Ultimate cloud-deployed platform

Manage transactions, fees, accounts and users, while maintaining top-level security.

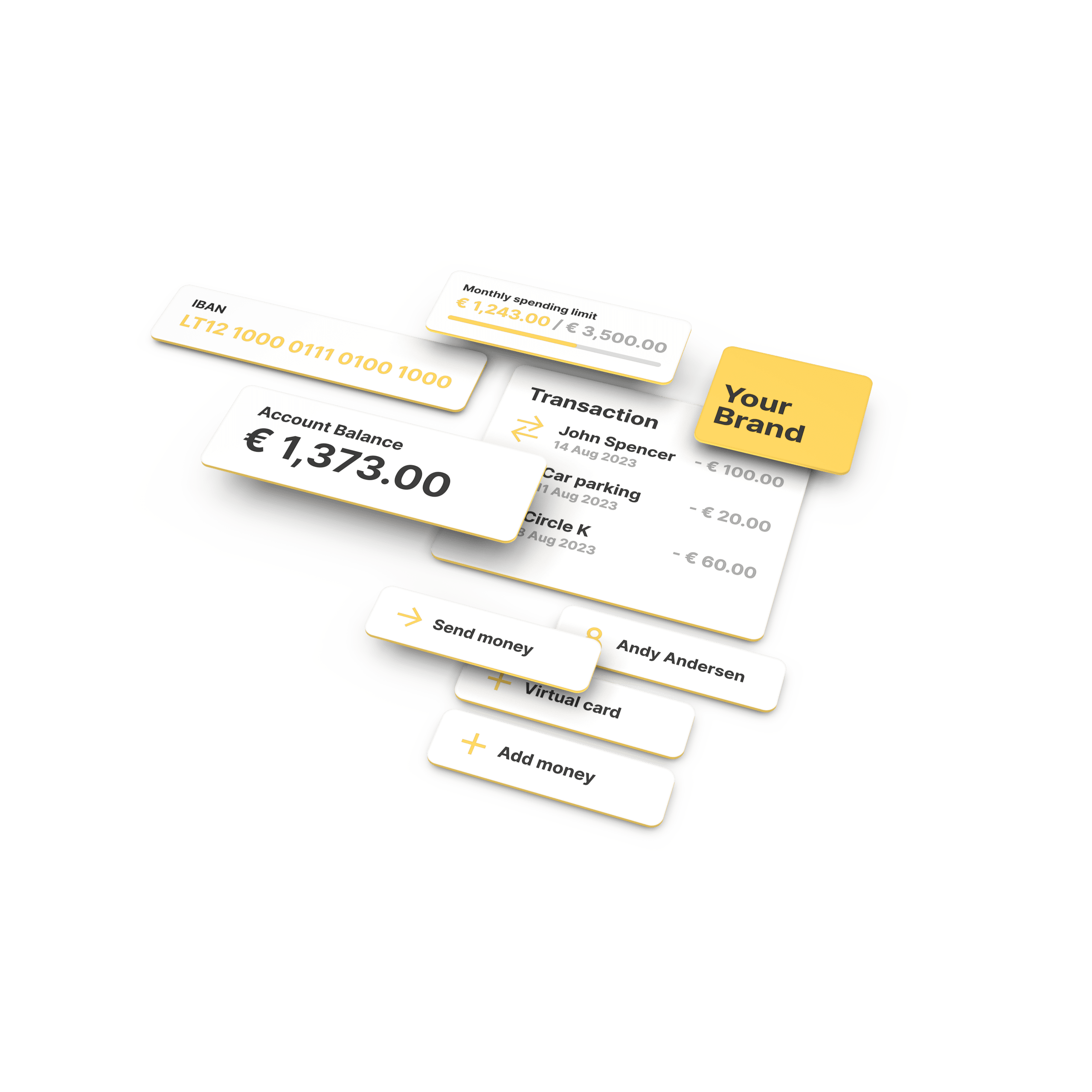

