All you need to develop a superior fintech solution

Expand your clients’ opportunities through seamless data integration and exchange.

Payment gateway to Centrolink

Automated cloud-based service for payment processing and management across Europe.

- Direct connection to SEPA

- Issuance of unique EUR IBANs

- SEPA transfers

- Fees lower than those set by commercial banks

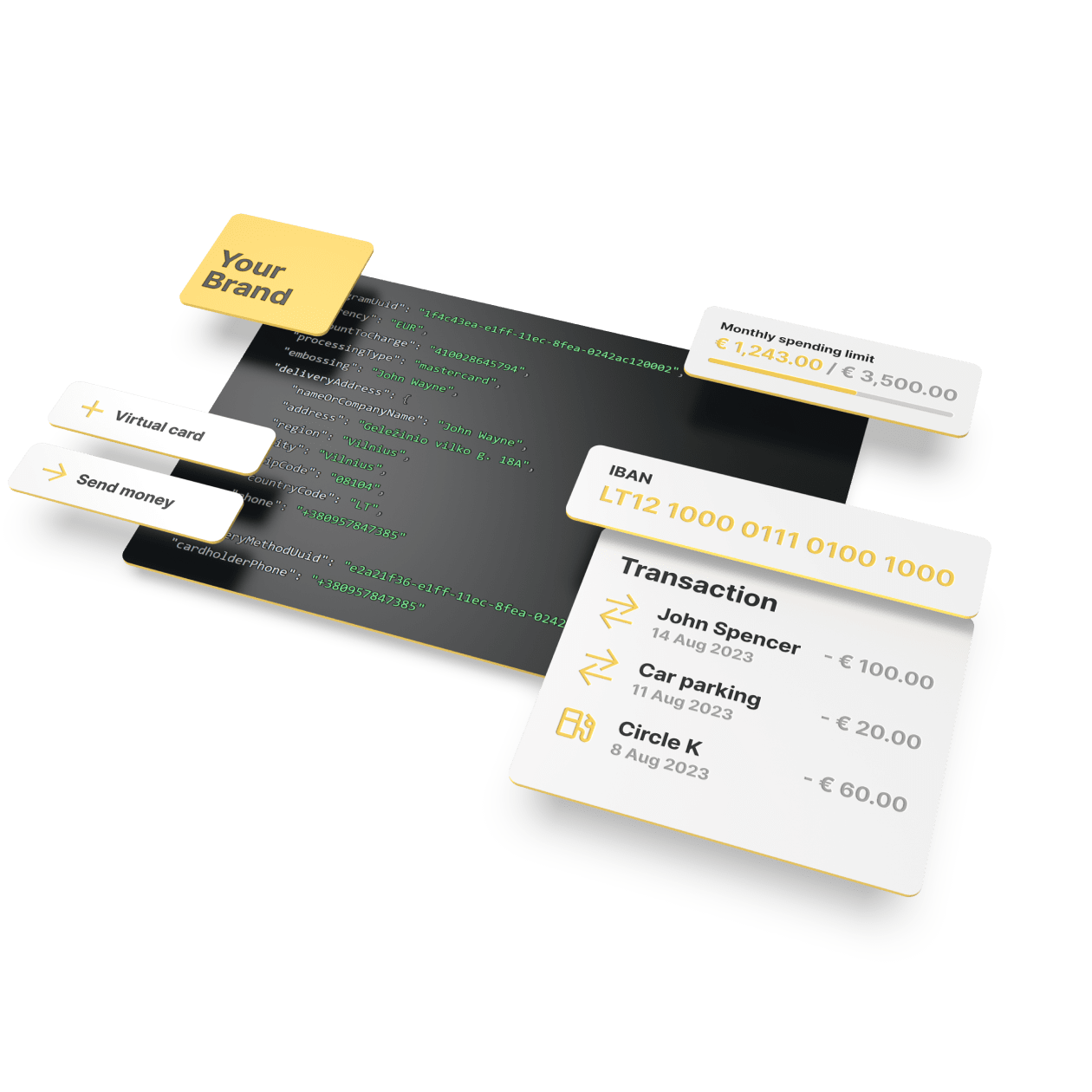

Card API

Generate and issue physical and virtual cards via Satchel API.

- Customizable cards

- Full control over transaction approval and management

- No third party involvement

Payment API

Give your clients access to a set of robust tools for flexible and powerful money management.

- IBAN generation

- Account & card balance check

- Transfer history

- Internal & Outgoing payments

- Profile creation

- Card top-up

Card acquiring

Generate customized physical and virtual cards for online and in-store payments. Fully automated, easily scalable and secure service, powered by Mastercard.

- Full compliance

- Flexible rates & tariffs

- No collateral requirements

- Customized fees

FAQ

API, or Application Programming Interface, stands for a software intermediary that connects two applications and allows them to communicate with each other using a set of definitions and protocols. You can think of an API as the messenger delivering the request of one application / provider to another one, which then sends a response back. A perfect example of API use is the weather application on your mobile device. Every time the data needs to be updated, the app on your smartphone sends an API request to the weather bureau’s software system to fetch the relevant information points and display them to you in the usual interface.

Under the open banking system banks open their APIs for use by third party providers, which allows the latter to access financial information needed to provide services to their users. This system has greatly improved user experience for customers worldwide thanks to the development of applications that deliver a better, faster and more intuitive personal and corporate finance management. Read more about the way we support open banking API at Satchel.

Payment APIs provide payment gateways for e-commerce businesses, allowing them to transform the checkout experience, making it simpler and more convenient for their customers. With a payment gateway API a digital business can optimize the payment process for the shoppers, while simultaneously making transactions more secure.

PSD2 gateway is a software solution that ensures banks compliance with PSD2 regulations through an API interface for third party providers (TTPs). The API provides access to user current accounts allowing TTPs to develop innovative and personalized financial services and products, while ensuring legislative compliance on all levels.