Banking solutions for the iGaming industry

From market momentum to operational readiness

The iGaming industry is experiencing unprecedented, impressive growth. By 2030, the global market is projected to reach a market volume of US$37.22 billion, with over 1.3 billion users contributing to its momentum.

This creates clear opportunities while also introducing new pressures. To stay competitive in a high-speed, high-stakes environment, iGaming companies must underpin their growth with robust, compliant, and future-ready financial infrastructure. Payment systems must be fast, secure, and frictionless, yet fully aligned with complex regulatory frameworks.

However, widespread regulatory fragmentation, banking hesitation, and outdated financial systems continue to constrain operators that are otherwise ready to lead.

To scale efficiently, the industry must confront these banking challenges head-on. Here’s what’s standing in the way, and how forward-thinking companies are navigating through it.

Key banking challenges for iGaming companies

Securing banking services as an iGaming operator is far from straightforward. The industry is often viewed as high-risk, and traditional financial institutions may hesitate to provide support, regardless of a business’s track record or licensing.

Common operational challenges include:

- Limited access to reliable banking due to industry risk perception

- Complex regulatory demands in jurisdictions like Anjouan and Curacao

- High and inflexible transaction fees

- Inefficient processes for cross-border payments

- Insufficient support for digital assets and evolving payment technologies

Payment processing is a central component of the user experience. Delays, transaction failures, or security issues directly impact user trust and retention. The technical flow of funds from the customer, through the gateway and processor to the merchant’s bank, must function seamlessly and securely. Modern processors must also take on fraud monitoring, risk assessment, and identity verification responsibilities, all while meeting global compliance standards.

Navigating global compliance: Licenses and regulations

As iGaming companies expand internationally, they face an increasingly intricate regulatory environment. Compliance is not just about avoiding penalties, but rather about enabling sustainable growth, maintaining operational integrity, and protecting user trust.

Money laundering prevention

iGaming platforms are frequently targeted by illicit actors seeking to exploit the high volume and velocity of transactions. Operators must employ automated, real-time monitoring systems to detect and flag suspicious behavior.

Data privacy and protection

Compliance with data privacy laws, particularly the GDPR, is non-negotiable. Operators are expected to enforce strong encryption standards, implement data minimization practices, and ensure full transparency in how user data is collected and processed.

Cost of compliance at scale

Manual compliance processes become inefficient as user volumes grow. To avoid operational bottlenecks, businesses need scalable, integrated solutions for KYC, AML, and ongoing due diligence.

Jurisdictional restrictions and geolocation

Companies must verify user location and identity with precision to ensure adherence to local regulations. This requires robust geo-blocking and identity verification tools that are frictionless for the user but rigorous in execution.

Regulatory reporting

Each jurisdiction imposes distinct regulatory reporting standards. Without a centralized system, preparing, formatting, and submitting these reports becomes a resource-intensive burden that can limit agility and expose the business to compliance gaps.

Building the right infrastructure: What to expect from a banking partner

An iGaming company’s financial ecosystem is only as strong as the banking infrastructure behind it. When selecting a banking or payment processing partner, companies must focus on more than just cost – they must evaluate capability, flexibility, and regulatory alignment.

Global transaction support

A banking partner should offer full coverage of key currencies and regions. SEPA and SWIFT payment processing, along with support for at least 20 currencies, are baseline requirements for global-facing operators.

Comprehensive payment methods

Support for a wide range of payment options, including bank cards, digital wallets, and local payment methods, ensures accessibility and convenience for users in different markets.

Fast processing, minimal friction

Transaction speed is essential. Any disruption in the payment flow can lead to user frustration and a decline in engagement. Delivering a frictionless experience demands well-integrated back-end infrastructure that performs consistently across all platforms and devices.

Enterprise-grade security

Top-tier payment providers offer a full suite of security measures:

- PCI DSS compliance

- Tokenization of sensitive data

- Multi-factor authentication (MFA)

- End-to-end encryption via SSL/TLS

- Proactive fraud detection and mitigation tools

Platform integration

The payment processor must integrate smoothly with the company’s existing systems, especially if the platform is mobile-first or API-dependent. Poor integration can compromise performance and introduce unnecessary risks.

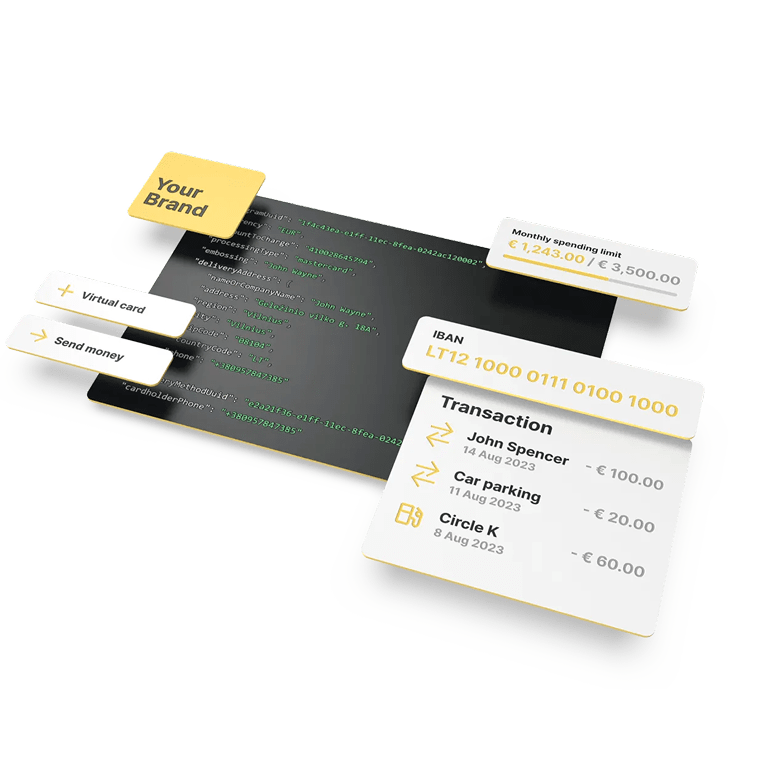

The role of Satchel in empowering iGaming businesses

Satchel is a European electronic money institution committed to delivering advanced banking solutions to iGaming companies. Our approach is built on experience, specialization, and an understanding of the nuanced demands of operating in a regulated digital environment.

We offer:

- SEPA and SWIFT payments in 20+ currencies

- Dedicated European IBANs

- Segregated accounts safeguarded by the Bank of Lithuania

- A compliance team with deep expertise in iGaming regulations

- API-first infrastructure for seamless integration

- Flexible pricing models suited for scaling businesses

- Dedicated support and operational guidance tailored to gaming clients

Our infrastructure enables iGaming companies to:

- Open and manage an account remotely

- Operate fully compliant with Anjouan and Curacao licenses

- Send and receive global payments efficiently

- Navigate regulatory requirements with confidence

- Focus on user experience without compromising security or compliance

Conclusion: Scaling sustainably, compliantly, and strategically

The iGaming sector continues to grow at pace, but the ability to scale responsibly depends on more than user engagement. Companies that succeed will be those who anticipate compliance challenges, build robust financial infrastructure, and choose partners that understand both the regulatory and operational landscape.

Satchel is committed to helping iGaming companies stay ahead through technology, compliance expertise, and strategic partnership.

To learn more or discuss your business needs, contact us at [email protected] or call +37052142278.