Banking across borders

Modern European tech companies are built to go global from day one. Whether you’re a SaaS startup hiring developers in Argentina or an iGaming business monetizing users in Asia, international expansion brings massive opportunities—and serious financial complexity.

As teams stretch across borders, revenue streams multiply and compliance challenges mount. What once was a simple bank transfer becomes a multi-layered operation involving multiple currencies, local regulations, and fluctuating exchange rates. Every move counts and every inefficiency becomes a cost.

This is where friction comes in, through hidden fees, slow settlements, and FX volatility that eats away at profits.

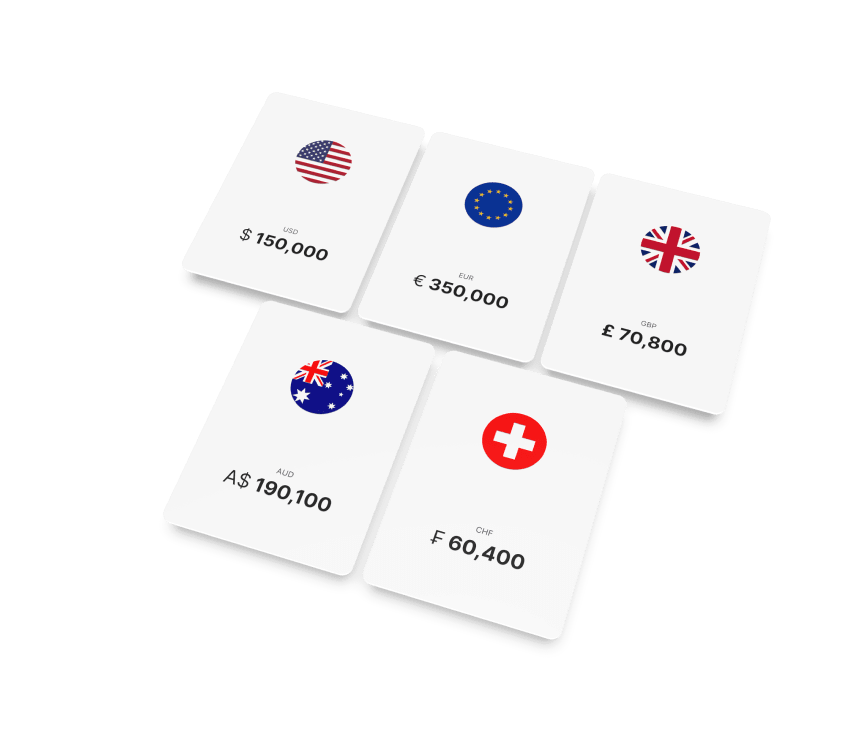

But here’s the good news: fintech is catching up. A new generation of financial tools is helping companies bank without borders. At the heart of this evolution are multi-currency accounts: a flexible, powerful tool that lets you hold, send, and receive funds in multiple currencies, while staying in control from a single touchpoint.

In this article, we’ll explore how companies are using multi-currency strategies to cut costs, optimize cash flow, and scale faster across international markets, on the example of EU-based software developers and iGaming businesses.

Why multi-currency accounts matter

Multi-currency accounts let businesses hold, send, and receive funds in multiple currencies from a single interface. Instead of opening separate bank accounts in each target market, companies can operate across borders with less friction and more visibility. For tech businesses in Europe, especially in the software and iGaming sectors, this is an opportunity to make operations efficient without getting entangled in a complex web of international finance.

Global cash management made simple

With a multi-currency account, you can view and manage all your transactions, domestic and international, in one place. That means better transparency, simpler accounting, and improved financial oversight. For CFOs and founders alike, it reduces the guesswork and noise from managing cash flow in silos.

Get better value from FX

Multi-currency accounts typically offer more competitive exchange rates than traditional banks. They also give you the option to hold funds in a foreign currency until market conditions are favorable, helping you avoid unnecessary conversions and preserve value.

Avoiding costly double conversions

Many platforms route international payments through intermediary currencies, often USD, before converting to the destination currency. This adds layers of fees and markup.

Multi-currency accounts eliminate this by letting you transact directly in your customers’, employees’, or suppliers’ currencies. For example, if you receive payments in Chinese yuan and have suppliers in China, you can hold and spend the yuan directly, cutting out unnecessary conversions and associated costs.

For startups and scale-ups operating internationally, even small savings on transaction costs can translate into a significant financial edge.

Managing FX risk exposure

Aside from simply being inconvenient, currency fluctuations are a risk to your bottom line. Whether you’re paying contractors, managing cloud infrastructure costs, or receiving customer payments from abroad, FX risk is always in the background.

Smart companies treat this as a strategic issue and plan accordingly.

Step 1: Map currency flows

Begin by mapping out your incoming and outgoing transactions. Break down revenues and expenses by currency and geography to identify your net exposure.

Where possible, match inflows and outflows in the same currency: this creates natural hedges that reduce volatility without needing financial instruments.

Step 2: Use financial hedging tools

For the gaps that can’t be naturally hedged, forward contracts or FX options can help. These tools lock in exchange rates for future transactions or provide protection if the market moves against you.

Step 3: Combine operational and financial hedging

The most resilient FX strategies blend both approaches, matching revenues and costs where possible, and using financial tools to cover exposure. This hybrid model provides predictability and keeps you focused on growth, not reacting to currency swings.

Choosing the right payment processing tools

Software providers and iGaming businesses need to focus on code and user experience, not FX markup and payment delays. The right platform can do the heavy lifting, automating complexity and unlocking better speed, control, and cost-efficiency.

Here’s what to look for in a payments partner:

- Local acquiring capabilities: Enables faster and cheaper card payments in each target market.

- Bulk payout support: Helps you scale payments to partners, contractors, or creators.

- Guaranteed FX rates: Reduces the risk of last-minute conversion losses.

- Multi-currency billing: Lets you price products and services in local currencies for a better customer experience.

The Satchel Multi-Currency Account is tailored for fast-growth tech businesses in the EU and beyond, offering a range of helpful tools and features, as well as global coverage and APIs. Here’s what it offers:

- 20+ supported currencies

- Dedicated IBANs for easy payments

- Bulk payment functionality

- Transparent and competitive FX rates

- Remote onboarding, fully digital

- Built-in security and compliance tools

- Responsive customer support from real humans

With Satchel, you’re equipped to smoothly send and receive global payments, manage currency exposure, and reduce back-office complexity.

The bigger European payments landscape

Europe is moving toward faster, smarter, more interconnected financial infrastructure. The SEPA Instant Credit Transfer scheme now enables near-instant settlement across 41 countries, including major markets like Germany, France, Italy, and the UK. That means faster cash flow and fewer delays.

Meanwhile, regulations like PSD3 are pushing for greater openness in banking APIs, and the Digital Euro, under development by the European Central Bank, is poised to introduce programmable, cross-border digital payments, designed to work alongside commercial banks and fintechs.

These changes are laying the foundation for a more competitive, transparent, and efficient payments environment. For tech companies, it’s an opportunity to align your infrastructure with the future of money movement.

Those who adapt early will be able to operate faster, pay smarter, and compete harder.

Go borderless & bank smart

If you’re building a tech company in Europe, your growth doesn’t stop at the edge of your country, and neither should your financial strategy.

Whether you’re reducing FX costs, optimizing treasury operations, or simplifying global payroll, multi-currency accounts give you the tools to operate on a global scale, without slowing down.

In a world where complexity is increasing, clarity and control are your competitive advantages. With the right strategy and the right partner, global growth will turn from a struggle to an opportunity.