From startup to scale-up

Scaling a tech company requires more than expanding your team or launching new products. It demands transforming your financial operations to support growth, manage risk, and maintain agility in a competitive global market. As your business evolves, the simple accounting tools and ad hoc processes that worked in the startup phase often become a bottleneck. To scale successfully and sustainably, your financial infrastructure must mature alongside your business.

In this article, we’ll explore the key areas where growing tech companies need to adapt, focusing on international expansion, scalable financial systems, relationship management, and the crucial role of multi-currency accounts for cross-border operations.

Multi-currency accounts: The backbone of international business

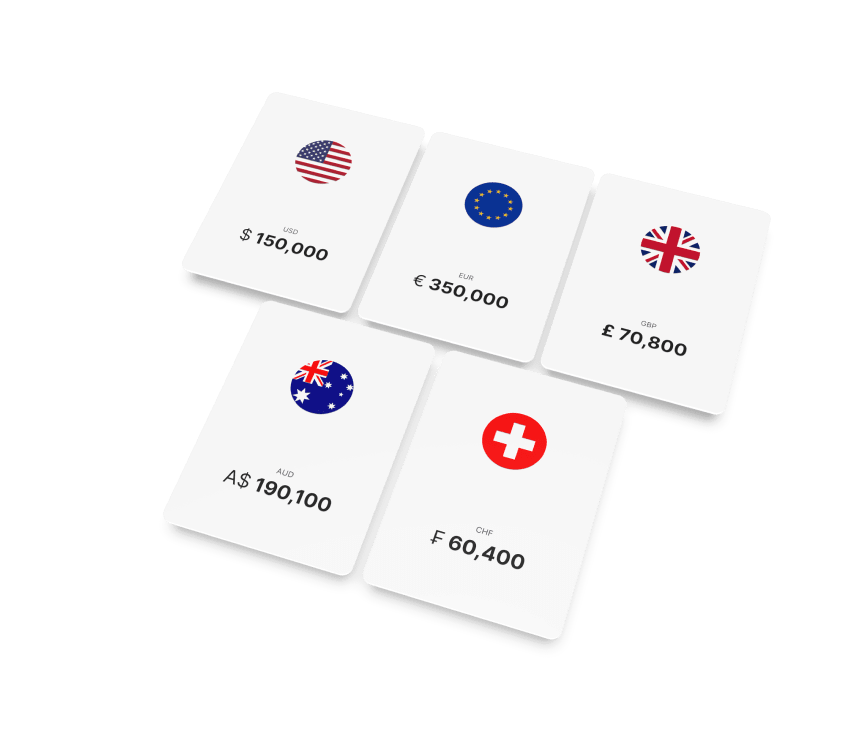

One of the most common challenges for startups transitioning into the scale-up territory and expanding internationally is handling payments in multiple currencies. Using multiple bank accounts, manually converting currencies, or relying on costly payment platforms can drain time, money, and energy, ultimately shifting the focus from core priorities to operational nuance. Multi-currency accounts, on the other hand, allow businesses to hold, send, and receive funds in multiple currencies from a single account, reducing conversion fees, streamlining operations, increasing transparency, and enabling more efficient management of international cash flow.

The Satchel Multi-Currency Business Account offers the ability to manage dozens of currencies under one roof. With features like real-time exchange rates, local account details for different currencies, and simplified cross-border payments, Satchel empowers scale-ups to operate globally without unnecessary friction. In short, if you’re serious and intentional about international growth, a multi-currency account isn’t optional – it’s a strategic necessity.

Scaling your financial infrastructure

In the startup phase, many companies manage their finances using spreadsheets and basic accounting software. But as you grow, the volume of transactions, payroll complexities, and reporting requirements expand rapidly.

Investing in scalable financial infrastructure is critical. Integrated ERP systems, automated reporting, and cloud-based accounting platforms allow scale-ups to handle high transaction volumes efficiently. They also reduce errors and provide real-time insights into cash flow and profitability – information that is vital for strategic decision-making.

A robust infrastructure goes beyond automation, building a finance function capable of supporting rapid growth without being overwhelmed by complexity.

Navigating international compliance and taxation

Expanding into new markets brings a host of regulatory and tax challenges. Each country has its own set of rules regarding VAT, corporate tax, and reporting obligations. Failing to comply can result in fines, legal issues, and reputational damage.

To manage this, scale-ups should invest in:

- Automated compliance tools that monitor transactions and tax obligations in different jurisdictions.

- Local financial advisors who understand regional regulations and can provide actionable guidance.

- Internal controls that ensure accuracy and prevent fraud or mistakes.

Having a multi-currency account also simplifies compliance by providing a clear record of international transactions in the native currencies, making audits smoother and faster.

Financial relationship management

As your business grows, so does the complexity of your financial ecosystem. Investors, banks, vendors, and partners all play a critical role in your company’s success. Transparent reporting and strategic communication are key to maintaining trust and ensuring access to capital when needed.

Scale-ups should focus on:

- Regular, clear financial reporting to investors and stakeholders.

- Forecasting and scenario planning to anticipate cash flow needs.

- Long-term relationship-building with international banks and payment providers to secure solid support on the growth journey.

Strong financial relationships can be a competitive advantage, allowing you to secure favorable terms, negotiate better rates, and access growth capital faster.

Leveraging technology for strategic advantage

Finance plays a strategic role in today’s chaotic dynamic business environment: uncovering insights, streamlining processes, and powering data-driven growth. Scale-ups can benefit from:

- AI-powered analytics that provide predictive insights for cash flow management.

- Automated invoicing and payment reconciliation to reduce administrative overhead.

- Financial dashboards that give executives real-time visibility across all markets and currencies.

Integrating these tools with a multi-currency account ensures that your cross-border operations are seamless, efficient, and fully transparent. With Satchel, companies can consolidate payments, track international transactions, and optimize currency conversions – all from a single touchpoint.

Preparing your finance team for scale

Even the best systems are only as effective as the people using them. Scaling a company means upskilling or hiring finance professionals capable of managing complex international operations, advising leadership on financial strategy and investment decisions, and interpreting data and navigating cross-border risks.

Your finance team should not just be reactive; they should proactively identify opportunities to optimize costs, improve cash flow, and enable global expansion.

Conclusion: Financial evolution as a growth strategy

Many entrepreneurs think of the transition from startup to scale-up as a milestone, but in reality, it is a whole metamorphosis. In the context of finance, the companies that succeed internationally are those that:

- Invest in scalable financial infrastructure.

- Prioritize compliance and regulatory oversight.

- Strengthen financial relationships with stakeholders.

- Leverage technology to gain strategic insights.

- Adopt tools like multi-currency accounts to enable smooth cross-border operations.

The Satchel Multi-Currency Business Account is designed specifically for scale-ups navigating the complexities of international growth, giving businesses the freedom to focus on strategy and expansion rather than administrative friction.

Scaling your business is hard, but with the right financial systems and tools in place, it becomes manageable, strategic, and ultimately empowering. Backed by the right partner, your finance function transforms into a global success engine, driving your leap from startup to scale-up and beyond, with effortless momentum.