Treasury management for high-growth tech companies

As a tech company grows and sets eyes on international expansion, the simple and straightforward finance arrangements that worked at first start to crack. An overwhelming 38% of startups, in fact, fail due to cash flow issues. What began as a local account and domestic currency quickly fragments into a web of subsidiaries, foreign currencies, and dozens of providers. In order to successfully overcome the growth pains, tech companies must treat liquidity differently, recognizing that investor capital isn’t infinite and that cash needs to last.

When each entity runs a separate account, the finance team loses sight of the group-wide position. Without consolidated control, moving cash across borders, converting currencies, and funding growth become slow, error-prone processes. At scale, treasury isn’t just an operational function: it becomes a strategic differentiator between companies that scale efficiently and those that burn runway.

In this article, we’ll look at how high-growth tech companies can strengthen their treasury operations — from improving cash visibility and managing currency exposure to consolidating banking relationships and ensuring global compliance. You’ll also discover how the Satchel multi-currency solutions and BaaS infrastructure empower modern finance teams to operate with clarity, control, and confidence.

How inefficiency shortens your runway

In high-growth tech, cash runway is your lifeline. But treasury inefficiencies quietly shave time off that runway. As noted by Silicon Valley Bank, the cost of managing cash poorly rises as spending accelerates, new markets open, and payment systems proliferate. When idle balances accumulate in one entity, FX conversions happen unnecessarily, inter-company funding lags, and the finance team spends precious hours reconciling rather than strategizing.

This kind of drag doesn’t always appear in the P&L but does reduce how long the company can keep growing before needing new capital. A smart treasury function views runway not just as months of cash, but as months of optionality – time to hire, iterate, expand, or survive a setback.

Multi-entity complexity and cash visibility

When you run a holding company, regional subsidiaries, and operational hubs across multiple jurisdictions, treasury grows complex fast. The first question you should be asking: where are all the cash balances? And can we move them to where they are needed?

In practice, this means that without real-time visibility, you end up with cash trapped in non-yielding local accounts, delays in funding payroll or growth, and a lack of clarity about group liquidity. Centralizing spend management and creating unified dashboards for treasury and payments is essential for fast-growth companies. The smarter groups build awake and integrated systems rather than relying on spreadsheets and bank statements.

Managing currency exposure intelligently

Expanding across borders means exposure to multiple currencies. When your revenues, expenses, and investments aren’t aligned by currency, FX movements become a hidden drag on growth. As Bank of America highlights, building a thoughtful investment policy and liquidity strategy is more critical than ever in tech, because you cannot assume you’ll simply raise more cash when needed.

Experienced and forward-thinking treasury teams map out their major currency exposures, apply natural hedges where possible (for example, revenues and costs matching the same currency), and apply structured hedging only when it adds measurable value. Deploying payment-data-driven forecasting and integrating FX into treasury policies becomes essential to make sure you are reducing surprises and maintaining agility.

Streamlining provider relationships

Early-stage companies often accumulate a handful of financial providers as they enter new markets. While pragmatic at the time, this becomes one of the main factors leading to operational complexity: multiple portals, multiple formats, manual reconciliations, and fragmented data. Round Treasury’s recent exploration of treasury best practices for startups emphasizes that as you grow, you should secure controls around bank count, segregation of duties, and cash allocation across institutions.

By consolidating your banking footprint, you simplify interfaces, standardize data flows, improve negotiating leverage, and reduce operational risk. A leaner number of financial partners doesn’t just feel “cleaner”—it accelerates and streamlines your treasury team’s day-to-day, helping them focus on the strategic elements of their job.

Compliance as a foundation, not a constraint

Cross-border growth comes with regulatory complexity: transfer-pricing rules, local banking mandates, currency controls, KYC/AML obligations, and a lot more. Maintaining visibility and control of cash flows as you scale requires awareness of regulations in each market and a structure that anticipates them.

For high-growth tech companies, compliance cannot be an afterthought. From account-opening and inter-company funding to repatriation strategies and audit trails, the earlier you build these into your treasury workflows, the better. When compliance and treasury work in tandem, you reduce the risk of trapped cash, regulatory delays, or surprise costs, which in turn increases your ability to operate internationally without doubts and hesitations.

