E-money decoded: explaining how EMI licenses work in EU and UK in 2024

Small and medium-sized businesses, LLCs, and entrepreneurs often run into challenges when trying to find the right business account for banking. Whether it’s dealing with application processing times, paperwork, fees, or initial deposits – the whole process can be a bit overwhelming. The situation gets trickier with the strict rules for business accounts and fewer options compared to personal accounts.

That’s where Electronic Money Institutions (EMIs) come into play. They’re a new breed of financial service providers offering corporate banking solutions through e-money accounts. It’s not your typical business account, but this innovative approach might be just what some businesses need for a simpler and more flexible banking experience. Let’s explore the perks of EMIs and how they’re changing the money management game in the digital era, allowing for more flexibility and personalization when it comes to electronic and digital transactions.

What are Electronic Money Institutions?

An EMI is a type of financial institution with the authority to issue electronic money and offer associated services. Electronic money is essentially a digital representation of value stored electronically. It’s designed for both domestic and international electronic transactions and is associated with terms like payment accounts, IBANs, and e-wallets. Digital-only payment institutions play a crucial role in diversifying financial services, especially in the expanding digital economy. They provide alternative options for specific financial services, placing a strong emphasis on electronic and digital transactions as opposed to traditional banking methods. Additionally, EMIs are gaining popularity among high-risk clients, often offering higher rates compared to the ones that traditional businesses have.

A Closer Look at E-Money

Electronic money (e-money) is a form of digital currency securely stored in a user’s account that is accessible through cards or smartphones and facilitates seamless payments for goods and services. Often associated with “digital” or “electronic wallets,” e-money encompasses any form of “magnetically stored monetary value,” including payment cards and computer hard drives.

EMIs secure regulatory approval predominantly from the national bank of the licensing country. In the UK, it is the Financial Conduct Authority (FCA) that issues EMI licenses, empowering entities to issue e-money and offer associated payment services. These services span transfers and global transactions using systems like SWIFT, SEPA in Europe, and CHAPS in the UK.

Similarly to EMIs, Authorized Payment Institutions (APIs) are also regulated by the FCA and provide payment services such as money remittance and foreign currency transfers. However, APIs cannot hold customer funds without a payment instruction for onward transmission. E-money, in essence, mirrors aspects of a payment account but comes with nuances that require consideration when determining its suitability for individual needs.

How Your Money Is Held in an E-Money Account

While banks have the authority to receive deposits and utilize them for lending, earning interest, and maintaining liquidity for customer withdrawals, the scenario is different for e-money firms. When an e-money company receives funds in exchange for issuing e-money, it is obligated to safeguard these funds and refrain from lending them out. This safeguarding can take the form of segregating the funds into a dedicated account separate from the firm’s own resources or investing them in secure, liquid, low-risk assets. These assets are subject to approval by the FCA and are held in a separate account by a custodian. Alternatively, the firm may opt for additional safeguards, such as an insurance policy or bank guarantee. These measures are in place due to the lower capital requirements and less stringent regulatory framework applicable to e-money firms compared to banks.

In the EU, EMIs are similarly bound to keep customers’ funds in segregated accounts. For instance, at Satchel, client funds are held by the National Bank of Lithuania, which ensures they cannot be used for lending purposes, providing a high level of security. Even in the case of unforeseen circumstances, the full amount of money is guaranteed to be refunded.

How Much Money Will Be Refunded in the Event of a European Bank’s Bankruptcy?

In the event of a European bank facing bankruptcy , the amount that will be refunded to depositors is determined by the regulations outlined in the deposit guarantee scheme of the corresponding EU member state. The EU maintains a standardized framework for deposit guarantee schemes, ensuring a baseline level of protection for depositors.

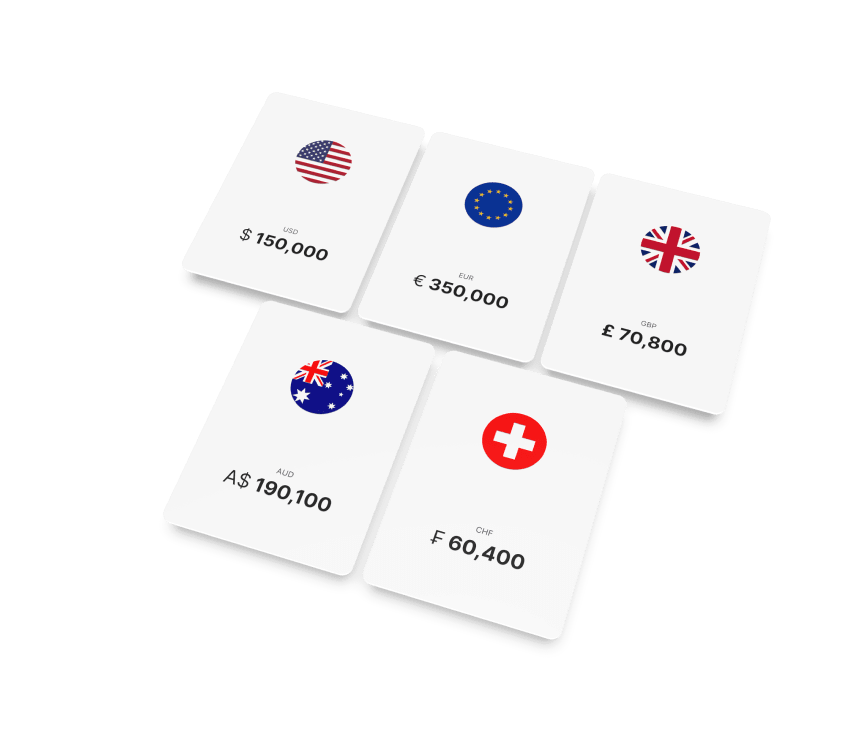

As of the latest update in February 2024, the European Deposit Guarantee Schemes Directive (DGSD) establishes guidelines for safeguarding depositors’ savings. The standard coverage across the EU guarantees up to €100,000 per depositor per bank, providing compensation in case of a bank failure. It’s crucial to note that specific details, including the maximum coverage amount, may vary between countries, with some EU member states offering levels of protection beyond the DGSD minimum. Given the potential changes in regulations, it is recommended to consult relevant national authorities and the specific deposit guarantee scheme in each country for the latest and most accurate information regarding deposit protection in the event of a bank’s bankruptcy.

In the United Kingdom, deposits are safeguarded up to £85,000 per depositor per bank through the Financial Services Compensation Scheme (FSCS). Established by parliament and financed by the financial services industry, the FSCS operates as a fully independent and complimentary service. This independence allows the FSCS to refund any funds held with a failed bank, providing compensation of up to £85,000 per account holder.

How Does Deposit Guarantee Scheme (DGS) Work?

A DGS acts as a financial safeguard for depositors in the event of a bank failure, providing a level of protection for their funds. Typically, the scheme guarantees deposits up to a specified limit per depositor, per bank, with the EU standard set at €100,000. Operating under a funding model where banks contribute annually to a national DGS fund, the accrued funds stand ready to protect depositors should a bank fail. This mechanism ensures swift reimbursements under force majeure circumstances and aims to bolster confidence in the financial system. The DGS works in collaboration with national financial authorities, actively participating in the resolution or liquidation process of a failed bank, and endeavors to communicate coverage details to the public to enhance awareness and trust in the banking system.