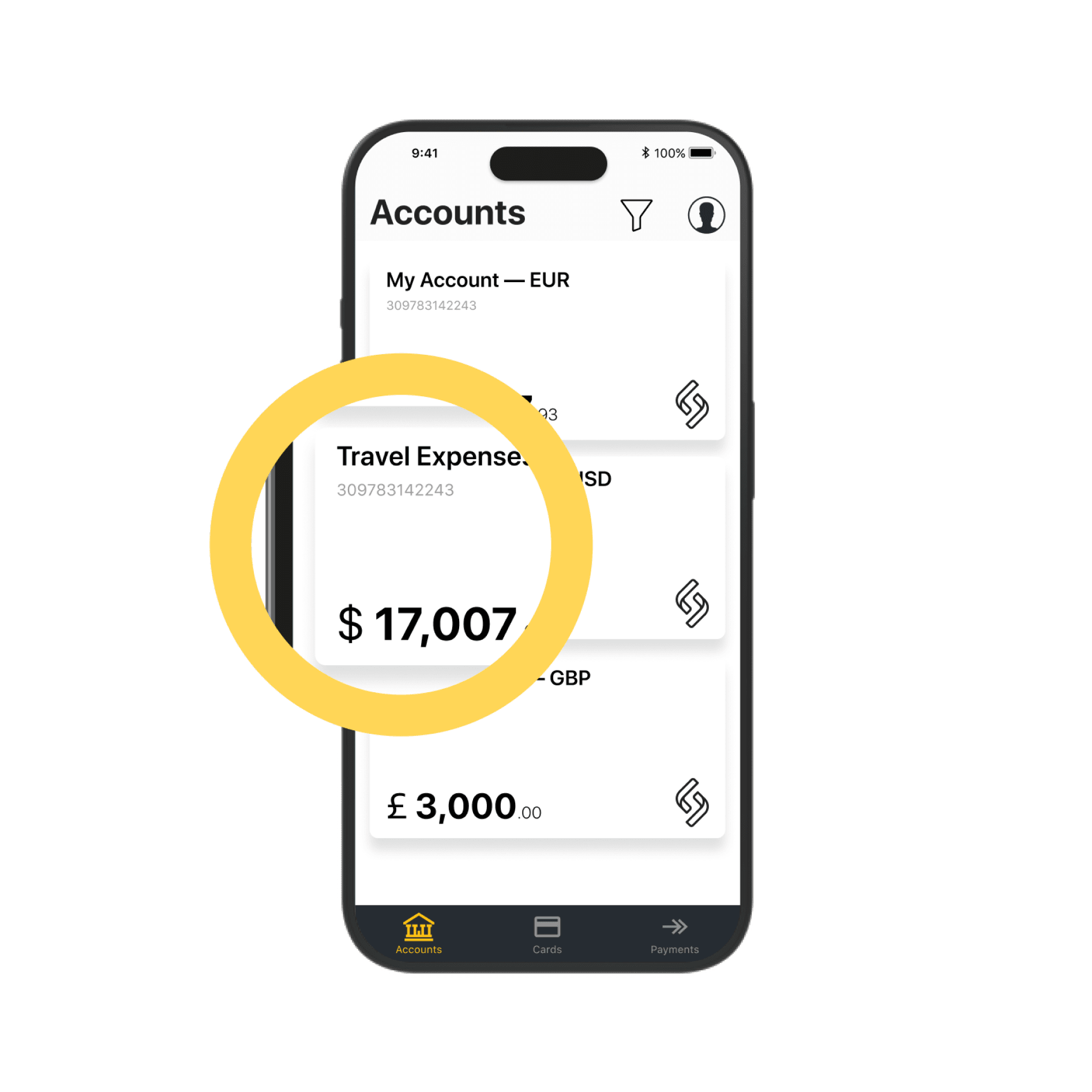

Desktop and mobile interface

A seamless online & mobile client office experience, fully secure and convenient.

