White-label cards: How businesses can launch branded payment solutions

In the world of digital everything, businesses across various industries are looking for ways to enhance customer loyalty, improve brand recognition, and simplify financial transactions. One of the widely used and effective solutions is white-label card programs, which allow companies to issue branded debit, credit, or prepaid cards without building a payment infrastructure from scratch.

What are white-label cards and how do they work?

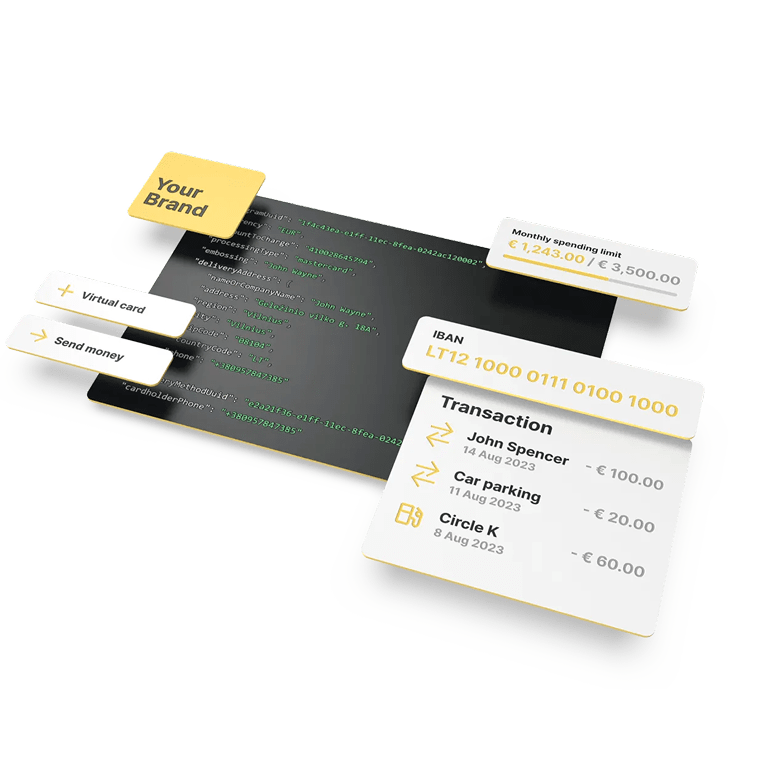

White-label cards are payment cards issued by a third-party provider but branded with a company’s logo and design. Businesses partner with a financial institution or fintech company that handles compliance, processing, and backend services, allowing them to focus on customer engagement and marketing. These cards function like traditional payment cards, enabling users to make purchases, withdraw cash, and even earn rewards, depending on the program setup.

Benefits of offering branded payment cards

Launching a white-label card program offers numerous advantages:

- Enhanced brand recognition: Every time customers use the card, they engage with the brand, increasing visibility and loyalty.

- New revenue streams: Businesses can earn from transaction fees, interchange fees, or premium card features.

- Improved customer retention: Loyalty programs and cashback incentives encourage repeated use and stronger brand attachment.

- Operational efficiency: Leveraging an existing payment infrastructure eliminates the need for businesses to develop costly financial systems from scratch.

Use cases for white-label cards

White-label card solutions are versatile and benefit multiple industries:

- E-commerce: Online retailers can offer branded prepaid or debit cards for payments and customer rewards.

- Fintech: Startups can introduce financial products like digital wallets with integrated payment cards to attract and retain users.

- Travel industry: Airlines, hotels, and travel agencies can provide branded travel cards with perks such as foreign exchange discounts and travel insurance.

- Loyalty programs: Businesses can design customized reward cards, enhancing customer engagement and repeat purchases.

Key considerations when choosing a white-label card provider

Selecting the right partner is critical for reaping the benefits of a white-label card program. Consider the following aspects:

- Regulatory compliance: Ensure that the provider adheres to financial regulations in your target markets.

- Technology & integration: A clockwork API and allrounded digital banking features are crucial for a smooth user experience.

- Customization options: The ability to tailor card design, rewards, and spending limits is essential.

- Security & fraud protection: Choose a provider with robust security measures to protect customers and transactions.

- Cost structure: Understand setup fees, maintenance costs, and revenue-sharing models.

Satchel: A reliable White Label Card program

It is safe to say that one excellent example of a trusted white-label card provider is Satchel. As a leading European fintech, Satchel offers fully customizable card programs that cater to various industries. With a secure and scalable infrastructure, businesses can launch branded debit, credit, or prepaid cards quickly and efficiently. Satchel ensures full regulatory compliance, necessary API integrations, and advanced fraud protection, making us an ideal partner for companies looking to enhance their payment solutions.

White-label card programs provide businesses with a powerful tool to strengthen brand identity, drive customer engagement, and generate new revenue streams. By partnering with a reputable provider (like Satchel), companies can successfully launch and manage branded payment solutions while focusing on their core business growth.