Exploring currencies used in global foreign exchange reserves

The realm of global currencies is dynamic and multifaceted, shaped by historical legacies, economic dynamics, and geopolitical shifts. Understanding this landscape is vital in navigating the complexities of modern finance and considering which currency to bet on in the near future. Let’s delve right in.

How Many Currencies Are There Worldwide?

Currently, there are 162 recognized fiat currencies worldwide, excluding cryptocurrencies. However, this number isn’t static. Various factors, including shifts in government policies, currency reforms, and the emergence of new cryptocurrencies, contribute to fluctuations in this count.

However, it’s important to note that 47 of these currencies are each tied to another currency with a fixed exchange rate. For instance, the Danish krone is a currency in its own right but is tied to the euro at a constant rate. Similarly, the Bahamian dollar corresponds directly to the US dollar in a 1:1 rate.

How Exchange Rates Are Formed

The creation of exchange rates is primarily driven by supply and demand dynamics within a market economy. Broadly defined, an exchange rate represents the value of one currency relative to another. While individuals may exchange currency for various reasons such as travel or international transactions, significant currency transfers often occur between nations to hedge against economic risks.

When countries face economic challenges, the value of their currency may decline. This decline is particularly pronounced for currencies with limited global use. As demand for such currencies diminishes, their exchange rates become more volatile, leading to uncertainty for investors and a subsequent decrease in value.

To stabilize currency fluctuations, governments and central banks implement various measures. One approach involves adjusting key interest rates to influence demand for the currency. Additionally, central banks may intervene directly in the foreign exchange market by buying or selling large quantities of currency to affect its value.

Overall, exchange rates are shaped by complex interactions between economic factors, market forces, and government policies, ultimately determining the value of currencies relative to one another.

Global Foreign Exchange Reserves

Moreover, some currencies serve as reserve currencies, extending their influence beyond their countries of origin. Generally speaking, the selection of currencies for reserves serves as a powerful indicator of their reliability. Therefore, you can confidently consider the list of currencies below as a valuable guide for the future.

As of July 2023, the landscape of global foreign exchange reserves encompasses several key currencies.