- Account management

- Intuitive mobile app iOS & Android

- Incoming and outgoing payments

- Currency exchange

- Messaging system

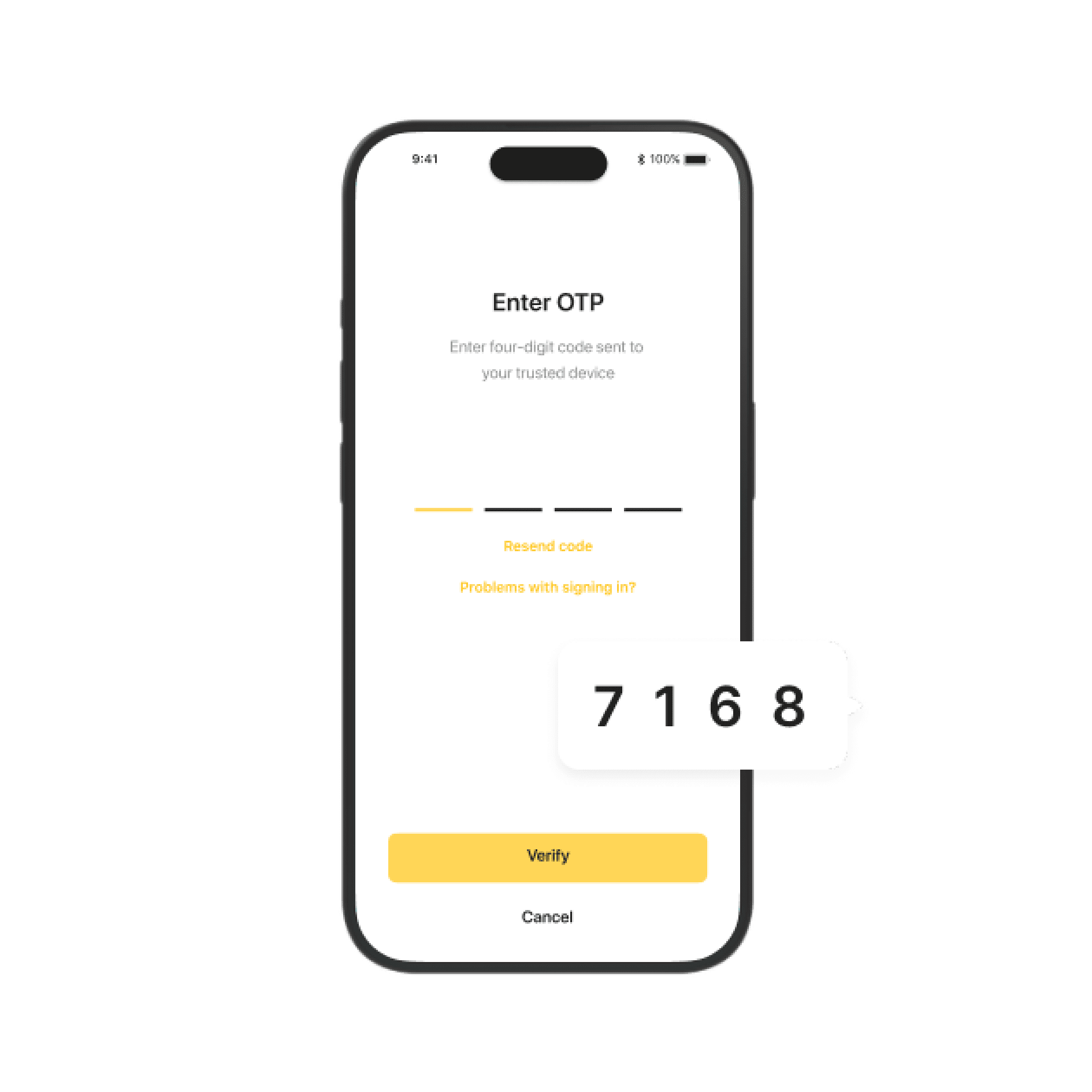

- Intelligent security features

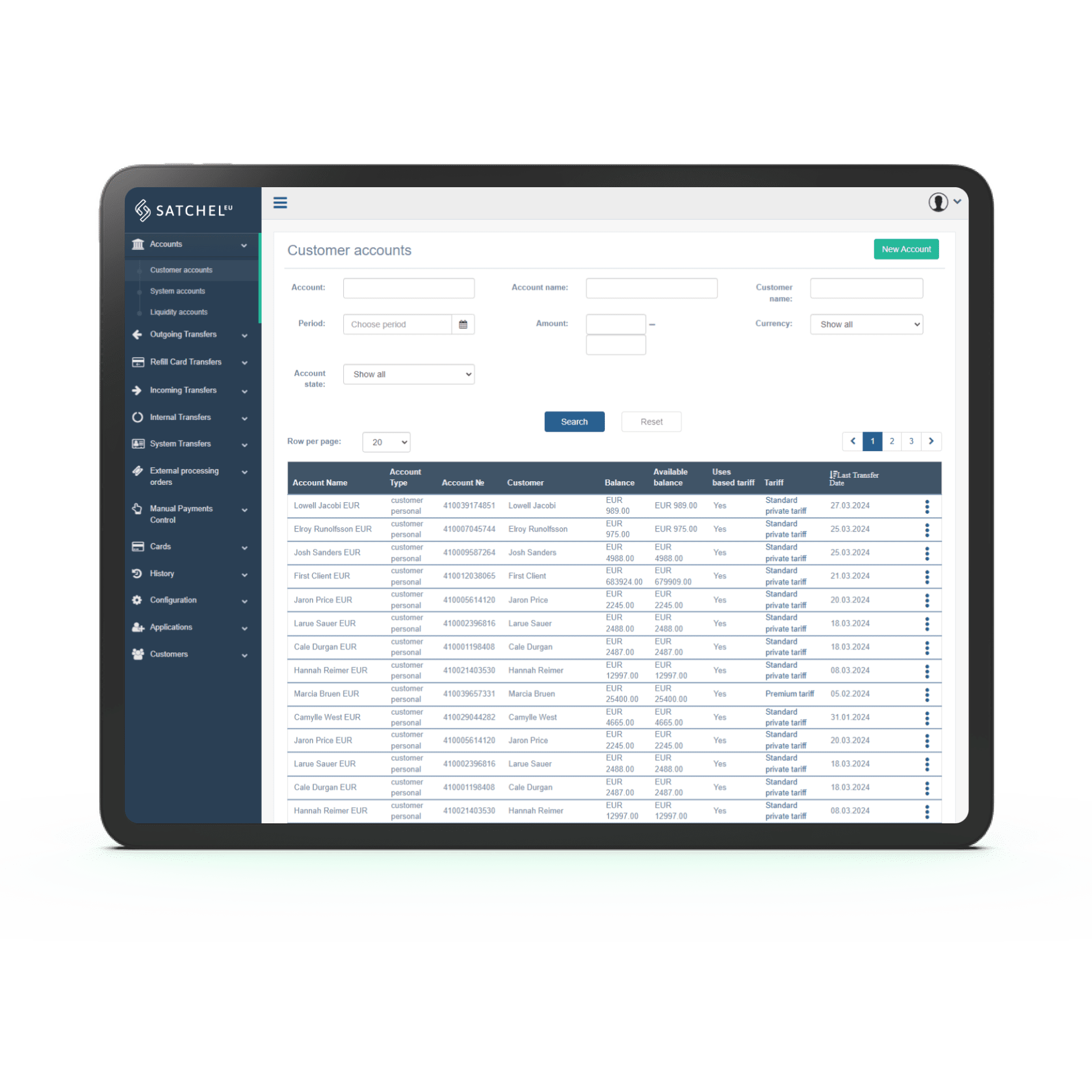

A back office for complete control

Monitor and administer all processes on the platform, ensuring compliance with policies, regulations, and terms of use.

- Internal messaging & ticketing system

- Card management system

- Onboarding module

- AML & Compliance module

- CRM module

- Payment module

- Statistics & Reporting

- System administration

- Tariffs & Commissions

Compliance that you can rely on

We have integrated AML & KYC procedures into our platform, connecting with the leading European and American third-party providers.

- Fast and secure onboarding

- Risk monitoring

- Advanced reporting system

SEPA gateway

Get a direct access to SEPA – one of the most efficient payments execution and management systems out there.

- No intermediaries

- SEPA Credit Transfer and SEPA Instant

- Unique European IBANs issuance

- Lower fees

Always get paid on time with e-Invoicing

- Create branded invoices in minutes

- Accept instant card payments or money transfers

- Send invoices via SMS, email or a custom link

- Manage invoices and payment status in the back-office

- Enjoy simplified accounting with a unique IBAN for each customer

FAQ

Software as a Service (SaaS) is a business model that allows a service provider to host its application on its servers and make it available to the consumers directly from the cloud. In other words, a user is able to access a provider's software or app, stored on the cloud in different data centers, via the Internet through any connected device. The only difference between traditional software and SaaS is that the latter isn’t downloadable and can’t be installed on a user device, which makes it one of the leading cloud computing applications. For more information, please read our dedicated blog post.

More and more large enterprises and SMBs are relying on the SaaS model to boost sales and enable marketing strategies. If you are wondering what makes software as a service products so attractive for customers, the answer is simple: they are feature-rich and easy-to-scale. By integrating SaaS solutions, organizations are able to save time and financial resources they would otherwise need to sacrifice to build robust & tailor-made functionality.

SaaS solutions are web-based and accessed through a web browser with no installation required, while conventional application software needs to be installed on a device in order for the user to access it. The most common examples of a SaaS platform are Salesforce, Atlassian, HubSpot, Slack, and Shopify.