Banking as a service Providers: A Comprehensive Guide

Banking as a service (BaaS) Providers

Banking as a Service platforms provide a comprehensive range of products such as IBANs, SEPA and SWIFT payment processing, and payment cards, and benefits including the absence of licensing requirements.

In light of significant changes within the banking sector, the behavior of the modern consumer has undergone a remarkable transformation. Online financial services have become the new standard, and the number of users exclusively engaging in digital banking is undeniably increasing on a weekly basis. Notably, Generation Z has grown up with a smartphone in hand, making online banking an everyday norm for them.

Modern businesses have an excellent opportunity to leverage and capitalize on this trend. The rapid expansion of BaaS solutions has made it easier to integrate financial products into market offerings, allowing companies from all sectors to pioneer digital banking transformation.

Explore the basics of BaaS, the opportunities it offers for non-bank entities, tips on selecting BaaS platform providers, and insights about its long-term potential in the financial industry.

What is Banking as a Service?

White Label Banking, also known as Banking as a Service or BaaS for short, is a business model that allows any company to seamlessly integrate financial services and products from licensed financial institutions into its market offering. Thanks to BaaS, companies without a banking license or digital banking expertise can effectively transform into financial institutions.

The costs related to setting up a digital banking platform that includes services like payment accounts, debit cards, loans, and payment solutions, can be surprisingly high. As a result, many companies turn to White Label / BaaS providers to simplify the adoption of banking products and optimize the integration process.

How Does BaaS Work?

In general, there are two most common operating models in the world of BaaS:

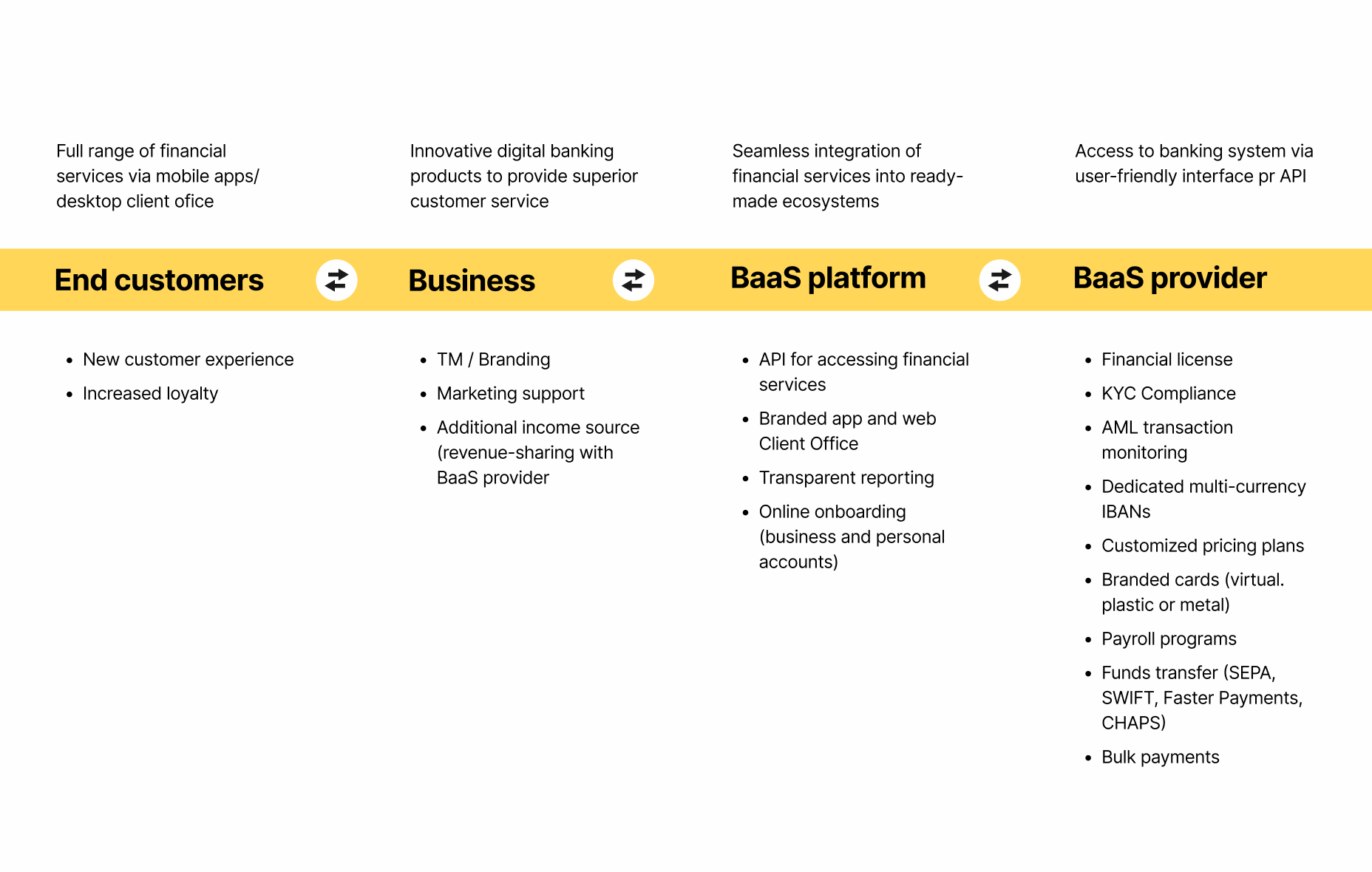

White Label Solution: In this model, a business acquires a comprehensive White Label solution, effectively becoming a virtual banking operator. This grants them access to the complete infrastructure, including essential tools, the BaaS platform, and APIs, all while operating under the license of their BaaS provider. The revenue generated can either be shared between the business and the BaaS provider or the business can set up fixed fees for each operation. At Satchel, the BaaS model functions as depicted in the visual representation below.

Third-Party Provider Access: In this model, licensed fintech companies, digital banking providers, or other third-party providers (TPPs) pay a fee for access to the BaaS platform. The financial institution authorizes the TPP to use its APIs and other necessary information to develop innovative banking products or offer branded banking services.

Thanks to its electronic money institution (EMI) license and a direct partnership with Mastercard Europe for card issuing, Satchel operates as a White Label banking provider and plays the role of the ultimate contractor in this process.

What Can BaaS Providers Offer?

BaaS platforms provide an extensive array of products and services through their partner network, including sublicensing, IBANs, SEPA and SWIFT payment processing, and support for various payment methods. Let’s delve deeper into each service:

Providing digital banking services without a financial license. This is one of the most significant advantages. Even without a banking license, your business can still become a financial services provider. BaaS allows you to operate under the provider’s license, saving significant time and money. Additionally, you gain access to a complete banking infrastructure without spending time or resources on developing one in-house.

Sublicensing. Acquiring a license can be time-consuming and resource-intensive, which can present multiple complications for a business. However, there is a great alternative- collaborating with a supervisory Electronic Money Directive (EMD) agent who can grant an e-money license.

Turnkey digital banking solution. You’ll have the ability to offer a wide range of financial services, providing your clients with a mobile application and desktop client office for managing international payments and payment card operations. With an online banking platform, you can seamlessly onboard both private and corporate clients.

IBAN issuance. BaaS platforms empower cross-border transactions by offering IBAN generation capabilities. They offer infrastructure for dedicated IBAN accounts and tools for multi-currency account management, enabling foreign market operations and instant currency exchange for cross-currency payments.

SEPA and SEPA Instant. White Label banking providers support SEPA payments within the EU / EEA, allowing instant euro transactions that are completed in up to 10 seconds.

SWIFT transfers. Furthermore, WL providers cooperate with payment processors to enable SWIFT payments.

Faster Payments and CHAPS. BaaS providers excel at simplifying financial transactions. They effortlessly set up Faster Payments and CHAPS – widely used methods for quick and simple transfers within the UK.

Currency exchange. Many White Label platforms provide instant currency exchange services, including cryptocurrency exchange. This enables your clients to perform rapid and secure global transactions in your preferred currencies. Depending on the platform, you can access a wide range of 30+ currencies.