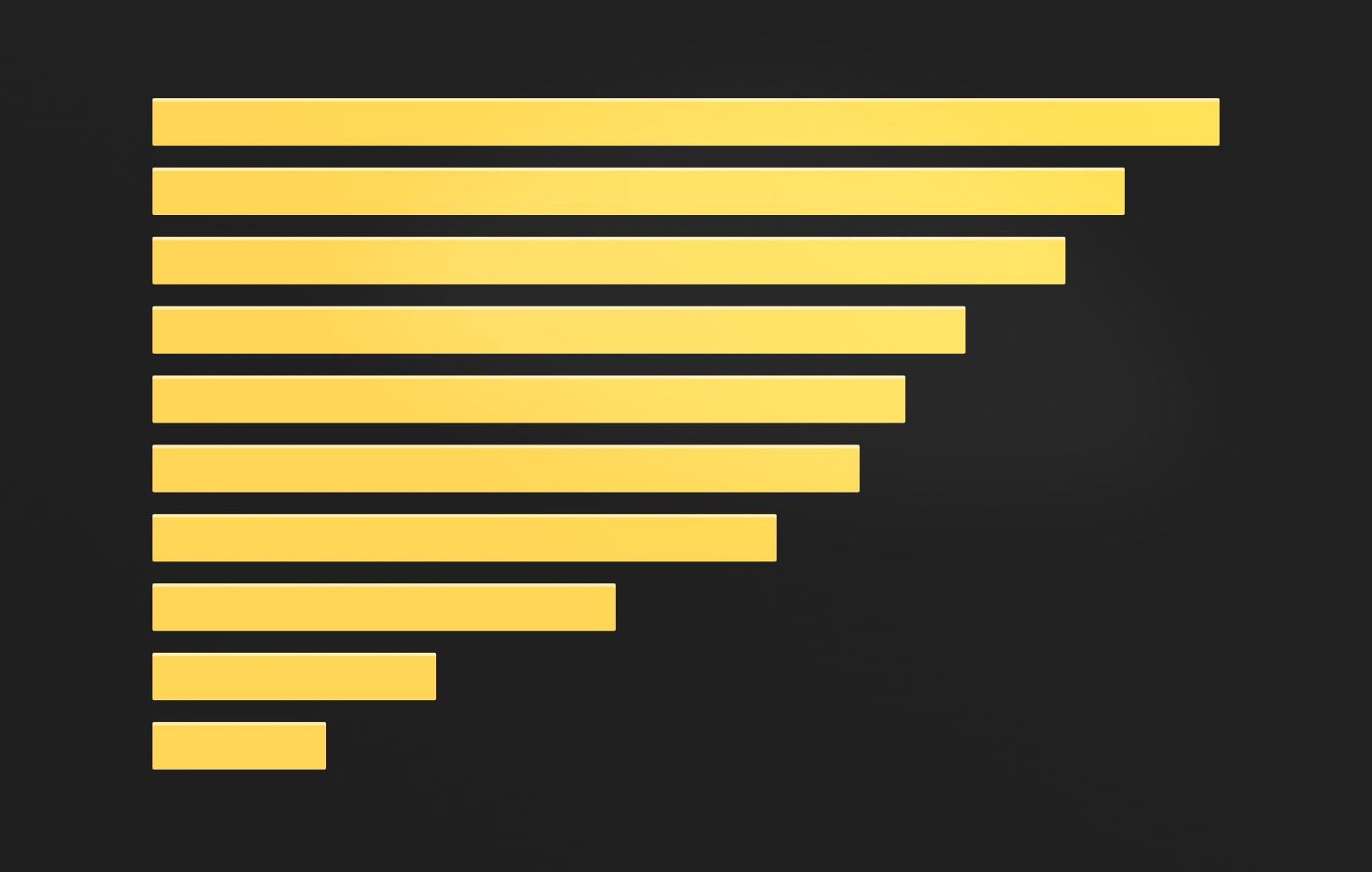

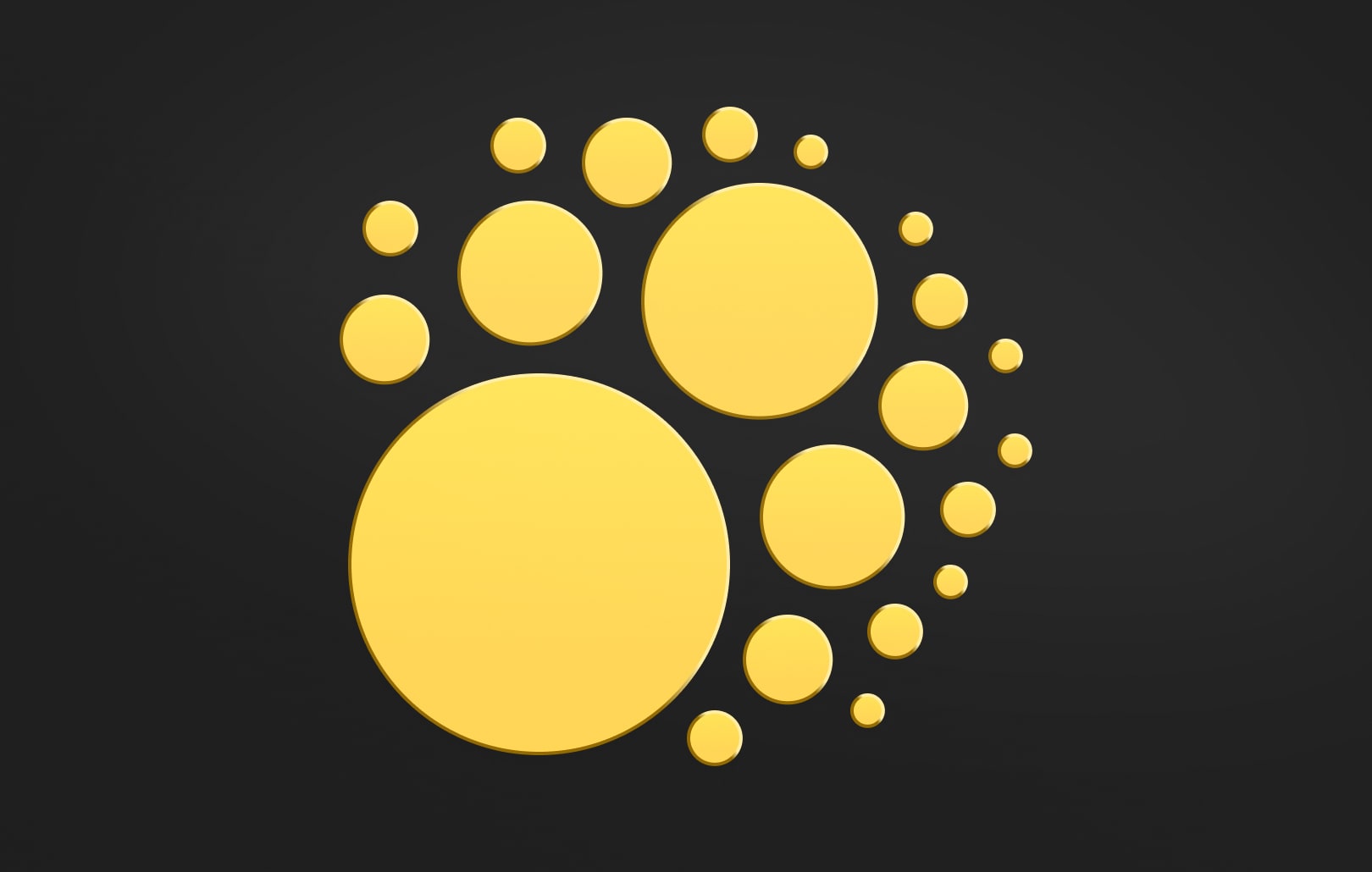

- US Dollar (USD). The US dollar, a key player since World War II, stands as a prime example. The USD maintains its stronghold as the predominant reserve currency, constituting approximately 59% of allocated reserves worldwide. Central banks favor significant USD holdings owing to its historical stability, extensive usage in international trade, and the United States’ stature as a major global economy.

- Euro (EUR). Comprising around 20% of global foreign exchange reserves, the EUR serves as the currency of choice within the Eurozone and holds status as a reserve currency. Its share has exhibited relative stability over time, reflecting its established position in the global financial system.

- Japanese Yen (JPY). The JPY is the official currency of Japan and is widely used in the foreign exchange market. It holds a significant role as a third reserve currency after the US dollar and the euro. The yen’s share in global reserves has been rising.

- British Pound (GBP). The GBP is the main unit of sterling and has been in continuous use since its inception. It is often referred to as the British pound or the pound sterling internationally. The GBP is the world’s oldest currency still in use and plays a vital role in global financial markets. The pound’s share in global reserves has also increased recently.

- Chinese Yuan (CNY). The CNY commands approximately 2.9% of global reserves. China has actively pursued the internationalization of the yuan, seeking to bolster its appeal as a reserve currency. Though its share remains modest, the yuan’s utilization has witnessed gradual growth, particularly in trade settlements and investment transactions.

What Is The Oldest Currency in Continuous Use?

The British pound sterling stands as the oldest currency still in circulation, boasting a remarkable history spanning over 1,200 years. Originating from Anglo-Saxon times, this enduring currency has maintained its prominence for several centuries. Its legacy extends beyond Great Britain to its former colonies and regions, including territories such as the Channel Islands, the Isle of Man, and various British Overseas Territories. Additionally, the pound sterling is widely accepted and used in international finance and trade, further solidifying its enduring significance in the global financial landscape.

If you’re looking for a reliable partner to set up a multicurrency account for your company, consider Satchel. As a European digital banking provider operating since 2018, we offer trusted services tailored to your business needs.