Finance solutions for fintech and payment companies

The European fintech landscape has never been more dynamic – or more regulated. As payment processors, fintech startups, and cyber risk management firms scale their operations across the EU markets, they face an increasingly complex web of regulatory requirements that can make or break their growth trajectory.

The challenge isn’t just understanding these regulations; it’s implementing a reliable financial infrastructure that ensures compliance while maintaining operational agility. This is where choosing the right financial partner becomes critical to long-term success.

The regulatory reality for European fintechs

European financial regulations have evolved to keep pace with digital innovation. The revised Payment Services Directive (PSD2), along with emerging frameworks for digital assets and open banking, creates a compliance landscape that demands both technical sophistication and regulatory expertise.

For fintech companies, this means balancing innovation with adherence to strict regulatory standards – a challenge that extends far beyond simple box-ticking exercises. Modern compliance requires integrated financial solutions that can adapt to regulatory changes while supporting business growth.

PSD2 compliance: Beyond the basics

PSD2 compliance goes deeper than implementing strong customer authentication. Payment service providers must navigate complex requirements around data protection, transaction monitoring, and customer consent management. The directive’s emphasis on open banking also means fintechs need financial partners who understand both the technical and regulatory implications of API-driven services.

Effective PSD2 compliance requires:

- Customer authentication systems that don’t compromise user experience

- Transaction monitoring capabilities that identify anomalies in real-time

- Clear data sharing protocols through secure API-driven services

- Automated compliance auditing and reporting mechanisms that reduce manual work

Payment regulations across European markets

Each European market brings its own regulatory nuances, creating additional complexity for fintechs operating across multiple jurisdictions. From Germany’s strict data protection requirements to France’s specific e-money regulations, payment companies need financial partners with deep local market knowledge.

Risk management in a regulated environment

Modern risk management for payment companies extends beyond traditional fraud detection. Nowadays, fintech companies must consider regulatory risk as a core component of their risk management strategy. This includes:

- Operational risk management: Ensuring business continuity while maintaining regulatory compliance across all markets of operation.

- Cyber risk considerations: Implementing security frameworks that meet both regulatory requirements and industry best practices for data protection. On that note, Satchel has built-in compliance tools that provide multi-layered security including 3D Secure authentication and advanced fraud detection systems.

- Regulatory change management: Building systems that can adapt quickly to new regulations without disrupting core business operations.

Regulatory reporting: Turning compliance into competitive advantage

Regulatory reporting requirements can seem burdensome, but forward-thinking fintechs are discovering how proper reporting infrastructure can provide valuable business insights. Fortunately, Satchel automated reporting systems don’t just satisfy regulators – they offer visibility into business operations and customer behavior patterns through real-time dashboards and analytics.

Building scalable reporting systems

Effective regulatory reporting requires more than periodic data dumps. Here’s what Satchel compliance infrastructure provides:

- Real-time transaction monitoring with intelligent anomaly detection algorithms

- Automated report generation that eliminates manual errors and reduces compliance costs

- Audit trails that support regulatory inquiries with detailed transaction histories

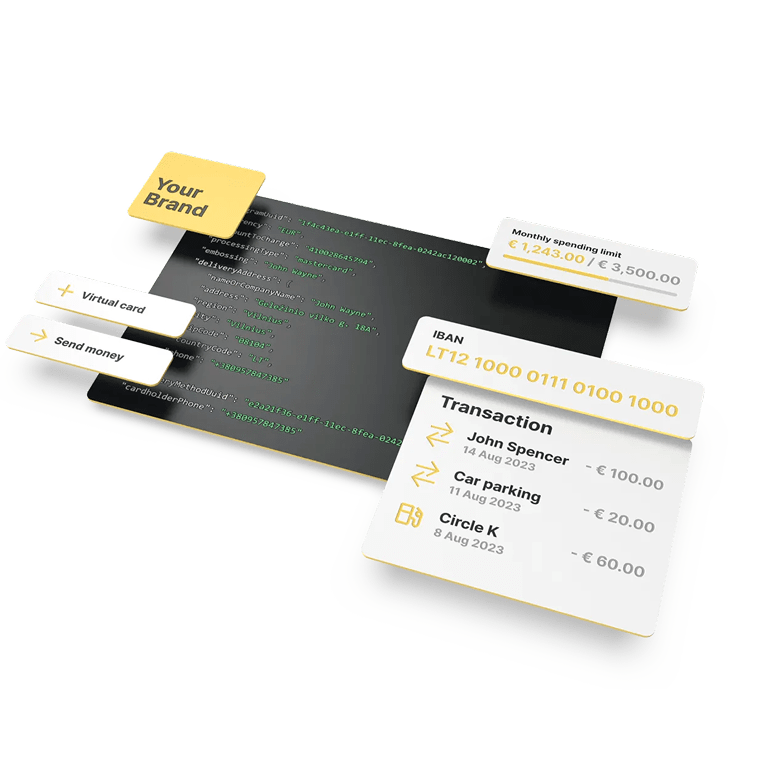

- API-driven integration capabilities that connect with existing business platforms and third-party services

Choosing the right financial partner

The right financial partner brings more than basic financial services – they provide regulatory expertise, compliance infrastructure, and strategic guidance that enables sustainable growth.

Key considerations when evaluating financial partners include:

- Demonstrated expertise in fintech-specific regulations

- Built-in compliance tools that automate routine compliance tasks

- API-driven services that enable integration and scalability

- Secure transaction and customer authentication systems including 3D Secure and 2FA

- Advanced transaction monitoring with real-time fraud detection

- Local market knowledge across target European jurisdictions

- Proven track record supporting companies through regulatory changes

Looking ahead: Preparing for regulatory evolution

European financial regulations continue evolving as regulators must balance innovation encouragement with consumer protection. Fintechs that build flexible, compliance-first financial infrastructure today will be best positioned to capitalize on tomorrow’s opportunities.

The key is finding financial partners who understand that compliance isn’t just about meeting current requirements – it’s about building systems that can adapt to future regulatory landscapes while supporting ambitious growth plans.

Discover how Satchel financial solutions help fintech companies navigate complex regulations with confidence here https://satchel.eu/fintech-consulting/.