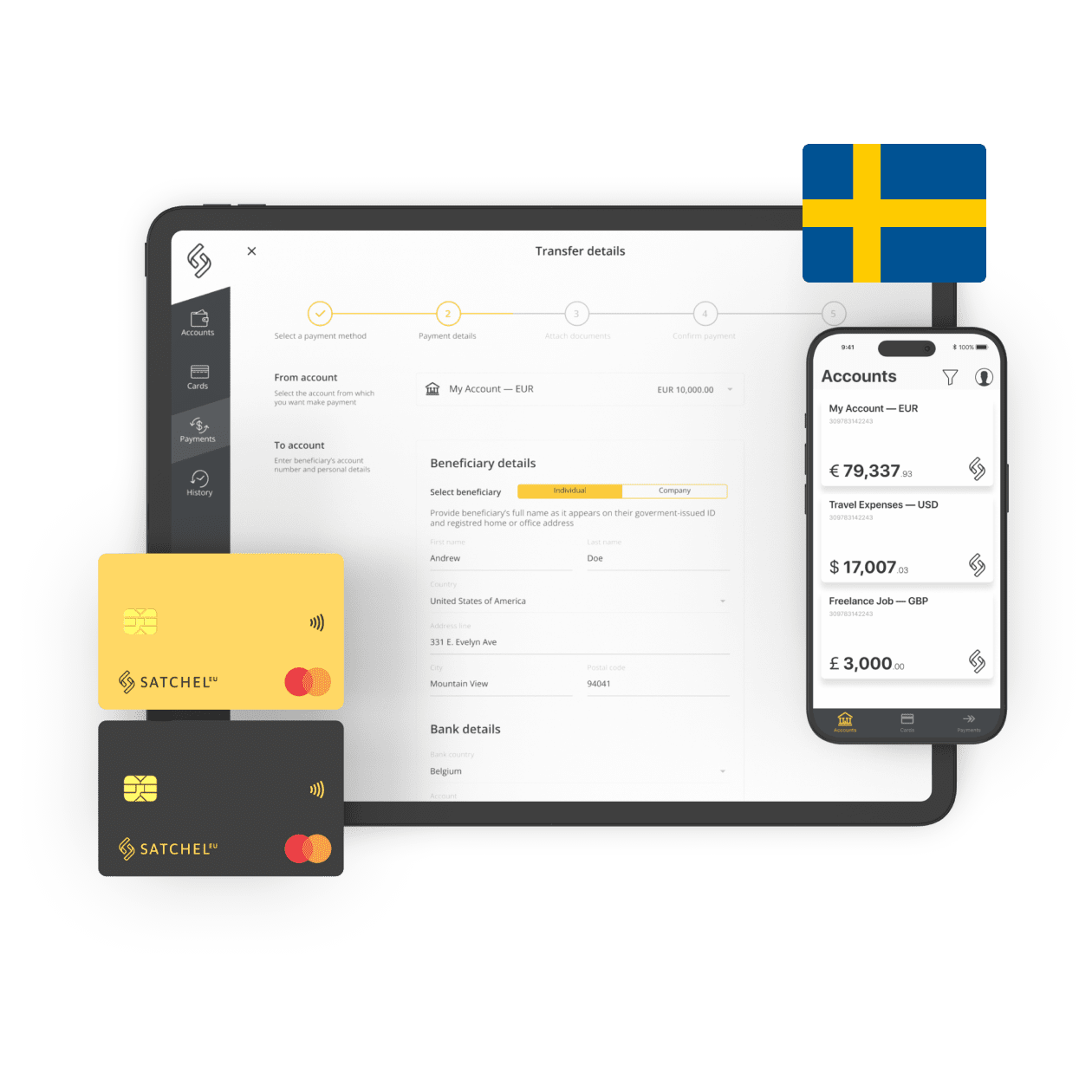

Online account opening for Swedish clients

Get a payment account online. Remote account opening for EU and non-EU residents in Sweden.

Personal Account for Swedish residents

- Open account remotely with just two personal documents.

- Get a unique European IBAN.

- Virtual and physical Mastercard tailored to your needs.

- No hidden fees and personalized pricing plans.

Business Account for Swedish residents

- Open an account online without waiting in line.

- Get a unique European IBAN.

- Start transacting in 20+ currencies through SWIFT and SEPA.

- Enjoy personalised customer support.

- Cover all business expenses with payment cards.