How Satchel empowers modern treasury management

At Satchel, we felt the pains and challenges of international growth on our own skin, and recognized that scaling tech businesses need more than localized financial solutions—they need a treasury ecosystem designed for global operations.

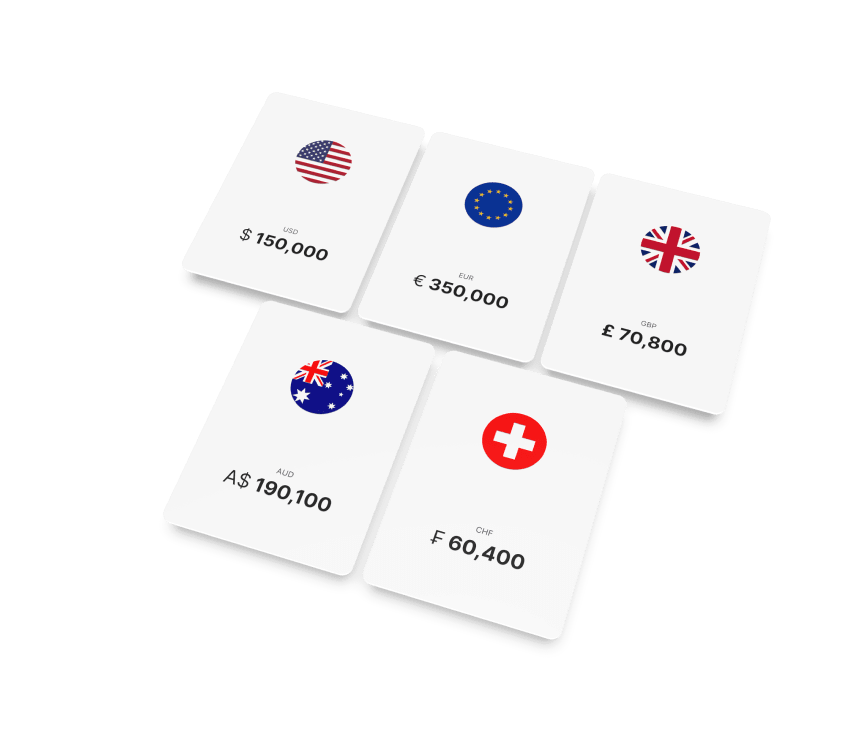

Our Multi-Currency Business Accounts give finance teams a consolidated view of global liquidity in real time. Instead of logging into multiple banking portals or juggling documents, you can see and manage all your balances and transactions through a single, intuitive interface. Whether you’re paying suppliers in USD, receiving revenue in GBP, or funding a new entity in EUR, Satchel streamlines every step of the process, making cross-border treasury management straightforward and transparent.

Beyond visibility, our platform is designed to help you move money faster, smarter, and more efficiently. You can settle payments in multiple currencies without hidden conversion fees, automate internal transfers between entities, and forecast liquidity with clarity. This unified approach not only saves time but also reduces operational risk, freeing your finance team from routine administration.

For tech companies building financial functionality into their own products, our Banking-as-a-Service (BaaS) solution extends that same infrastructure through powerful APIs. With it, you can embed payments, currency exchange, and more directly into your platform, without the underlying complexity. From automating cash management to streamlining FX workflows and enforcing treasury controls programmatically, Satchel helps you bring modern financial operations to life inside your own ecosystem.

Our core aim is to turn treasury from a fragmented set of accounts and processes into a connected, data-driven command center for global finance. It’s the infrastructure we wish we’d had when scaling—now built for the next generation of high-growth companies.

The takeaway

Scaling a tech business in today’s fast-moving, competitive environment is as much about financial precision as it is about innovation. Liquidity pressures, volatile markets, and complex regulatory frameworks can challenge even the most ambitious teams, but with the right treasury infrastructure, those challenges turn into opportunities.

At Satchel, we believe treasury management should be a strategic growth enabler, not a back-office burden. Our solutions are built to give you that advantage — from multi-currency accounts and global payments to API-driven infrastructure. Whether you’re expanding into new markets or optimizing liquidity across existing ones, we provide the precision and speed you need to move your business forward.

In a world where every decision counts, the right treasury partner makes all the difference. If you are ready to build the financial foundation to scale globally, Satchel is here to help.