Multi-currency business account vs. traditional one: Which is right for you?

Choosing the right business account is crucial for managing international transactions efficiently. Multi-currency accounts and traditional business accounts each offer distinct advantages, depending on your company’s financial needs.

Pros and cons of multi-currency vs. traditional business accounts

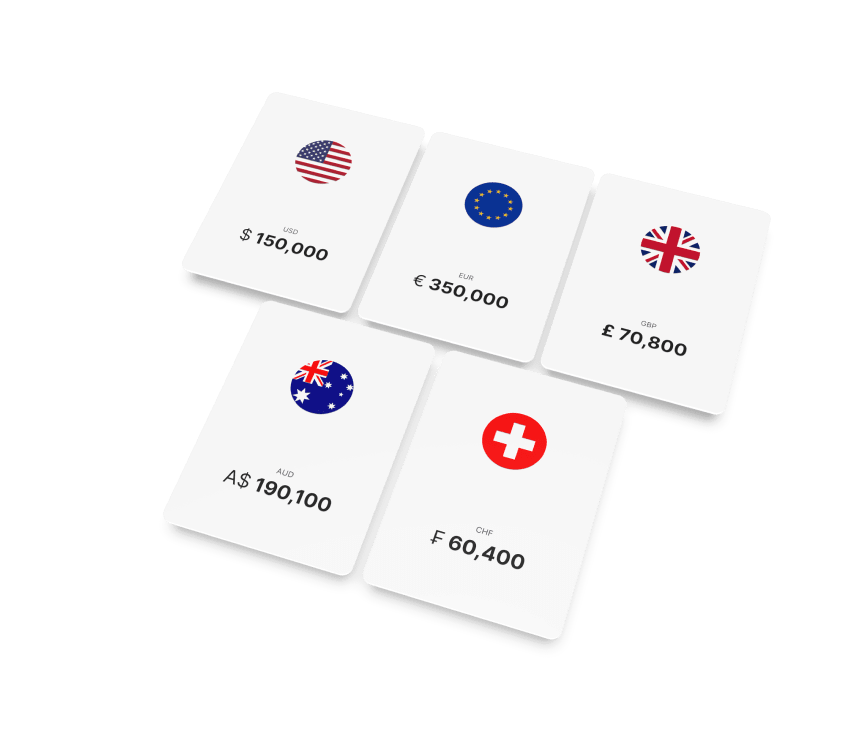

Multi-currency accounts allow businesses to hold, send, and receive multiple currencies within a single account, reducing the need for frequent currency exchanges. This can lower costs and simplify financial management. However, these accounts may come with fees for certain services and may not always offer the same level of local banking infrastructure as traditional banks.

Traditional business accounts provide stability, local branch access, and often come with additional financial services. However, they typically charge higher fees for international transactions and currency conversions, making them less cost-effective for businesses dealing in multiple currencies.

Saving on exchange rates and transaction fees

Multi-currency accounts help businesses avoid costly exchange rate fluctuations and excessive transaction fees. By holding balances in different currencies, companies can time conversions strategically, reducing unnecessary costs. Traditional banks, on the other hand, often apply higher foreign exchange margins and charge extra for cross-border payments.

Key features to consider

When selecting a multi-currency account, look for:

- Foreign exchange (FX) management: Competitive rates and hedging options to manage currency risk.

- Local IBANs: Enable businesses to receive payments as local transactions in different countries.

- Integrations: Compatibility with accounting software, payment gateways, and e-commerce platforms for smooth financial operations.

Best use cases

- E-commerce: Businesses selling internationally benefit from receiving payments in multiple currencies without conversion losses.

- Freelancers: Professionals working with global clients can receive payments in different currencies while avoiding high conversion fees.

- Global trade: Importers and exporters can manage supplier payments efficiently without incurring unnecessary banking costs.

Both multi-currency and traditional business accounts have their place. For companies with frequent international transactions, a multi-currency account offers cost-saving advantages and operational flexibility. Traditional accounts remain a strong choice for businesses prioritizing local financial services and long-term banking relationships.