SWIFT & SEPA Payment services

For easy transactions.

SEPA Instant

A SEPA Instant account with Satchel enables you to make real-time transfers. Your money is guaranteed to reach the recipient’s account immediately.

- Execution time up to 10 seconds

- 24/7/365 availability

- Supported across 36 countries in Europe and the UK

- Added security of transactions

- No hidden fees

SEPA Transfers

SEPA enables you to make cross-border payments within Europe as convenient as domestic transfers. 36 countries in the EU, EEA, and EFTA, including the UK, are currently members of the SEPA project.

- Lower transaction costs

- No hidden fees

- Execution time in 3 – 24 hours

- Security and accuracy of transactions

SWIFT Transfers

The SWIFT network connects over 11,000 financial organisations around the world and handles on average over 28 million international transfers daily.

- 38 supported currencies

- Transparent transaction route

- Available in over 100 countries

- Traceable payment information

Mass payments

Optimize the payment process and avoid manual periodic payment initiation.

- Pay multiple recipients at once

- Up to 5000 recipients per transaction

- Available for personal and business account holders

- Payouts via API calls or batch file

- 38 currencies, 115 countries

- Dedicated customer support

- Instant validation

- 24/7 availability

- Integrated security and compliance

Debit Mastercard card by Satchel

Link it to several accounts in different currencies

Pay in the currency of the transaction

Avoid currency exchange fees

Direct access to your funds

What is the difference?

