E-commerce banking: What you should know

E-commerce is no longer a domestic game, making today’s online sellers global by default. Logistics, sales, marketing, and customer support have evolved rapidly to meet this borderless reality. Payments? That’s where it gets more complicated.

The old ways of managing money (think juggling bank accounts, waiting on slow settlements, bleeding margins to currency conversions) have become a bottleneck to growth.

Scaling internationally demands a new kind of financial infrastructure – one built to accept, move, convert, and settle money quickly and transparently across borders. In this article, we break down the key pillars of payment infrastructure for international sellers and explore how businesses can future-proof their cross-border operations.

Why your payment gateway is now a growth strategy

Payment gateways aren’t just checkout tools anymore, but strategic growth levers. For e-commerce brands selling in multiple markets, the gateway determines more than just how people pay. It influences conversion rates, trust, and ultimately whether a customer completes their purchase.

Global shoppers want local experiences. That means seeing prices in their own currency and being able to pay with familiar methods, whether that’s iDEAL in the Netherlands, Alipay in China, or PayPal in the US. A one-size-fits-all approach leads to abandoned carts.

Top-tier gateways today integrate seamlessly with platforms like Shopify or WooCommerce and support dozens of localized payment methods. Sellers who embrace this flexibility go beyond meeting customer expectations, boosting revenue and improving user experience, which in turn, increases retention and loyalty.

Inventory financing meets smart banking

If you’re growing your product line or scaling inventory ahead of peak season, you’ll need capital. But traditional financing options, especially for international sellers, often involve high interest rates, rigid terms, and slow approvals.

That’s where fintech lenders and FX-ready business accounts step in. By offering credit lines tailored to your cash flow (based on real-time sales or marketplace performance), these solutions provide the working capital needed to grow inventory without tying up liquidity.

Combine that with multi-currency accounts, and you’re not only getting funding, but paying suppliers in local currencies, avoiding unnecessary conversions, and reducing friction across your supply chain.

International settlements: Faster money, lower fees

Settling payments across countries is notoriously painful. Between intermediary banks, SWIFT fees, and FX spreads, it’s easy to lose 2–4% of your revenue without even realizing it.

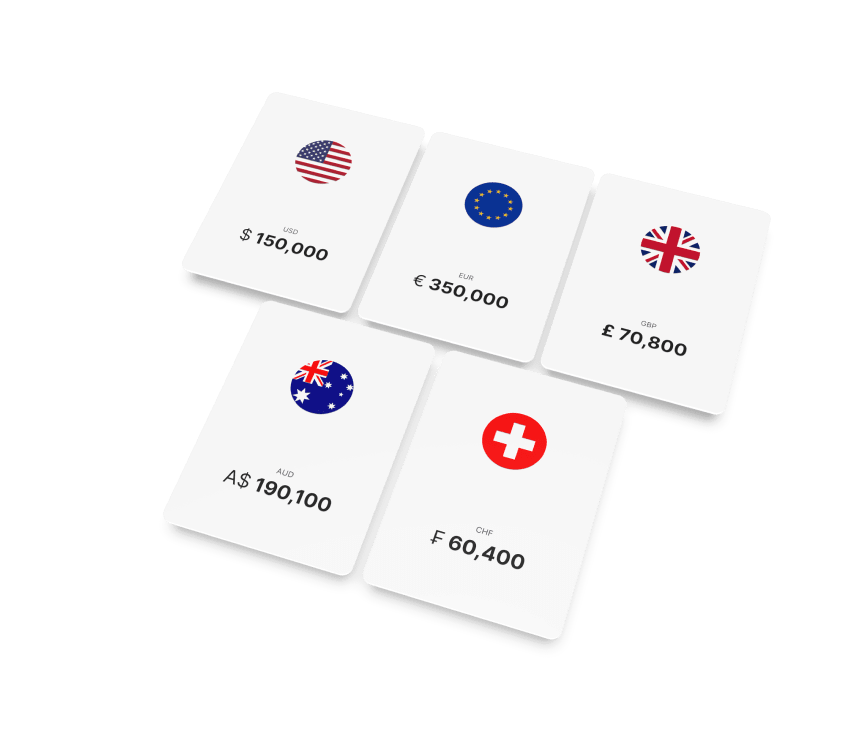

Modern business accounts for e-commerce are changing that. Instead of routing every transaction through slow, fee-heavy correspondent banking networks, they offer:

- Local bank details in key markets (like USD, EUR, GBP, PLN, etc.)

- Real-time or same-day settlements

- Multi-currency balances so you can hold, convert, and send money when it makes financial sense

As a result, you can operate like a local business in every market you serve, without setting up entities or opening regional bank accounts.

Marketplace payouts without the waiting game

If your business depends on marketplaces like Amazon, Etsy, eBay, or Zalando, you already know the drill: long payout cycles, surprise fees, and delays that mess with your cash flow.

The best fintech-native business accounts today are solving this with integrations that:

- Speed up payouts

- Reduce transaction costs

- Give real-time visibility into incoming funds across marketplaces

Instead of waiting 7–14 days to access your earnings, you can immediately reinvest that money into ads, inventory, or further expansion.

One account, multiple currencies, zero headaches

Juggling multiple bank accounts in different countries adds complexity to your operations, with each coming with its own UI, fees, compliance burden, and reconciliation pain.

That’s why international sellers are increasingly switching to accounts that support:

- A unified user interface

- Local account details in major markets

- Multi-currency holding, receiving, and sending

- Smart conversion tools that let you time FX to your advantage

It’s about control. You can invoice in EUR, pay suppliers in CNY, hold profits in USD, and decide when to convert, based on your margins and the market. No forced conversions. No losses to bad timing.

What comes next: Building the infrastructure behind the checkout

Speed and cost are just the start. As cross-border payments grow more complex, sellers also need reliability, visibility, and compliance. The winners will be those who build infrastructure that not only clears transactions, but also:

- Adapts to regulatory changes

- Offers real-time tracking

- Provides smart FX and tax reporting

- Integrates with ERPs, accounting tools, etc.

As more buyers and sellers move online, the pressure is on to make international payments feel local – fast, cost-efficient, and seamless. That means partnering with platforms that understand the entire lifecycle of a global transaction, not just the moment money moves.

Satchel for global e-commerce

At Satchel, we’re rethinking business banking for cross-border commerce. Our Multi-Currency Business Accounts give e-commerce sellers the financial infrastructure they need to go global with confidence:

- Multi-Currency Accounts with European IBANs

- Hold, convert, and send money in 20+ currencies

- Real-time international transfers via SEPA and SWIFT

- Transparent pricing with no surprises or hidden fees

- Fully digital onboarding to get started in days, not weeks

- Developer-friendly APIs for seamless integrations

Whether you’re managing supplier payments across continents or receiving marketplace payouts in different currencies, Satchel gives you the infrastructure to manage, move, and grow your money, minus the complexity.

Conclusion: Cross-border is the new normal

Global growth is within reach for every e-commerce business. But only those who invest in smart financial infrastructure will scale without compromise. Stop patching together payment systems that weren’t built for global trade, and upgrade to a setup that’s fast, flexible, and built for the reality of modern selling.

Because in global e-commerce, how you get paid is just as important as what you sell.