Business finance for high-risk industries

The iGaming industry generates billions in revenue globally, yet licensed operators struggle with basic business banking. Despite operating legally, iGaming companies face account closures, frozen funds, and payment restrictions that can cripple operations overnight.

Understanding these challenges – and finding the right financial partner – isn’t just about convenience. It’s about survival in an industry where payment disruptions can shut you down.

The “high-risk” label reality

Traditional banks classify iGaming as high-risk for reasons beyond actual risk. That includes regulatory uncertainty as banking compliance teams lack gaming expertise and err on the side of caution. Industry reputation also factors in: there’s association with money laundering concerns, despite strict AML requirements for licensed operators. Lastly, there are chargeback concerns because of higher dispute rates due to problem gambling and unlicensed operators.

This creates real operational challenges:

- Sudden account closures without warning

- Lengthy approval processes for basic services

- Higher fees and reserve requirements

- Limited payment method options

- Restricted merchant service access

Multi-jurisdiction complexity

Each gaming jurisdiction has distinct banking requirements. For instance, UK (UKGC) requires strict player fund segregation, extensive record-keeping, and applies specific payment processing rules. Malta (MGA) allows EU passporting rights but has established detailed financial crime prevention rules and capital requirements. Curacao is more flexible but raises banking challenges due to perceived regulatory gaps.

Licensed operators must maintain financial infrastructure supporting compliance across all operating jurisdictions.

Payment processing challenges

iGaming payment processing faces unique obstacles:

- Complex payment flows: Player deposits, withdrawals, bonus funds, and segregated accounts.

- Chargeback threats: Even well-run operators face disputes from problem gamblers and fraud.

- Payment method restrictions: Many providers refuse gaming operators.

- Multiple PSP dependency: Need backup processors but adds reconciliation complexity.

- Withdrawal speed expectations: Players demand fast payouts despite banking restrictions.

Liquidity management complexities

Licensed operators face cash management challenges:

- Player fund segregation: Cannot use player deposits for operational expenses.

- Regulatory capital requirements: Minimum capital levels tie up operational funds.

- Peak period fluctuations: Major events create massive deposit/withdrawal swings.

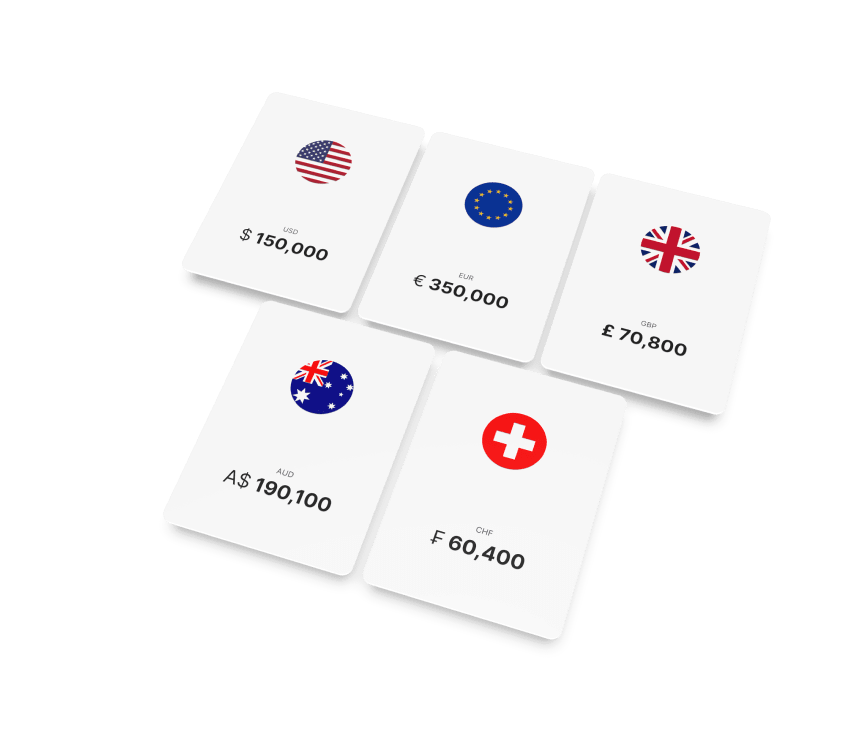

- Multi-currency operations: Complex treasury management across different markets.

- Real-time monitoring: Constant visibility needed for compliance and efficiency.

Compliance requirements

AML/KYC obligations for iGaming are among the industry’s strictest:

- Transaction monitoring: Sophisticated systems to identify money laundering patterns.

- Source of funds verification: Demonstrate player deposits come from legitimate sources.

- Regulatory reporting: Detailed financial reporting across jurisdictions.

- Audit trail maintenance: Comprehensive transaction histories for regulatory examinations.

The Satchel solution

Satchel understands that licensed iGaming operators need financial partners who comprehend industry challenges. Therefore, we offer solutions that answer the iGaming industry players’ crucial financial needs. With our multi-currency infrastructure you can manage funds across jurisdictions through a single platform with real-time visibility into segregated accounts. At Satchel, we accept payment flows including deposits, settlements, administrative payments, and can provide access to both SEPA and SWIFT. Built-in compliance tools at Satchel generate audit trails and documentation for regulatory requirements, with transaction monitoring for suspicious activity. What’s most important is that our team has industry expertise and understands regulatory landscapes across major gaming jurisdictions as well as specific financial requirements.

Ready to move forward?

Licensed iGaming operators need financial relationships built on industry understanding, not blanket “high-risk” classifications. Financial service disruptions aren’t an option when regulatory compliance demands sophisticated financial infrastructure.

For licensed operators building sustainable, compliant operations, choosing specialized financial partners represents a strategic decision impacting every business aspect.

Contact Satchel today to discuss how our specialized Business Accounts support gaming operations with the expertise and infrastructure you need.