Why multi-currency business accounts are essential for global growth in 2025

As businesses expand internationally, managing multiple currencies efficiently has become a necessity rather than a convenience. Multi-currency business accounts offer a practical solution for companies navigating global markets, reducing financial friction and improving cash flow management.

Supporting international expansion

Multi-currency accounts enable businesses to transact across borders without requiring multiple bank accounts in different countries. This simplifies financial operations, improves liquidity, and allows companies to accept payments in local currencies—enhancing customer experience and trust.

Avoiding high Forex fees and optimizing payments

One of the biggest challenges of international transactions is the cost of currency conversions. Traditional banks often charge high forex margins and additional fees on cross-border payments. Multi-currency accounts help businesses avoid these costs by allowing them to hold and pay in foreign currencies without unnecessary conversions, saving significant amounts in the long run.

Real-time FX rates and their impact

Exchange rates fluctuate constantly, affecting the cost of global transactions. Multi-currency accounts often provide access to real-time FX rates, enabling businesses to time their conversions strategically and reduce exposure to unfavorable rate changes. Some fintech providers also offer hedging options to manage currency risk more effectively.

Why Satchel Multi-Currency Business Account?

- Open a unique multi-currency business account online

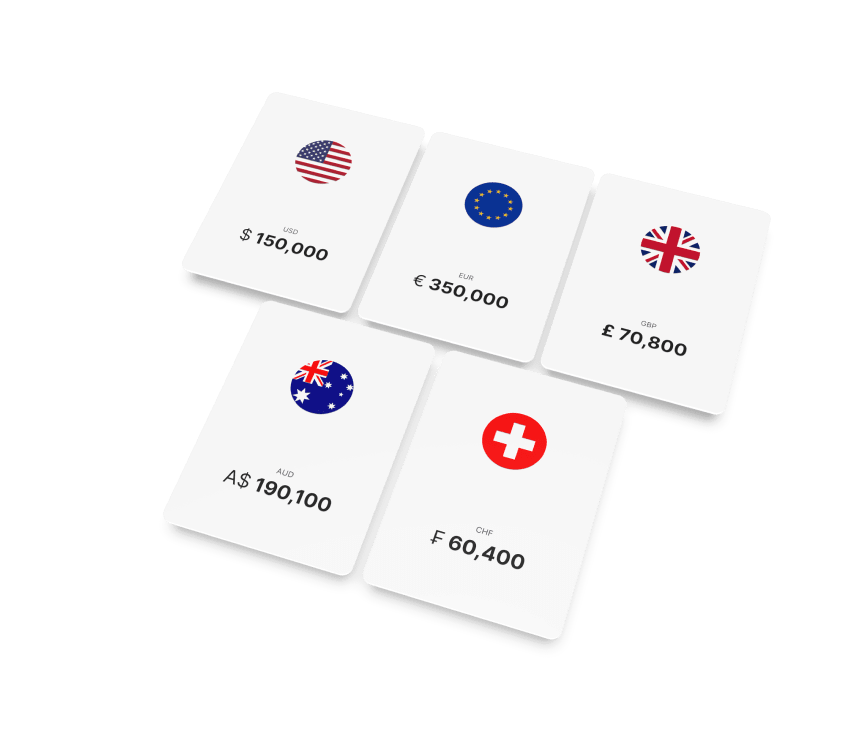

- Transact in over 20 currencies

- Easily manage operations via the Satchel app or web Client office

- Enjoy the flexibility of global banking from anywhere

- Access live customer support whenever needed

- Have your funds stored in a segregated account in the Bank of Lithuania

- Keep your transactions protected with security features like 3D Secure and 2FA

- Benefit from our partnership with Mastercard Europe

- Rely on our transparent fee structure without hidden fees

- Unlock competitive FX rates

The bottom line

For businesses looking to efficiently grow internationally in 2025, multi-currency accounts are no longer optional—they are a critical tool for financial efficacy. By reducing forex fees, optimizing payments, and leveraging real-time exchange rates, companies can focus on growth without being held back by banking limitations.