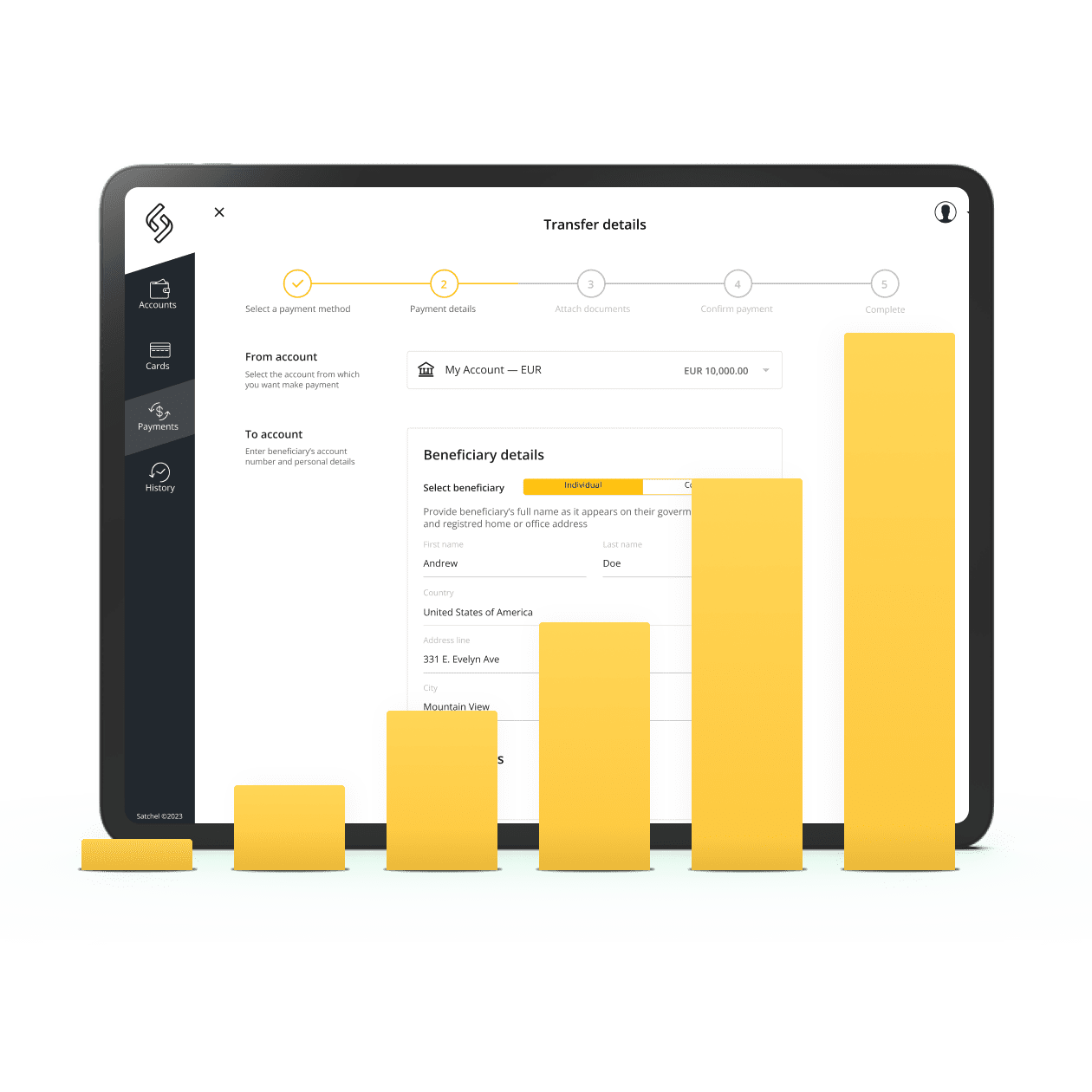

Payment accounts for Swedish clients in 3 steps

Submit your online application with just two personal documents.

We will process the application remotely within 1-3 business days.

Welcome aboard!

