Corporate banking in the cloud era: What decision-makers need to know

Digital economy of today establishes that cloud technology, having been an IT trend in the past, now is more likely a business imperative. The numbers are telling: the public cloud market in banking, financial services, and insurance (BFSI) is projected to grow from $74.2 billion in 2024 to $305.44 billion by 2034, reflecting a 15.2% CAGR over the next decade.Corporate banking-wise, moving to the cloud reflects a paradigm shift that is changing operational efficiency, client engagement, and risk management. As decision-makers in both growing companies and established firms alike polish their banking strategies, let’s take a look at the implications and opportunities of cloud-powered corporate banking.

The cloud revolution in banking

The cloud has substantially altered the ways financial institutions operate. From core banking systems to customer relationship management and real-time data analytics, cloud infrastructure enables scalability, flexibility, and faster innovation. To summarize what this means for corporate banking:

- Faster onboarding and service deployment

- Real-time access to transaction and account data

- Simplified compliance and reporting

- Enhanced cybersecurity and data recovery protocols

Compared to legacy systems, cloud platforms can integrate well with third-party services and fintech solutions, which allows banking service providers to offer more tailored and flexible financial offerings. This explains how, according to Number Analytics, as many as 82% of large banks now have formal cloud strategies, while 43% of tier-one institutions (systemically significant, largest, and most stable banks) have migrated the greater part of their applications.

Key benefits for business clients

Businesses manage a variety of complex financial operations on a daily basis. Here, cloud-enabled banking services provide distinct advantages:

1. Scalability and agility

Cloud-based systems are more advanced in a way that they allow financial service providers to adapt to the evolving needs of their clients without the necessity to undergo costly infrastructure overhauls. Businesses that expand into new markets or scale operations naturally expect their banking partners to move at their speed.

2. Enhanced security and compliance

Modern cloud platforms feature advanced security protocols, like end-to-end encryption, AI-powered threat detection, and real-time monitoring. These features help financial service providers and their clients meet increasingly stringent regulatory requirements, including those under GDPR, PSD2, and AML directives.

3. Improved data management and insights

With cloud banking, clients’ cash flows, payments, and liquidity are more visible and clear as real-time dashboards and analytics provide better visibility into the data. This is a valuable tool for CFOs and finance teams who can now make faster and more accurate data-driven decisions.

4. Greater integration with fintech tools

Cloud banking allows easy integration of ERP systems, payroll software, and invoicing platforms with the tools companies already use. This translates into better workflow automation and reduced manual errors.

Main factors to consider choosing a cloud-based banking partner

With all the benefits listed above, it is no surprise that the adoption of cloud banking only accelerates. However, not all providers are equal. When evaluating prospective partners, decision-makers should consider the following factors:

- Data residency (location) and sovereignty (legal authority): Ensure your financial service provider complies with local and international data protection laws.

- API capabilities: Look for rich API access to support easy integration with systems you already use.

- Business continuity and uptime: A reliable cloud banking provider should offer high availability, risk mitigation, and disaster recovery solutions.

- Customer support and service: Your cloud banking partner should be as efficient and responsive as the technology they offer.

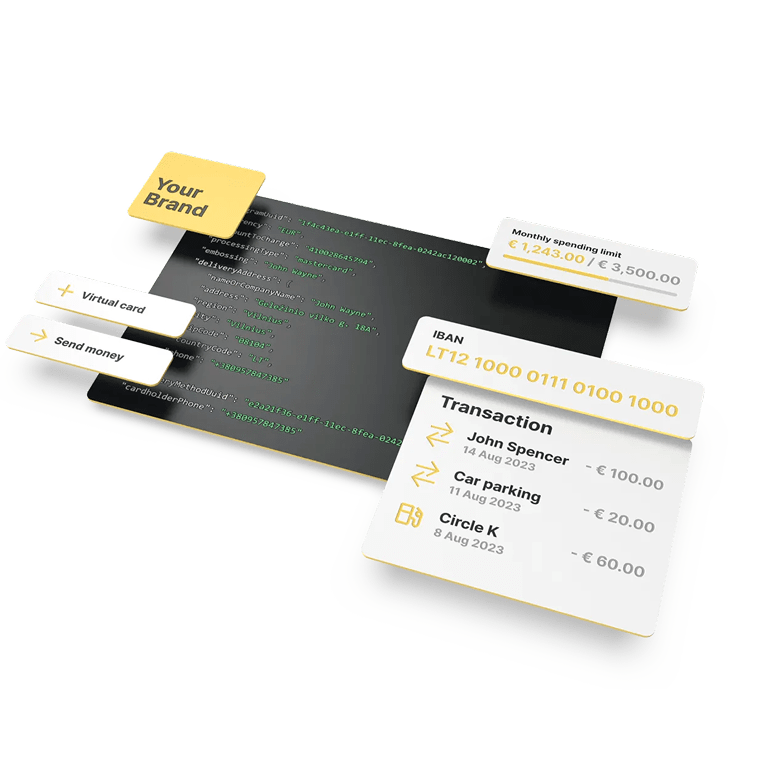

Satchel approach to cloud-based corporate banking

At Satchel, we combine innovative cloud infrastructure with our in-depth expertise in digital finance as we deliver flexible, secure, and future-ready corporate finance solutions. Our platform supports real-time payments, multi-currency accounts, cloud-based BaaS, and other advanced financial tools designed for the needs of modern businesses.

We prioritize:

- Security-first design

- Regulatory compliance across jurisdictions

- Custom integrations and APIs

- User-centric digital interfaces

Perhaps you’re a skyrocketing startup or an already-established enterprise looking for better financial infrastructure? Satchel offers a smart, cloud-based banking experience that evolves together with your business.

Final takeaways

Thankfully, corporate banking is no longer confined to physical branches and legacy systems. The cloud has instigated an era of more dynamic, integrated, and secure financial services. For decision-makers, now is the time to jump on the cloud-powered banking (if you haven’t already) and experience new levels of efficiency and capability. With the right partner, the future of corporate finance is not only digital—it’s quite limitless.