Advantages and disadvantages of multi-currency accounts

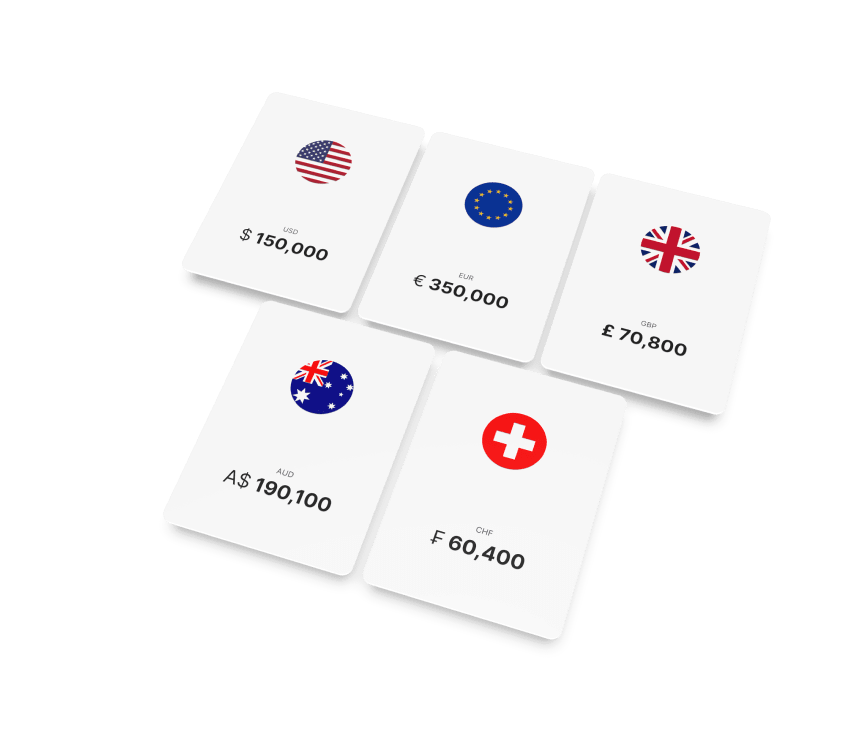

Traditional single-currency accounts are suitable for businesses transacting in one currency and operating within one country / territory. However, for those dealing with multiple currencies regularly, the convenience of multi-currency accounts is undeniable. Let’s delve deeper into the advantages and disadvantages of multi-currency accounts.

Pros of Multi-Currency Accounts

Multicurrency accounts have transformed global financial transactions for businesses and individuals alike, offering a host of advantages that streamline operations and improve financial management. Here’s why they’re indispensable:

- Convenience and Simplification

- Centralized management: All currency needs are consolidated into a single, easy-to-use platform for efficient asset oversight.

- Digital accessibility: Enjoy the convenience of online and mobile banking features for instant account management, including transfers, payments, and balance checks.

- Cost-Effectiveness

- Reduced conversion costs: Direct transfers in preferred currencies minimize or eliminate conversion fees, resulting in significant long-term savings.

- Transparent fee structures: Clear fee schedules for currency transactions ensure predictable costs, enhancing efficient cost management.

- Local Bank Details

- Multiple local account details are provided, including the bank account number, branch code, or bank code for banks in Hong Kong or elsewhere, depending on a banking provider.

- Risk Mitigation

- Currency fluctuation management: Holding multiple currencies allows for proactive responses to favorable exchange rates, mitigating risks associated with currency volatility.

- Enhanced liquidity: Diverse currency holdings increase financial liquidity, facilitating seamless asset movement without conversion delays.

- Operational Flexibility

- Swift transactions: Immediate access to multiple currencies enables prompt payments or investments, empowering businesses to capitalize on opportunities swiftly.

- Localized payments: Conducting transactions in local currencies can lead to better terms and strengthen partnerships with suppliers and associates.

- Specialized Applications

- Simplified global investments: Direct currency transfers make investing in foreign markets seamless, bypassing conversion hurdles and delays.

- Management of international living expenses: Streamline financial obligations in different countries, ideal for expatriates, frequent travelers, and property owners.

- Simplified education expenses: Facilitate direct payments for tuition, living expenses, and allowances in the currency of the educational institution’s location, alleviating the burden for parents of students studying abroad.

Multicurrency accounts offer unparalleled efficiency, flexibility, and cost-effectiveness in managing global transactions, catering to diverse business and personal financial needs. They represent a versatile financial tool that empowers users with greater control over their finances.

Cons of Multi-Currency Accounts

Despite the numerous benefits offered by multi-currency bank accounts, they also pose several challenges. Here are some key considerations to keep in mind:

- Costs and Fees

- Variable Fees: While some multi-currency accounts offer low or zero fees for currency conversion, others may impose significant charges for account maintenance, ATM withdrawals, or international bank transfers.

- Interest Rates: Multicurrency accounts typically do not provide attractive interest rates on deposits, potentially outweighing any interest income with the cost of maintaining multiple currency balances.

- Management Complexity

- Rate Monitoring: Tracking fluctuating exchange rates for multiple currencies can be time-consuming, requiring customers to closely monitor rates to make informed financial decisions.

- Regulatory Compliance

- Adhering to various financial regulations across different currencies can be complex, encompassing tax implications, anti-money laundering rules, and reporting obligations, adding to recordkeeping and legal compliance burdens.

- Risk Factors

- Exchange Rate Risks: Holding multiple currencies exposes accounts to inherent volatility, with balances in one currency susceptible to losing value against another, affecting the overall account worth.

- Account Limits: Multicurrency accounts may come with restrictions such as transaction limits or maximum balance caps for specific currencies, impacting financial planning and liquidity.

- Accessibility and Availability

- Range of Banking Services: The availability of features in multicurrency accounts can vary among financial institutions, with some lacking desired features like subaccounts or real-time currency transfers.

- Geographic Restrictions: Some financial institutions may restrict access to multi-currency accounts based on the residency of applicants, limiting availability to certain countries or regions.

- Integration Concerns

- Account Syncing: There is no guarantee of full integration between multi-currency accounts and financial software used for bookkeeping or expense tracking.

- Transaction Timing: Transferring funds between different currency balances may not always be instantaneous, potentially causing delays, especially in volatile markets.

While multi-currency accounts offer undeniable advantages for managing international finances, it’s essential to carefully assess these challenges against the benefits to determine if such an account aligns with your financial objectives.