Tailored card programs. Businesses, including merchants, can issue personalized payment cards in collaboration with FinTech platforms. These card programs can be customized to cater to specific requirements, whether it’s for financial management, currency exchange, payment services, or fostering customer loyalty. You have the flexibility to create both virtual and physical payment cards, seamlessly linking them to e-wallet accounts.

KYC compliance. For companies entering the banking sector, adhering to security regulations is imperative to prevent issues like fraud and money laundering. Mostly, BaaS platform providers offer comprehensive KYC solutions by default. This includes identity verification methods such as ID card, facial recognition, and utility bill checks to prevent identity theft and ensure that customers are who they claim to be.

Leading Banking as a Service Platforms

Explore some of the top BaaS platforms that can become your express ticket to swiftly entering the market.

Satchel is a European BaaS provider, offering tailored financial solutions to meet businesses’ unique needs. It offers White Label digital banking, customized cards, and exclusive BaaS services for cryptocurrency exchanges. With over 25 seamlessly integrated BaaS projects spanning across the markets of the EU, UK, North America, and Asia, you can expect an exceptional embedded finance experience. As an EMI, Satchel provides technical connectivity to SEPA through the Centrolink payment system. It was the first Lithuanian EMI to become a principal member of Mastercard® Europe for card issuing.

Clearjunction specializes in integrating frictionless and automated cross-border payments into your service offerings. They also navigate the complexities of risk and compliance while providing a wide array of additional features. This global payment solution provider helps you overcome barriers and challenges related to banking and payments.

Swan’s BaaS platform allows companies to embed banking features. Via Swan’s APIs, European companies can integrate banking services (accounts, cards, and payments) into their own products. The company takes responsibility for all compliance matters, including KYC, AML, SCA, and more. Partners don’t need to become licensed as regulated agents.

Railsr (formerly Railsbank) provides a seamless journey for your customers. This platform offers a range of financial capabilities, including digital wallets, payment solutions, rewards programs, loyalty points, and cards. These features seamlessly integrate into your brand’s products to create an enjoyable embedded finance experience.

Treezor is a provider of outsourcing and White Label solutions for electronic payments. It owns a European License and is one of the approved suppliers for MasterCard Prepaid. As an e-money issuer and a payment institution, Treezor offers a white-label solution dedicated to prepaid cards, e-wallets, marketplaces, crowdfunding, and collaborative consumption platforms.

Clear.Bank‘s API is utilized by a broad spectrum of users, from financial institutions to merchants. It offers access to a fully regulated banking infrastructure, simplifying the process of opening and managing accounts. Moreover, it enables real-time payment processing, streamlining your financial operations.

Currencycloud, the last BaaS provider on our list, enables you to remain competitive in a fast-paced market. Their services encompass everything you need, from virtual wallets and accounts to the ability to send, receive, and manage multi-currency payments, ensuring your financial solutions stay relevant in the fast-paced digital banking environment.

Who Can Benefit from a BaaS Platform?

BaaS providers are the game-changers many businesses need when they aspire to offer fintech products or services but face resource limitations. The conventional route of developing a new financial product involves a labyrinthine journey – finding a reliable partner, committing to lengthy contracts, navigating compliance regulations, and eventually constructing the financial app or service you envisioned.

If you’re determined to streamline this complicated process, save on costs, and add a distinctive financial touch to your products, consider partnering with a direct BaaS provider. Don’t venture down the uncharted path alone. Instead, seek out a team of experts who can expertly navigate the intricate stages of product development.

Turnkey BaaS solutions equip businesses from an array of industries to seamlessly launch their own digital-only banking. These all-in-one solutions extend their capabilities to:

- FinTech

- Cryptocurrency exchanges

- e-Commerce

- Sports

- Automotive

- Education

- Logistics

- Any other industry

What are the Benefits of White Label Banking

Here are the top 5 benefits of White Label banking implementation for your business:

1) No Need for a Banking License. With an embedded banking solution, you won’t have to navigate the complexities of acquiring a banking license. Your banking solution will operate under the banking license of your provider, ensuring full regulatory compliance.

