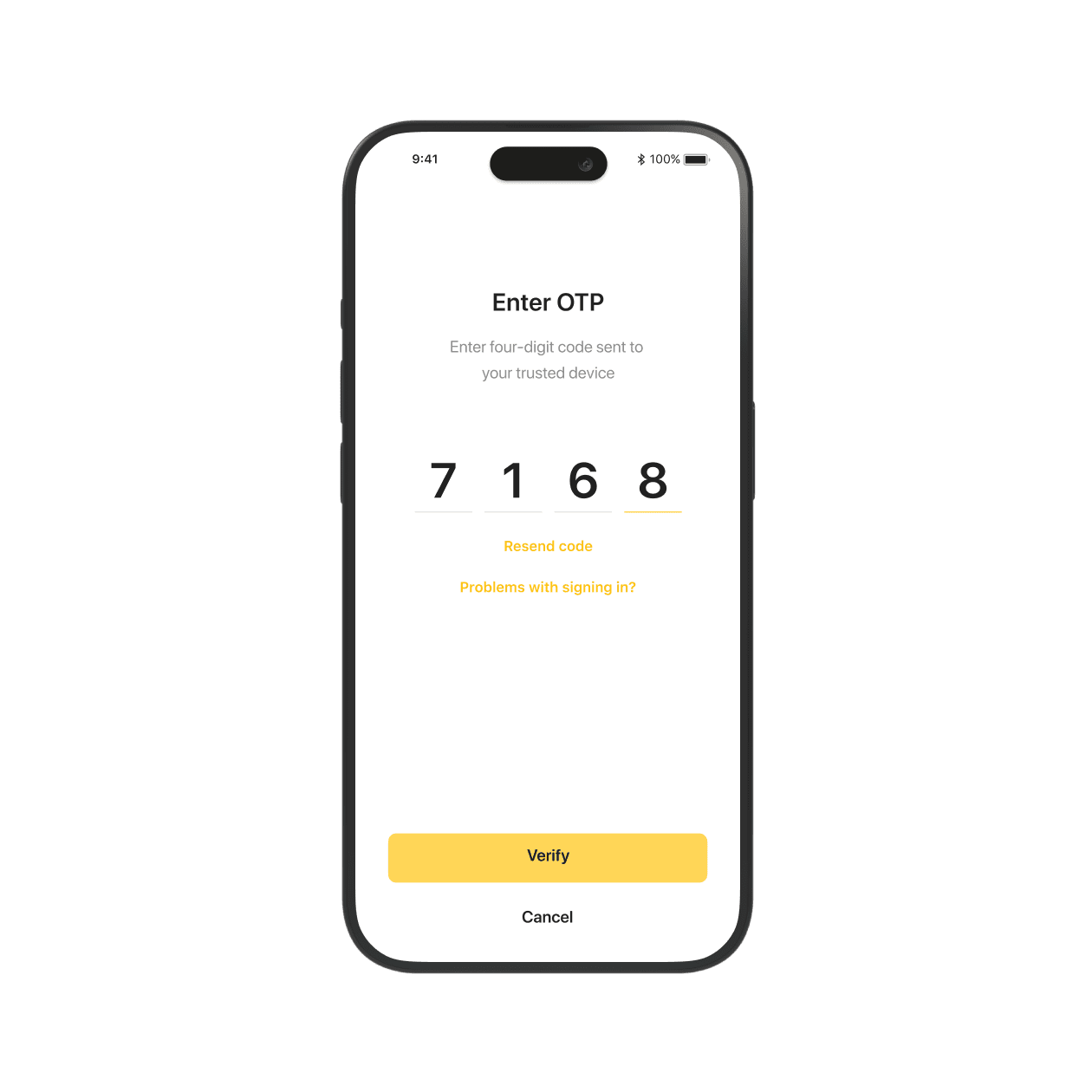

Robust security

We employ smart security features that ensure full compliance to the regulations and safety of your customers' funds.

- PSD2

- 2FA

- Fraud prevention mechanisms

Mario S.ItalyI am the CEO of a Milan-based financial consulting firm for startups.

Being in the business for over 6 years, we realized that one of the most common issues our clients face is the difficulty to open an account for their company in an Italian bank.

This is why I decided to leverage the Banking as a Service offer and, honestly, it was one of the best decision’s I’ve made for my business.

We can now open accounts and process payments of our clients directly, with no intermediaries. The set-up was really fast and the platform is very easy to manage and navigate.

