Strategic finance for group structures

Managing multiple entities across jurisdictions presents unique financial complexities: from disparate relationships with financial providers and variable local regulations to fragmented cash flows and tangled intercompany obligations. These challenges not only slow consolidation but also expose groups to inefficiencies, FX exposures, and compliance risks.

However, by centralizing finance, ideally through a corporate treasury or finance hub, group entities can unlock efficiency through consolidated oversight, streamlined liquidity, and cost reductions. In a landscape increasingly defined by agility and transparency, centralized financial management offers both control and strategic optionality.

In this article, we explore the strategic pillars of group finance – from the role of corporate treasury and cash pooling mechanisms to managing intercompany transactions, consolidating reporting, and building a centralized framework – with practical insights on how solutions like Satchel can support multi-entity structures.

The role of corporate treasury in group structures

Corporate treasury functions within group structures encompass far more than just cash management – they serve as a nerve center for liquidity planning, funding, risk mitigation, and internal performance. Core responsibilities include cash and liquidity management, funding and capital optimization, risk control, intercompany netting, and funds transfer pricing (FTP) to allocate internal costs fairly.

Group finance management and cash pooling mechanisms

Cash pooling has become a cornerstone of centralized group liquidity. By offsetting surpluses in some subsidiaries against deficits in others, organizations minimize external borrowing and gain a clearer, consolidated view of their cash positions.

Two models dominate in practice. Physical cash pooling, often structured as zero-balance or target-balance accounts, involves the daily sweeping of subsidiary balances into a central master account. This gives treasurers tight control and clear audit trails, though it requires careful management of intercompany loans and tax obligations. Notional cash pooling, by contrast, aggregates balances only conceptually: subsidiaries retain their own accounts, but the financial provider calculates net interest positions across the group. This approach preserves autonomy, avoids transaction costs, and is easier to administer, though in many jurisdictions it requires legal frameworks such as cross-guarantees.

The benefits are compelling: lower borrowing costs, improved cash visibility, greater negotiating leverage with financial providers, and centralized FX risk management. But compliance must be taken seriously. Transfer pricing rules demand that interest charges are set at arm’s length and tax authorities expect treasury entities to have proper documentation in place to avoid disputes.

Managing inter-company transactions effectively

Intercompany transitions, such as loans, dividends, cross-border services, and sales between group entities, sit at the heart of group structures. These transactions are vital for funding and resource sharing but, if poorly managed, they create reconciliation headaches and attract regulatory scrutiny.

Best practice begins with globally standardized policies and master data, ensuring consistency in documentation, transfer pricing, and process execution. A uniform chart of accounts further simplifies reporting and makes eliminations more reliable. Increasingly, automation is playing a decisive role, linking ERP and treasury systems to reduce manual errors, accelerate reconciliations, and maintain transparent audit trails.

Regular reconciliations and internal audits remain critical. By aligning intercompany charges with arm’s-length standards and documenting the rationale, groups both ensure fairness and protect themselves in the face of tax authority reviews.

Consolidated reporting and financial control

For holding companies, consolidated financial reporting is non-negotiable. Without it, executives lack a clear picture of group performance.

Key benefits:

- Unified insights across subsidiaries

- Compliance with relevant accounting standards and procedures

- Decision-making support with accurate group-level data

According to Gartner, 72% of CFOs and finance leaders rate metrics, analytics, and reporting as their top focus area for 2025. Modern tools, such as ERP-driven automation and specialized consolidation software, can accelerate eliminations, simplify multi-currency conversions, and ensure transparent audit trails. Yet challenges remain: timing mismatches, FX fluctuations, and transfer pricing adjustments often slow the consolidation process. Overcoming these obstacles requires not only advanced systems, but also strong governance frameworks and smart digital integration across the group.

Building a centralized financial management framework

Building an effective centralized framework starts with creating a dedicated central treasury or finance company that acts as the operational and governance hub. Standardized policies and harmonized master data ensure consistency across the group, while programmed workflows and automated reconciliations maintain efficiency. Just as important is embedding tax and legal compliance at every level, ensuring that treasury functions and transfer pricing practices withstand external review.

How Satchel can support group finance operations

The Satchel Business Account provides the infrastructure – While Label Cards, APIs, multi-currency transactions, and more – designed to support group structures that require centralized financial operations.

Why it’s powerful for multi-entity groups:

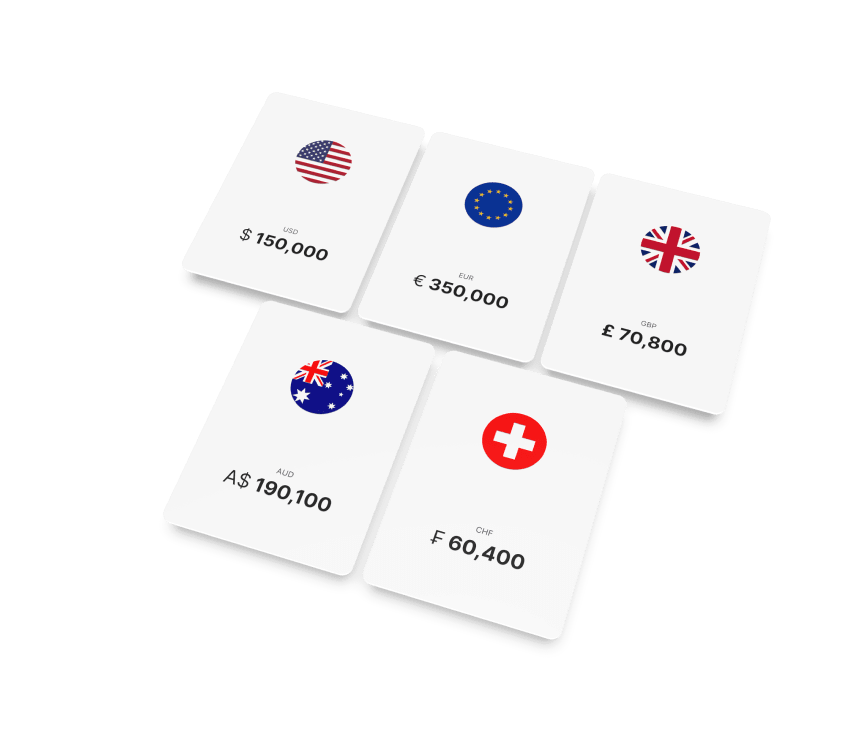

- Multi-currency capabilities for cross-border payments: Send and receive funds in 20+ currencies with a single multi-currency IBAN, simplifying international operations.

- Streamlined accounting: Gain full visibility over balances and transaction history, ensuring efficient, transparent bookkeeping.

- Optimized FX management: Access competitive rates to reduce costs and minimize foreign exchange risks.

- Scalable, compliant infrastructure: Built to support treasury operations with auditability, governance, and regulatory alignment at its core.

Satchel makes executing cash pooling schemes, automating intercompany workflows, and ensuring seamless movement of funds across entities both practical and efficient. Its modular setup, coupled with strong security measures, provides the transparency, control, and flexibility essential for strategic finance in complex group structures.

Conclusion: Centralized finance as a growth enabler

Centralized strategic finance in group structures brings significant value, optimizing liquidity, reducing borrowing costs, harmonizing reporting, and enhancing governance.

By adopting tools like cash pooling, standardized intercompany processes, automation, and consolidation platforms, and underpinning them with a modern financial infrastructure like Satchel, groups unlock operational agility and financial clarity.

Investing in systems, governance, and integration is not an overhead – it’s a strategic enabler. With disciplined frameworks and the right infrastructure, corporate families can drive efficiency, compliance, and sustainable growth.