2) Comprehensive 360-degree Banking Ecosystem. Your digital banking experience will be fully branded in your corporate design, maintaining consistency and ensuring adherence to your brand identity. BaaS solutions typically include a robust core banking platform, secure payment gateways, a user-friendly website, a customized mobile app, and individual Client Office accounts for each unique client.

3) International Payments with IBAN Issuance. With a BaaS offering, you will be able to seamlessly facilitate international payments and issue IBANs. The services usually cover SEPA, SWIFT, CHAPS, Faster Payments, and other transfer methods.

4) Payment Card Issuance. You will be able to enhance your neobank’s product range with both virtual and physical payment cards designed to match your brand.

5) Compliance, Legal, and Technical Support. The BaaS provider’s dedicated team will ensure compliance and supervise transactions to uphold the highest standards of security and customer protection. They will seamlessly integrate industry-leading tools such as Ondato and Napier to enhance your solution.

6) New Revenue Stream. The BaaS model can expand your service offerings, serving as a robust source of additional income and a solid foundation for future growth.

7) Enhancing Customer Loyalty. Introducing financial services adds a new dimension to the customer journey, boosting loyalty to your business.

Banking license, technical infrastructure, compliance support, and branding options create a powerful ecosystem for your financial services, elevating your business’s value proposition and enhancing customer satisfaction.

How to Select the Best BaaS Provider?

The world of Banking as a Service has witnessed exponential growth, with a surge in demand for cutting-edge banking platforms. This has given rise to a multitude of new players in the market. Navigating this landscape to choose the perfect BaaS provider for your unique business concept can be quite a challenge. With numerous providers offering an array of banking features, it’s crucial to make an informed decision. Here are the key factors to consider:

1. Experience and Proven Track Record. When you’re checking out a White Label banking solution, what really counts is whether they’ve already done similar projects. Fancy websites can be deceiving; what you need is a skilled team with a history of successful projects. Also, find out if the BaaS provider is a direct service operator and if they hold licenses for financial services and card issuance.

2. Range of Products. Ideally, you’d want a one-stop solution without the need to juggle between multiple providers. Opt for a provider that offers a wide selection of specialized, high-quality products and services. Seek a provider with a diverse range of offerings, allowing you to create a comprehensive, scalable solution with all the necessary features.

3. Regulatory Compliance: Regulatory compliance is crucial for safeguarding your business’s assets and reputation. Select a BaaS provider that adheres to essential regulations, ensuring the trustworthiness of your financial services. It’s important to note that compliance support should be included in the pricing.

By carefully evaluating these factors, you can confidently choose the BaaS provider that best aligns with your business vision and requirements.

What Are the Key Features of BaaS?

1. Flexibility and Scalability. Top BaaS providers excel at effortlessly scaling existing financial solutions to meet your evolving needs. Imagine it as a customizable tool that adapts precisely to your unique requirements. Whether you’re an aspiring entrepreneur, a small business owner, or a large corporation, BaaS empowers you to increase your earnings and leverage your client database.

2. Speed and Efficiency. Being able to execute financial transactions under the provider’s BaaS banking license within the ready-made BaaS platform ensures both speed and efficiency. This approach not only saves you money but also valuable time. It provides access to a comprehensive financial ecosystem that simplifies the process of opening payment accounts in multiple currencies, catering to both personal and corporate needs, and ensures smooth local and international money transfers. Your clients can also enjoy the advantages of a user-friendly app and a web client office.

3. Innovation and Competitiveness. By partnering with a reliable BaaS provider, you ensure that your financial offering remains innovative and competitive. BaaS platforms continuously evolve, introducing new features to enhance user experience. Each release automatically becomes available to you, granting you access to a world of constant innovation and cutting-edge technologies. This enables you to implement modern financial solutions that align with the evolving demands of your business outlook.

4. Security and Reliability. Security is paramount when it comes to your and your clients’ finances, and BaaS offers robust protection. This innovative solution ensures the highest level of security for financial data and transactions, providing peace of mind that money is under reliable control.