Cross-border payroll solutions for remote-first tech teams

Remote-first work has redefined how tech companies build teams. The best engineers, designers, and data scientists no longer sit in the same office, or even the same continent. Hiring globally gives you access to exceptional talent, competitive salary structures, and around-the-clock productivity.

But there’s a catch: paying people across borders can quickly turn into a logistical maze. Different currencies, tax regimes, banking rails, and compliance requirements can overwhelm even the most agile finance teams. Many growing tech companies discover that payroll, something meant to be routine, becomes a major obstacle to scale.

But payroll complexity can be transformed into a competitive advantage. When your organization can pay teams reliably, transparently, and compliantly across borders, it signals professionalism and trustworthiness, attracting and retaining global talent.

In this guide, we’ll explore how to manage multi-currency payroll, handle compliance with confidence, and reduce hidden costs. We’ll also show how the Satchel Multi-Currency Account helps remote-first tech companies bring speed, transparency, and control to their global payroll operations.

Currency & exchange challenges in multi-currency payroll

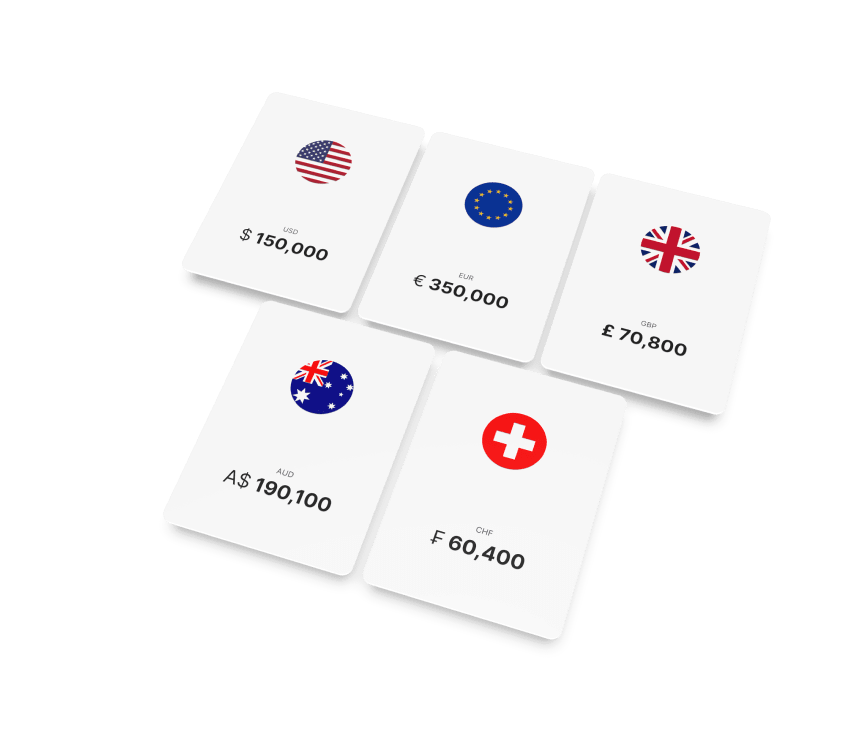

As tech teams expand globally, payroll often becomes a multi-currency puzzle. Employees expect to be paid in their local currency, forcing companies to manage multiple accounts, conversions, and fluctuating exchange rates. What seems like a simple transaction can quickly turn into a moving target when payroll spans ten or more currencies.

Currency swings can make budgeting unpredictable. A weakening local currency might stretch your budget, while a sudden appreciation can inflate costs overnight. Yet for many businesses, the real challenge isn’t volatility, it’s visibility. According to the 2025 Global Payroll Payments Report, FX discrepancies affect around 18% of international payroll payments, reducing accuracy and trust.

To regain control, forward-thinking companies are adopting multi-currency accounts and integrated payment platforms that centralize transactions, monitor FX rates in real time, and ensure cost transparency. Locking in rates for payroll cycles or negotiating clear FX margins can stabilise expenses and eliminate unwelcome surprises.

When you can see the full picture – what you’re paying, what employees receive, and where value is lost – global payroll becomes not just compliant but confidently predictable.

Navigating compliance complexity across jurisdictions

Compliance is the number one challenge in global payroll – and for good reason. According to the recent Getting the World Paid survey, 63% of payroll leaders cite compliance as their biggest cross-border payroll pain point.

Working hours, benefits, termination rules, and minimum wage laws vary dramatically between jurisdictions. So do tax obligations – from withholding rates and employer contributions to filing deadlines and audit standards. A small oversight in one market can snowball into penalties or retroactive liabilities in another.

Misclassification adds another layer of risk. Treating full-time employees as contractors (or vice versa) can trigger back taxes, fines, and even legal disputes. And with payroll handling sensitive personal data, compliance also extends to privacy regimes like the EU’s GDPR and regional data protection laws, where audit trails and consistency are essential.

For remote-first companies, the smartest move is often to partner with a reliable global payroll provider that will stay ahead of local legislation and manage compliance intricacies, while your central team maintains visibility and control. The result: a compliant, efficient payroll operation that scales confidently across borders.

