Financial infrastructure for scaling software companies

As software companies transition from startup to scale-up, their financial needs evolve far beyond basic transactional requirements. Today’s CFOs need sophisticated financial infrastructure that can support rapid growth, international expansion, and complex operational demands without the overhead of traditional corporate finance solutions.

Beyond basic financial services

Growth-stage tech businesses face unique challenges that standard business accounts simply can’t address. Multi-currency operations, automated payment flows, real-time financial reporting, and good integration with existing tech stacks have become table stakes, not nice-to-haves.

The modern CFO’s toolkit requires financial partners who understand that software companies operate differently. They need services built for the digital economy, not legacy systems adapted for it.

Cash flow management: The growth engine

For SaaS businesses, cash flow management extends far beyond monitoring account balances. Subscription revenue models create complex cash flow patterns with recurring payments, prorated charges, and international collections that require sophisticated handling.

Modern financial infrastructure should provide real-time visibility into cash positions across multiple currencies and accounts, automated reconciliation of subscription payments, and predictive cash flow modeling that accounts for churn rates and expansion revenue. The goal is transforming cash flow from a reactive monitoring exercise into a proactive growth planning tool.

International expansion made simple

When software companies scale globally, they encounter a maze of payment methods, currencies, and regulatory requirements. European IBANs, SWIFT connectivity for global transfers, and multi-currency account structures become essential infrastructure, not administrative afterthoughts.

Modern EMIs like Satchel provide SWIFT accounts supporting over 20 currencies with access to global and local payments, enabling businesses to transact in beneficiary currencies and avoid exchange fees across more than 100 countries. This infrastructure allows tech companies to collect payments locally while maintaining centralized treasury management.

Payment automation: Efficiency at scale

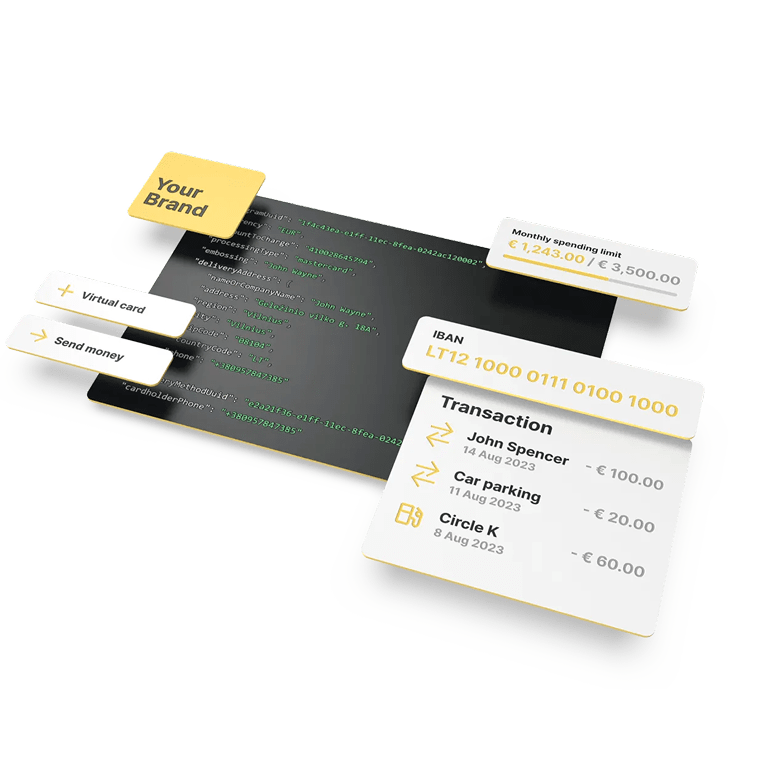

Manual payment processes become bottlenecks as software companies scale. Modern CFOs need payment infrastructure that integrates well with their existing systems, supports API-driven automation, and handles complex payment scenarios without human intervention.

This includes automated vendor payments, employee compensation across multiple jurisdictions, customer refunds, and subscription billing reconciliation. The right financial infrastructure becomes an extension of the company’s technology stack, not a separate system requiring manual data entry and reconciliation.

Financial reporting for growth decisions

Traditional financial reporting focuses on historical performance, but growth-stage software companies need forward-looking insights. Modern financial infrastructure should provide real-time data feeds that integrate with business intelligence tools, support automated reporting workflows, and enable scenario modeling for growth planning.

This means moving beyond monthly bank statements to daily cash flow visibility, automated variance analysis, and integration with key business metrics like customer acquisition costs and lifetime value calculations.

The EMI advantage for tech companies

Electronic money institutions represent the digital era of financial services, built by Internet people for Internet people, offering modern compliance procedures with better fraud protection and less paperwork. For software companies, this translates to faster account opening, API-first integrations, and services designed around digital business models.

Modern EMIs offer comprehensive solutions including European IBANs, SEPA and SWIFT payment processing, payment cards, and specialized products like Banking-as-a-Service (BaaS) and Software-as-a-Service (SaaS) solutions, providing tech companies with financial infrastructure that matches their technological sophistication.

Building financial infrastructure for tomorrow

The most successful software companies treat financial infrastructure as a competitive advantage, not a cost center. They choose partners who understand their unique needs, offer scalable solutions, and provide the technological integration capabilities that enable automated, efficient financial operations.

As software companies continue to reshape global business, their financial infrastructure must evolve to support new business models, international expansion, and the rapid pace of technological change. The CFOs who recognize this shift and invest in modern financial infrastructure will be the ones who successfully scale their companies in an increasingly competitive landscape.

Ready to modernize your financial infrastructure? Explore how Satchel services can support your software company’s growth at satchel.eu.