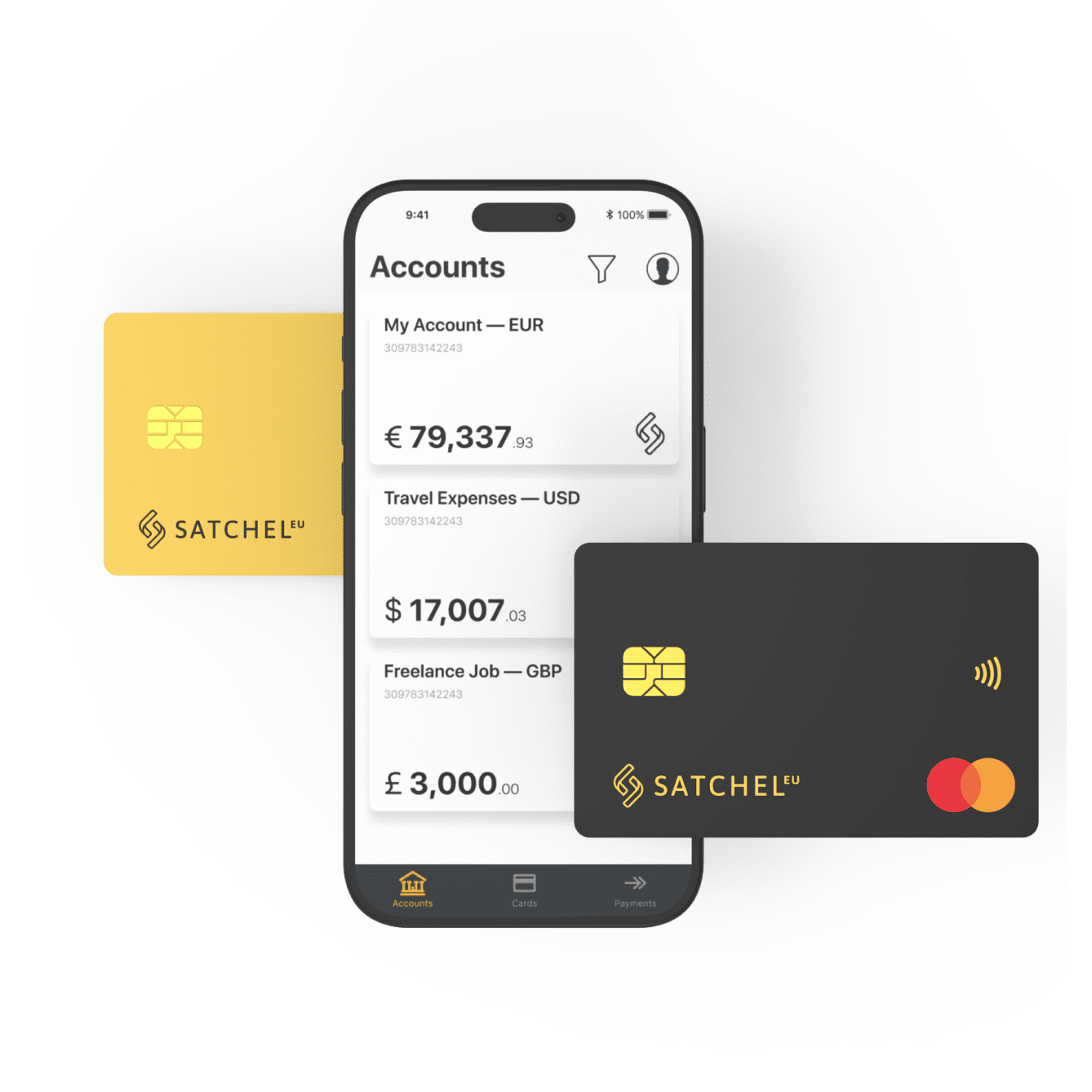

Satchel card that fits you

The Satchel card is a go-to tool for businesses or those who lead an active lifestyle and make several payments a day.

- Secure online shopping

- Daily payments

- White Label solution, powered by Mastercard

Collect

A simple way to receive money worldwide.

Pay

Convenient transfers internationally.

Innovate

A digital banking platform for developing business needs.

Convert

Currency exchange without hidden fees.

Manage

Useful features for full control over your funds.

FAQ

Getting an online account living in Sweden is now hassle-free.

You have two options: traditional banks or neobanks/EMIs, such as Satchel. The accounts provided by either of these institutions offer similar features, including a European IBAN for essential financial activities for your company, such as payments and transfers. The most significant distinction between them is convenience, ease, and speed of account opening.

With an EMI, the whole process can be completed online: filing the form, scanning/uploading documents, and going through onboarding. At Satchel, Business and Personal Account options are accessible to both EU and non-EU residents. So you do not need to travel overseas to open an account in person.

Each of our payment accounts has a unique European IBAN, allowing our customers to access the European and global financial ecosystem 24/7. All financial operations are done online through the mobile app or desktop Client Office. Customers can also order a physical or virtual Mastercard card for convenient daily payments.

In practice, the most popular products and services offered by Satchel are the following:

- SEPA payments in Euro;

- SWIFT transactions worldwide;

- Mastercard payment cards;

- Digital asset services.

This means that, in addition to Europe, Satchel financial services can be used in countries where SWIFT transfers are available, or where Mastercard cards are accepted.

The list of documents for account opening at Satchel differs for Personal and Business Accounts.

For a Business Account, you must provide:

1. Online application form.

2. Copy of the business owner’s passport or ID (the latter – only for citizens/residents of the EU or the EEA).

3. Proof of address.

4. Detailed business description.

5. Corporate documents.

6. Supporting documents on clients/suppliers.

7. Documents with supporting information about initial funding.

8. Verification through the Ondato solution.

For more information, please visit this link.

The list of documents for a Personal Account:

1. Your passport or national ID.

2. Proof of address or bank statement translated into English or Lithuanian.

3. Verification is carried out through the Ondato solution.

For more details, please refer to this link.

We provide the opportunity to open four different types of accounts:

- Business Accounts that meet all corporate needs;

- Merchant Accounts for e-commerce;

- Private Accounts for daily personal needs;

- Freelancer Accounts for self-employed individuals working remotely (EU-only).

These accounts can be divided into two categories based on the procedures and documents required. Both Business and Merchant Accounts require the same list of documents. Private and Freelancer Accounts also have the same requirements when it comes to account opening.

The procedure for opening a payment account at Satchel is the same for everyone. All clients must submit an online form and provide the required list of documents for Business and Personal Accounts.

There is no difference in the number of documents required to open an account for citizens of Europe, the UK, or other non-European countries.

However, there is a list of countries that we do not onboard clients from. You should check our blacklisted jurisdictions page for complete certainty.