What is an IBAN?

IBAN (International Bank Account Number) is a standardized format for bank account numbers used internationally to streamline cross-border payments. It includes country codes, check digits, and detailed bank account information, ensuring accurate and efficient transaction processing. IBANs reduce errors in international transfers by standardizing account formats across participating countries.

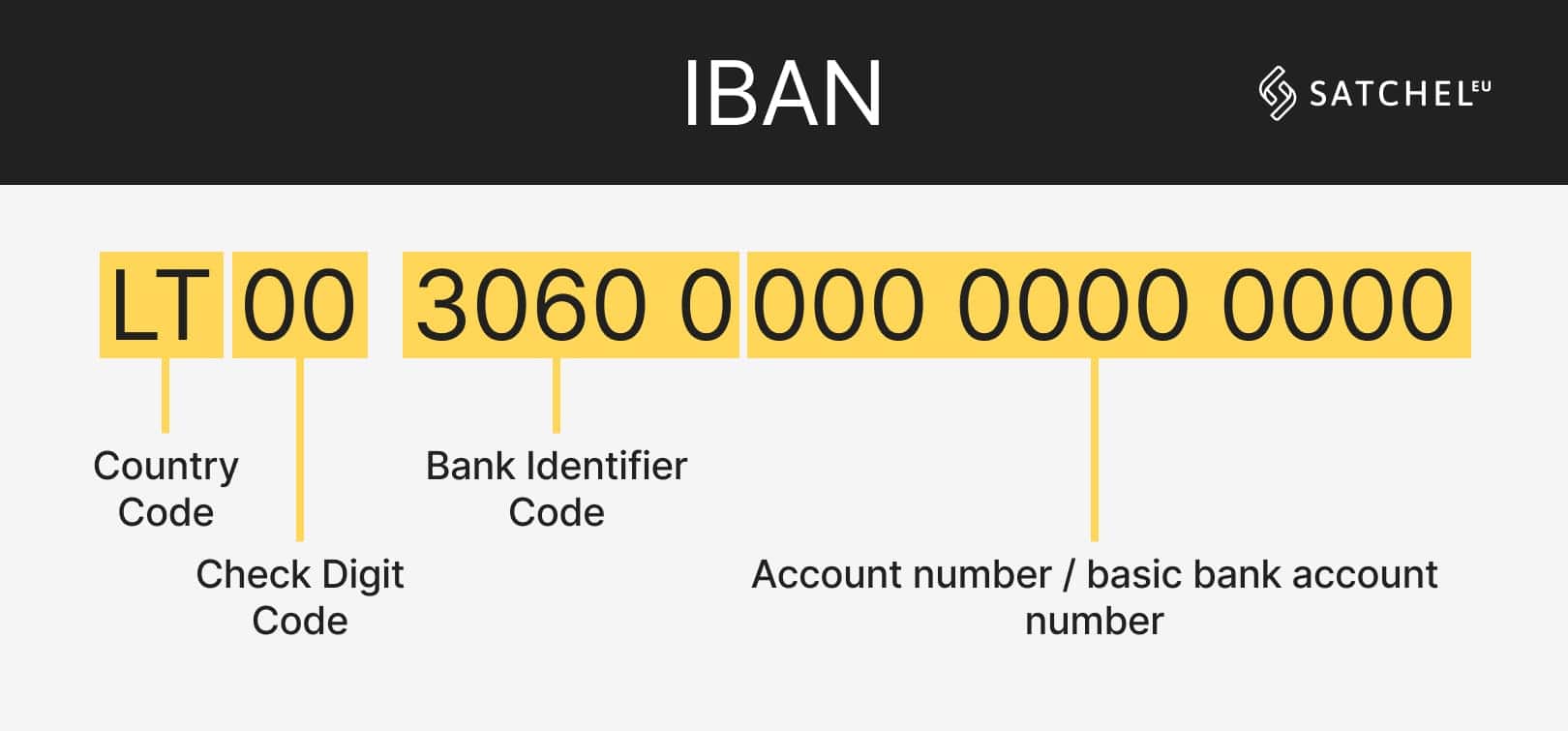

IBAN structure

It typically consists of 15-34 alphanumeric characters, depending on the country. Here’s an example of a Satchel IBAN:

List of countries that support IBANs

Over 70 countries use IBANs, mainly in Europe. IBAN-supporting countries ooutside the EU are the Middle East, the Caribbean, and parts of Africa.

Why don’t all countries have IBANs?

Not all countries adopt IBANs due to differences in financial infrastructure and regulatory priorities. Some, like the U.S., continue using local systems that suit their domestic banking needs, such as ABA routing numbers and SWIFT codes for international payments. The IBAN system is most beneficial for regions where seamless cross-border transactions are frequent, like within the Single Euro Payments Area (SEPA).

IBAN vs BIC

BIC (Bank Identifier Code), also known as the SWIFT code, complements the IBAN by identifying the receiving bank, ensuring payments are routed correctly.

BIC consists of 8 or 11 alphanumeric characters, denoting:

- Institution Code

- Country Code

- Location Code

- Branch Code (optional)

IBAN specifies the exact account, while BIC identifies the bank in cross-border transactions. Both work together to facilitate secure and efficient international payments.

Where can you find your Satchel IBAN?

You can find your account details by taking the following steps:

Satchel web Client office

- Sign in to your Satchel account using a one-time password

- Go to the Accounts tab on the left side of your screen

- Click on the Account that you need the information for

- Click on the Funding Instructions tab and expand the details

Satchel mobile app

- Sign in to your Satchel account

- Go to the Accounts tab

- Click on the Account that you need the information for

- Click on the Funding Instructions tab

For more answers, please visit our FAQ page https://satchel.eu/faq/payments-and-transactions/.