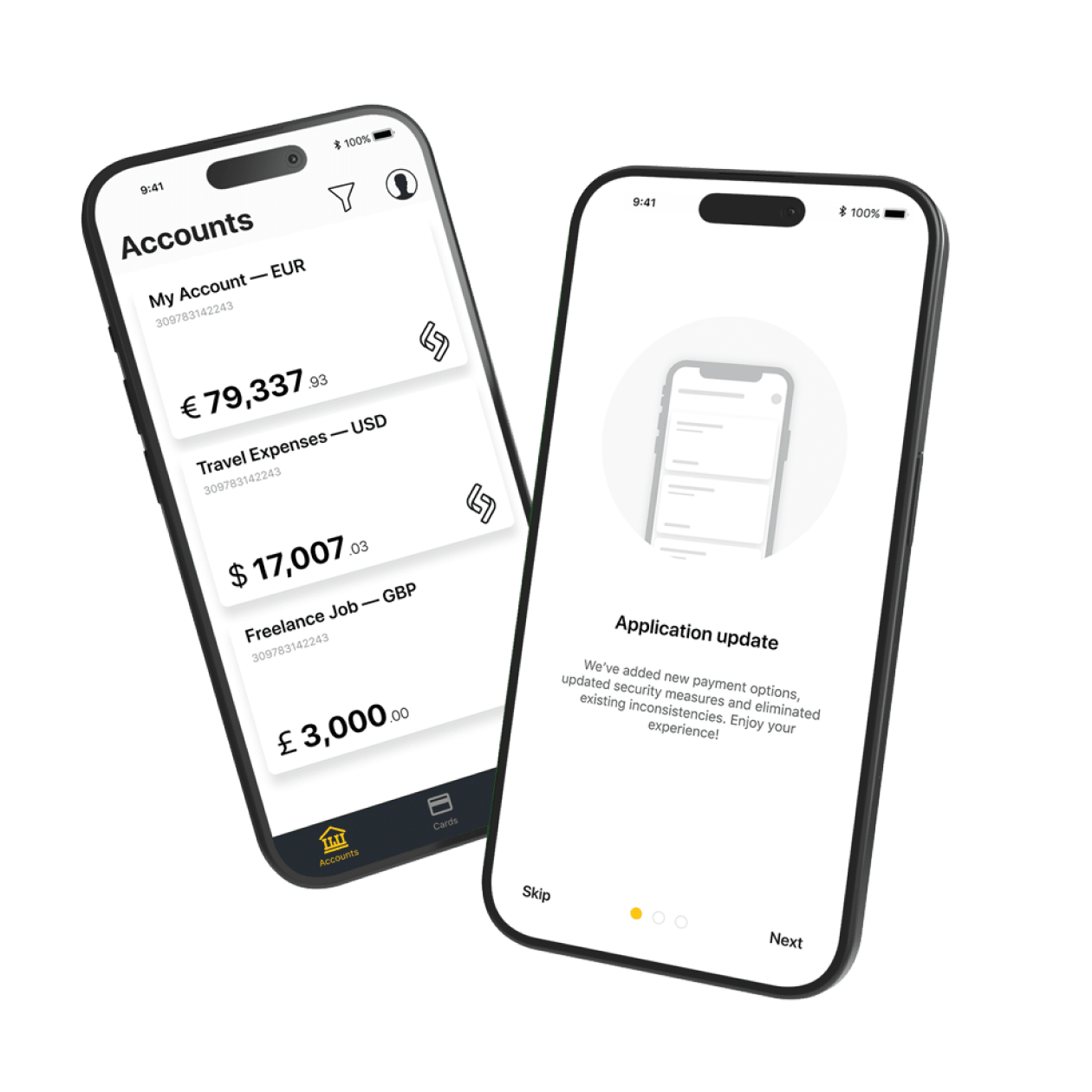

Join the neobank ecosystem

Our Banking as a Service platform is being constantly upgraded with new features that enhance functionality and the user experience. Each update will become available to you automatically after the release.

FAQ

Baas, or Banking as a Service, refers to an end-to-end model in which a non-financial business integrates the digital banking services of a licensed bank/financial institution directly into its market offering via an API. The main advantage of this model is the ability to provide financial services such as payment accounts, mobile banking, and payment cards to customers without the need to acquire a banking/EMI license. For more information on how BaaS works, read our dedicated blog post.

With a Banking as a Service solution from Satchel, you get a payment and financial infrastructure in your design in just a month, with no license requirements; the offer includes:

- Personal and business accounts

- Multi-currency IBANs

- Payment gateway for card processing

- SEPA and SWIFT transaction processing

- Branded payment cards

- Reporting panel

- Compliance with AML and fraud prevention

- Expert customer support

Our cutting-edge white label platform undergoes frequent updates, introducing new features to enhance both functionality and user experience. You can seamlessly access each update automatically as soon as it is released.

Our BaaS solution can be integrated into any non-financial business such as consulting, transportation, and legal advisory that is willing to offer financial products to its customers.

The key benefit of our BaaS solution is the ability to expand your market offering without having to acquire a financial license or spend time and resources developing a technology stack. Customers can select the financial products and services they need, then customize and use them to meet end-user needs. To find out what opportunities Banking as a Service can open up for your business, read our blog post.

Latest news and articles