Speed & reliability of payments globally

Payroll is about more than accuracy – it’s about trust. Even a perfectly calculated paycheck loses its value if it arrives late or unpredictably. For remote-first teams, delays can damage morale, erode confidence in leadership, and even hurt retention.

Cross-border payments are notoriously tricky. Traditional international wire transfers often pass through multiple intermediary banks, each adding processing time and potential fees. Routing can be opaque, and delays in one country can cascade, leaving employees waiting for days. The more intermediaries involved, the greater the risk that payments will arrive late, incomplete, or at an unexpected exchange rate.

Speed and reliability depend on leveraging the right payment infrastructure. Leading global payroll providers partner with local banking networks or access local clearing rails, enabling funds to reach employees faster and more predictably. For example, SEPA Instant transfers across Europe can deliver payments in seconds, while SWIFT networks handle longer-range transfers with transparent timelines.

Beyond timeliness, these systems also reduce operational friction for finance teams. Centralized platforms track the full payment journey, provide real-time status updates, and flag any delays automatically, giving payroll teams clarity and control. By combining fast, predictable payout rails with clear visibility, companies can ensure employees are paid on time, every time, strengthening trust and making global payroll a competitive advantage rather than a headache.

True cost visibility & optimization

Headline fees rarely tell the full story. Even if your banking partner advertises low transaction costs, intermediary banks can levy unadvertised charges, and currency conversion margins may be hidden in fine print. Without a clear view of all these costs, your payroll budget can quickly exceed expectations, and what employees actually receive may differ from what you intended.

Understanding the true cost of payroll requires looking beyond gross salaries. It’s a sum of multiple components: employer taxes, benefits, FX conversion costs and margins, banking and transfer fees, platform charges, and administrative overhead. Evaluating only the fees or quoted rates of individual providers can be misleading.

Complexity grows when companies use multiple providers across different markets – sometimes exceeding 10. Each additional vendor creates a new layer of administrative work, reporting challenges, and potential discrepancies. This fragmentation makes benchmarking costs, tracking efficiency, and identifying hidden charges extremely difficult.

The solution lies in unified global payroll platforms. By consolidating payments, FX management, and reporting in a single system, companies gain full transparency into their costs across jurisdictions. Real-time dashboards and analytics allow finance teams to benchmark expenses, identify inefficiencies, and forecast future payroll obligations with confidence. Beyond cost control, this visibility strengthens operational decision-making and ensures employees are reliably and accurately paid.

Operational simplification: Single-platform vs fragmented systems

Managing global payroll through a patchwork of local banks, multiple vendors, and spreadsheets creates significant operational friction. Data silos, version mismatches, and coordination overhead are common pain points, and communication across time zones only magnifies the complexity. As one survey of global payroll challenges notes, lack of standardization, inconsistent vendor management, and fragmented reporting consistently rank among the top issues for finance and HR teams.

Adopting a unified payroll platform can transform this complexity into efficiency. A single system consolidates reporting, dashboards, and approval workflows, ensuring everyone is working from the same data. Standardized formats and governance reduce errors and make compliance more straightforward, while integration with HR and finance systems eliminates redundant tasks and improves decision-making. Unified platforms also simplify audits, giving teams a clear trail of transactions and approvals – a critical safeguard for multinational operations.

For teams expanding across multiple countries, a hybrid model or fully outsourced global provider often becomes essential, delivering scalability, control, and the operational simplicity needed to pay employees on time and without friction. PwC notes that companies which implement a global payroll operating model benefit from standardized governance and reduced duplication, which enables them to focus on strategic initiatives rather than firefighting operational issues.

Streamline global payroll with the Satchel Multi-Currency Account

One of the biggest friction points in cross-border payroll is managing multiple currencies. Traditional banking often requires separate accounts for each market – each with its own fees, compliance checks, and reconciliation burden. Satchel simplifies this through its Multi-Currency Account and payroll solutions, designed for companies that pay and receive funds in multiple countries.

The business clients of Satchel can hold, send, and receive funds in 20+ currencies from a single account, as well as leverage:

- Favorable FX rates to streamline transactions and minimize risks.

- Payment cards for all business needs, powered by Mastercard.

- Payroll program for salary payouts and corporate expenses.

The account integrates seamlessly with SEPA, SEPA Instant, and SWIFT networks, ensuring fast, reliable payments whether you’re compensating developers in Berlin or support staff in Manila. The Satchel platform eliminates hidden conversion markups common in traditional banking, showing real exchange rates and transparent fees.

Regulated as a European Electronic Money Institution (EMI) under the Bank of Lithuania, Satchel safeguards funds in segregated accounts and adheres to stringent EU regulations for security and anti-money-laundering compliance. Combined with live customer support and intuitive management via the Satchel app or web client office, this multi-currency account gives businesses the operational control, speed, and compliance assurance needed to scale payroll globally.

Key takeaways

As tech teams go global, cross-border payroll becomes the backbone of trust, compliance, and growth. Managing multiple currencies, navigating local regulations, and ensuring on-time payments can make or break your remote-first strategy.

By approaching payroll as a strategic capability, supported by transparent processes and reliable infrastructure, you turn complexity into control.

With a dependable partner like Satchel, you gain access to all the key functionality to pay employees accurately, on time, and in their local currency, wherever they are.

In a world where talent has no borders, your payroll shouldn’t either.