How to Open a Payment Account Online in France

If you’re a non-EU citizen and looking for the most convenient and straightforward way to open a payment account in France, you’re in the right place. With modern technology and the right information, you can now easily open an account remotely from the comfort of your own home. In this article, I will explain how to open up an account in just a few simple steps. By getting familiar with the options and understanding the potential pitfalls, you can quickly open an account in France to efficiently manage your finances.

What is the best method to open a payment account in France?

There’s no need to discuss the traditional method of opening an account – it’s generally the same all over the world. Collecting and getting your paperwork certified can take a while and also be quite expensive.

I want to focus on the more modern and convenient option – opening an account online, which seems to be the best option at the moment. After filling out and submitting the required forms, your new account will be set up in a matter of just a few days or weeks, depending on account type and provider’s internal rules. Having a fully digital account allows you to access your funds from your mobile device/computer, which is an ideal solution for the modern active lifestyle. Moreover, digital banking is advantageous from the financial standpoint, due to attractive fees and commissions. All things considered, going digital when it comes to banking is a quite rewarding experience.

Online account opening in France with an EMI

Opening a payment account is usually a daunting task, especially in France. Luckily, there are EMI (electronic money institutions) / digital-only banking providers to the rescue! Below are some of my personal arguments in favor of this approach.

1. The account opening process at EMIs is smooth and seamless.

Digital banking providers are usually less demanding; primarily, they do not require you to:

- Prove French residency (a utility bill with your home address in your country of residence will be enough);

- Have French employment or a taxpayer ID;

- Pay an onboarding fee (you will only be charged if your account opening application is approved).

These are also the main requirements for getting an EU IBAN at Satchel.eu.

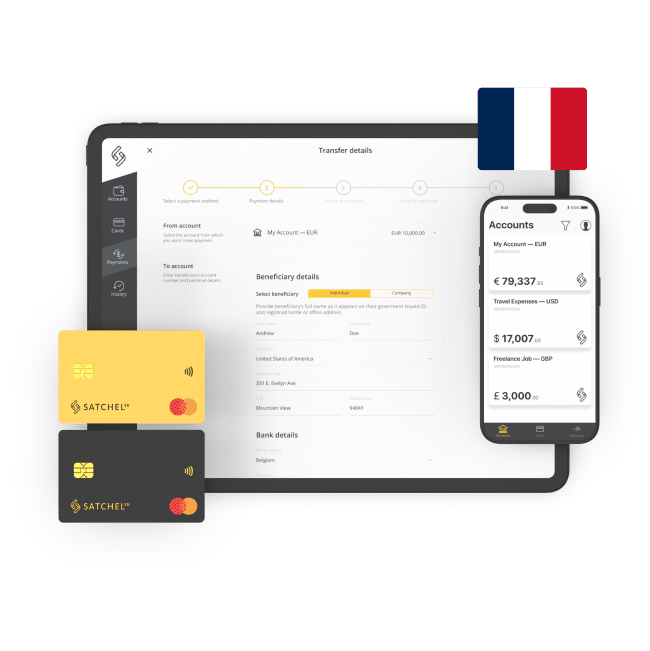

2. 24/7 app money management with features such as multi-currency accounts and currency exchange, as well as the ability to make money transfers (SEPA & SWIFT) and use virtual or plastic payment cards.

3. EMIs are typically more crypto-friendly since the cryptocurrency exchange market is largely unregulated in the EU, which makes traditional financial institutions hesitant to facilitate such transactions.

4. When it comes to security, digital-only banking providers deploy highly secure and technologically advanced tools for the protection of your personal data.

5. But please remember, operating under the license of an electronic money institution means that you will not be able to take loans or make a cash deposit. However, a potential pitfall is that the money you loan from a traditional financial institution may come from someone’s deposit – and vice versa: when you deposit money into your account, the financial services provider may immediately turn it into loan material.

EMIs mostly offer features like payment accounts, payment cards, SEPA and SWIFT payments, and so on. Whichever financial institution you choose to open an account with, it’s important to research the fees and requirements and make an educated choice.

What documents do I need to open an account in France?

In order to open an account in France, you will need the following documents:

- Proof of identity (as an EU citizen, you should bring your national identity card and your passport; non-EU citizens need a passport and a valid visa);

- Proof of your address in France (as an EU citizen, you can provide a utility bill in your name from your home country; non-EU citizens must provide a valid French residence permit, a valid rental agreement, or a “certificat de résidence”) But at Satchel.eu, you don’t need to be a resident of an EU/EEA country to get an account; a utility bill from your home country is all that’s required;

- Proof of previous bank statements from your home country if you are an international student;

- An application form for opening a current account in France, which can usually be found on the financial services provider’s website.

For a business account, you will need to provide the company’s registration documents (e.g., Articles of Association) and other corporate documents upon request.

The full list of documents for online company or private account opening at Satchel can be found at the following links: business or personal.

Bonne chance!