Should you offer embedded finance? BaaS guide for non-financial companies

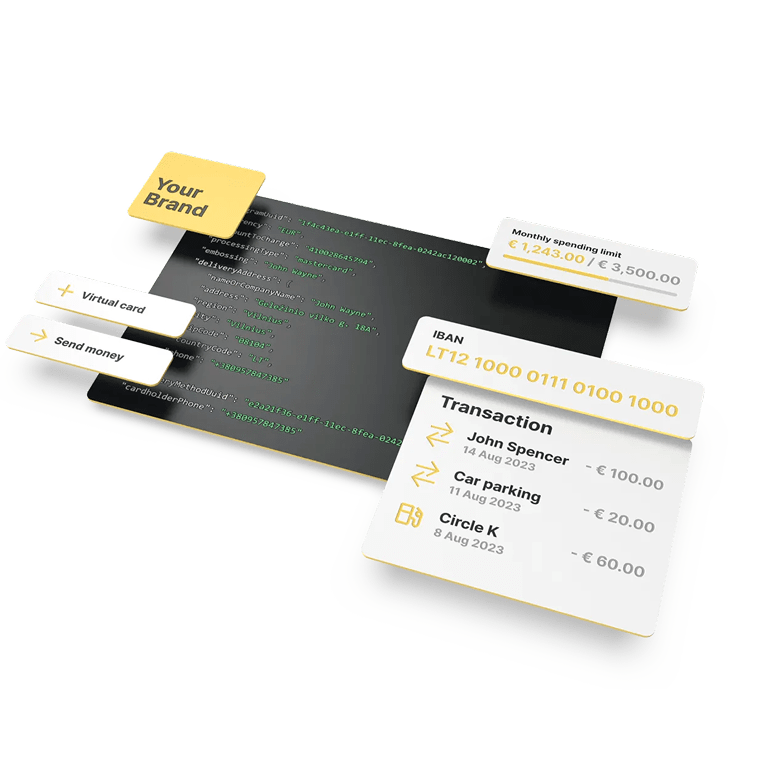

In recent years, financial services have moved beyond banks and fintech firms, being embedded within industries as diverse as retail, travel, and software. This transformation—driven by Banking-as-a-Service (BaaS)—has enabled businesses to integrate financial products into their ecosystems, reshaping customer interactions and revenue streams.

The rise of embedded finance and its impact on customer experience

Consumers now expect more from their favorite brands. Whether they are booking a trip, purchasing electronics, or subscribing to a software platform, the ability to pay, finance, or even insure a purchase without leaving the platform enhances convenience. Businesses that integrate financial services directly into their offerings not only meet these expectations but also create deeper engagement with their users.

Embedded finance allows companies to provide features such as instant lending, branded payment cards, and built-in insurance, transforming one-time transactions into ongoing relationships. The result is a more connected and value-driven customer experience.

Approximately 56% of businesses now offer at least one form of embedded finance, with 55% of non-financial companies planning to introduce these services within the next two years.

How different industries are leveraging BaaS

Retail: Increasing conversion rates and customer loyalty

E-commerce platforms and brick-and-mortar stores alike are embedding financial services to drive sales. Buy Now, Pay Later (BNPL) options allow consumers to make purchases more easily, while branded credit cards offer rewards that encourage repeat business. Retailers can also provide instant refunds or cash-back incentives, further strengthening customer loyalty.

Retailers implementing embedded finance solutions have experienced a 5% to 12% increase in conversion rates, a 15% to 30% rise in average order values, and a 4% to 7% boost in revenue.

In 2024, 30% of consumers considered using Buy Now, Pay Later (BNPL) services for holiday shopping, with 23% stating that BNPL helps them stretch their holiday budgets.

Travel: Simplifying payments and enhancing service offerings

Travel companies are integrating financial tools to offer installment payments, currency exchange services, and travel insurance within their platforms. These features remove friction from the booking process and give travelers more confidence in their purchases, reducing drop-off rates and increasing average order value.

SaaS: Creating new revenue streams

Software providers are embedding banking features such as automated invoicing, revenue-based financing, and digital wallets. By offering these services, SaaS companies not only improve user retention but also generate additional revenue through transaction fees and financial product partnerships.

Why businesses are investing in embedded finance

Beyond enhancing customer experience, integrating financial services brings tangible business benefits:

- Higher retention rates: Customers who rely on embedded financial tools are more likely to remain engaged with a platform.

- Increased customer spend: Financing options, loyalty programs, and instant payments encourage users to spend more.

- Diversified revenue streams: Transaction fees, interest margins, and embedded insurance offerings create new income sources.

The embedded finance market is projected to grow from $115.8 billion in 2024 to $251.5 billion by 2029, reflecting a Compound Annual Growth Rate (CAGR) of 16.8%.

Compliance and risk management considerations

While the potential of embedded finance is significant, businesses must navigate a complex regulatory landscape. Partnering with a licensed BaaS provider like Satchel can simplify compliance, but companies must still address key concerns such as:

- Data security: Handling financial transactions requires strict data protection and fraud prevention measures.

- Regulatory adherence: Depending on the region, businesses may need to comply with banking, lending, and consumer protection laws.

- Risk management: Offering financial services introduces risks such as credit defaults, chargebacks, and liability issues.

Is embedded finance right for your business?

Adopting BaaS requires careful planning and a clear understanding of how financial services fit within your existing business model. Companies that successfully implement embedded finance often see increased customer loyalty, improved revenue opportunities, and a stronger competitive position. However, success depends on choosing the right financial partners and ensuring regulatory compliance.

For businesses looking to stay ahead in an evolving digital economy, embedded finance isn’t just an option—it’s a strategic advantage worth exploring.