| SWIFT | SEPA Instant | SEPA | |

|---|---|---|---|

| Countries | Over 200 countries | SEPA area | SEPA area |

| Fees | From € 10 to € 30 | From € 0 / 0.2% | From € 0 to € 5 |

| Currencies | 38 | EUR | EUR |

| Speed | 2-5 business days | Up to 10 seconds | < 1 business day |

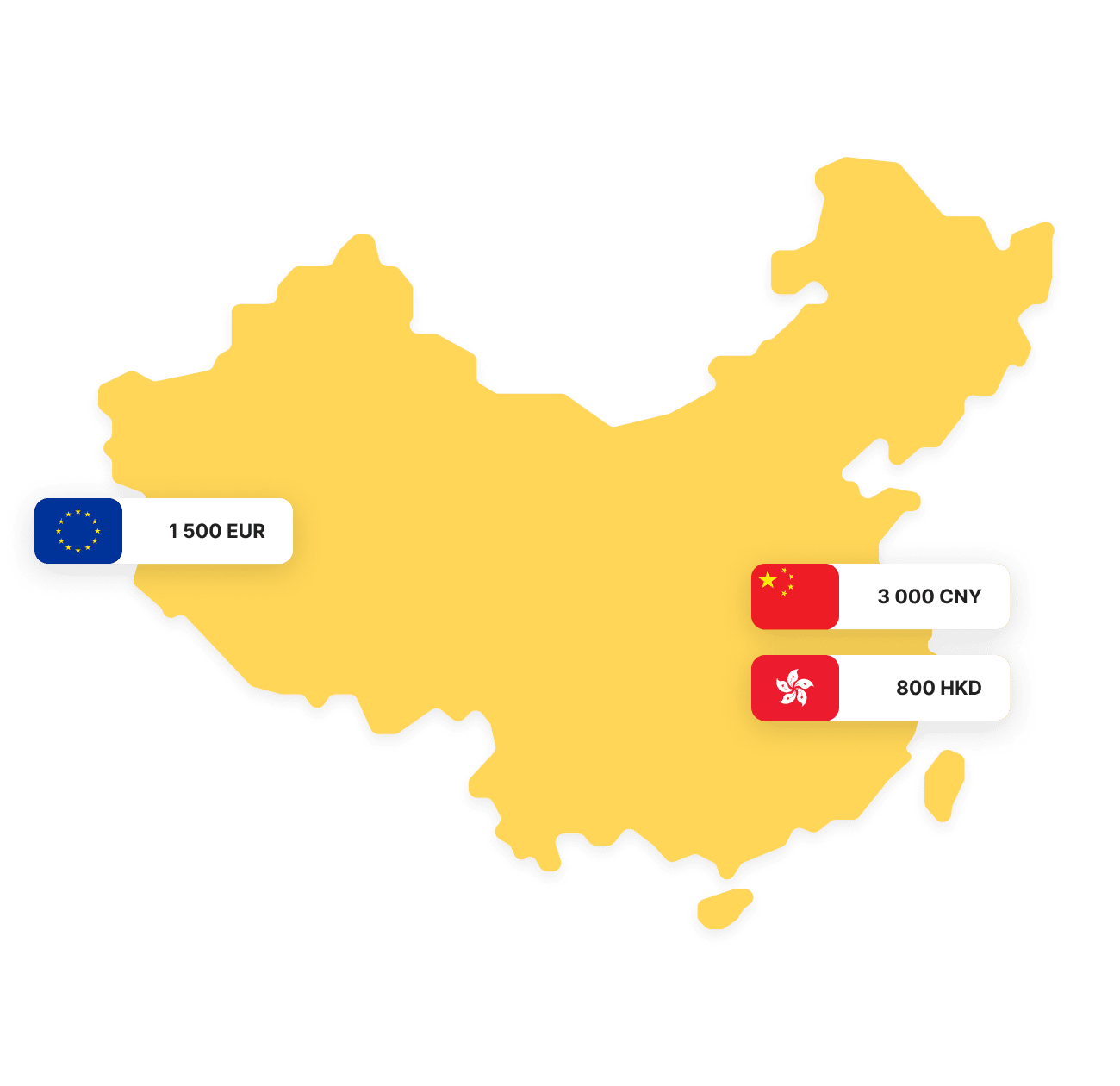

Streamline EU-China transactions

Transact in Chinese Yuan and Hong Kong Dollar and get direct access to the Chinese and European markets.

Accounts can be opened for both EU and Chinese residents

FAQ

Single Euro Payments Area is a payment integration initiative of European countries, which allows users to make simplified transfers in euro, both in terms of speed and cost-efficiency. European citizens and residents use SEPA payments for different motivations, which include but are not limited to billing for services or products, receiving salaries, pensions, and various regular payouts, sending money to friends and family, etc. Many businesses fully rely on SEPA within Europe, as the system helps them satisfy their main needs: purchasing raw materials, buying and selling ready products, sending salaries to their employees, clearing money obligations with their partners, and the list goes on.

If the sender or recipient’s account is in a different currency, currency exchange will be required. For more information on international transfers, please read our dedicated blog post.

To send a SEPA transfer, you need to log in to your account with your provider and initiate a transfer as you normally would. You will then need to add a recipient along with the required details and the IBAN of the recipient’s account. That’s it, your SEPA transfer is good to go.

SEPA Instant Credit Transfer is a scheme that enables faster and more secure payments within the SEPA area. The transactions are processed in just a few seconds, which is drastically faster than traditional payments.

SWIFT is another cross-border wire transfer network, which currently connects over 10,000 banking institutions in 210 countries. Not all financial institutions are connected to SWIFT without third parties, but instead use correspondent banks that act on their behalf, following mutual agreements. Thus, one simple transaction may sometimes be subject to fees from a couple of different institutions. SWIFT transactions are executed in 38+ currencies, but the fees are higher compared to SEPA transfers. Besides, while SEPA transfers are usually executed on the same day, SWIFT transactions may take up to a few working days. To find out more about the difference between SEPA and SWIFT, please read our dedicated blog post.

To make a SWIFT transfer, you need to initiate the transaction, enter your recipient's information (name, address, bank name and address, recipient's bank account number, and their bank's SWIFT/BIC code) and the transfer amount, and finalize the process by confirming your payment.