Bank of Lithuania Financial Market Supervision Service annual overview

The Financial Market Supervision Service (FMSS) of the Bank of Lithuania held its annual meeting with Electronic Money Institutions (EMIs) and Payment Institutions (PIs). During the meeting, FMSS officially presented the structural changes that are currently taking place. EMIs and PIs were also familiarized with the performance results for the period from 2007 to 2013. Market participants were also introduced to 2021-2025 strategic development guidelines. During the meeting, it was emphasized that the financial sector both global and Lithuanian, is undergoing rapid changes. Therefore, regulatory authorities must adapt, becoming more flexible and agile.

Structural changes inside FMSS

During the meeting with market participants, the structural changes within the service itself and the reasons for them were explained in more detail. These changes were primarily determined by the trends in the financial market itself. More and more financial services are moving into the digital space. Consumers themselves also expect to be able to manage money matters directly from their phones or other daily-used devices. Brand new players emerge in the financial market every day, taking over some of the functions of traditional institutions. These changes have both rewards and risks: the dangers of cybercrime and money laundering are more relevant now than ever. To mitigate them, supervisors need to adapt and rethink their structure, as well as where and how they should use the available resources, and which problems are most relevant to the majority of stakeholders. The renewed FMSS now consists of three divisions: the Banking and Insurance Supervision Department, which is responsible for the activities of banks and unions, the Financial Services and Market Supervision Department, which supervises other financial market participants, and the Legal and Licensing Department.

Financial Market Supervisory Authority 2017-20. review

Over the past four years, the FMSS has set itself the goal of creating a smart, attractive, and competitive environment for the financial sector. To accomplish this task a whole range of actions were used. The first course of action was to improve the regulatory and supervisory environment by removing unnecessary barriers to market entry and operation. To this end, detailed guidelines have been developed on how the various financial services should be provided. Another strategic goal is to nurture the relationship with the financial market participants themselves based on trust and mutual respect. In order to achieve this, the focus was primarily on the availability of information. Special publications have been prepared, surveys, meetings, and consultations have been organized regularly. Lithuania is aiming to create an ecosystem that is ideally suited for testing new products and ideas. FMSS committed itself to significantly simplifying its licensing process, creating the most favorable conditions for testing.

Electronic Money and Payment Institutions 2020 results

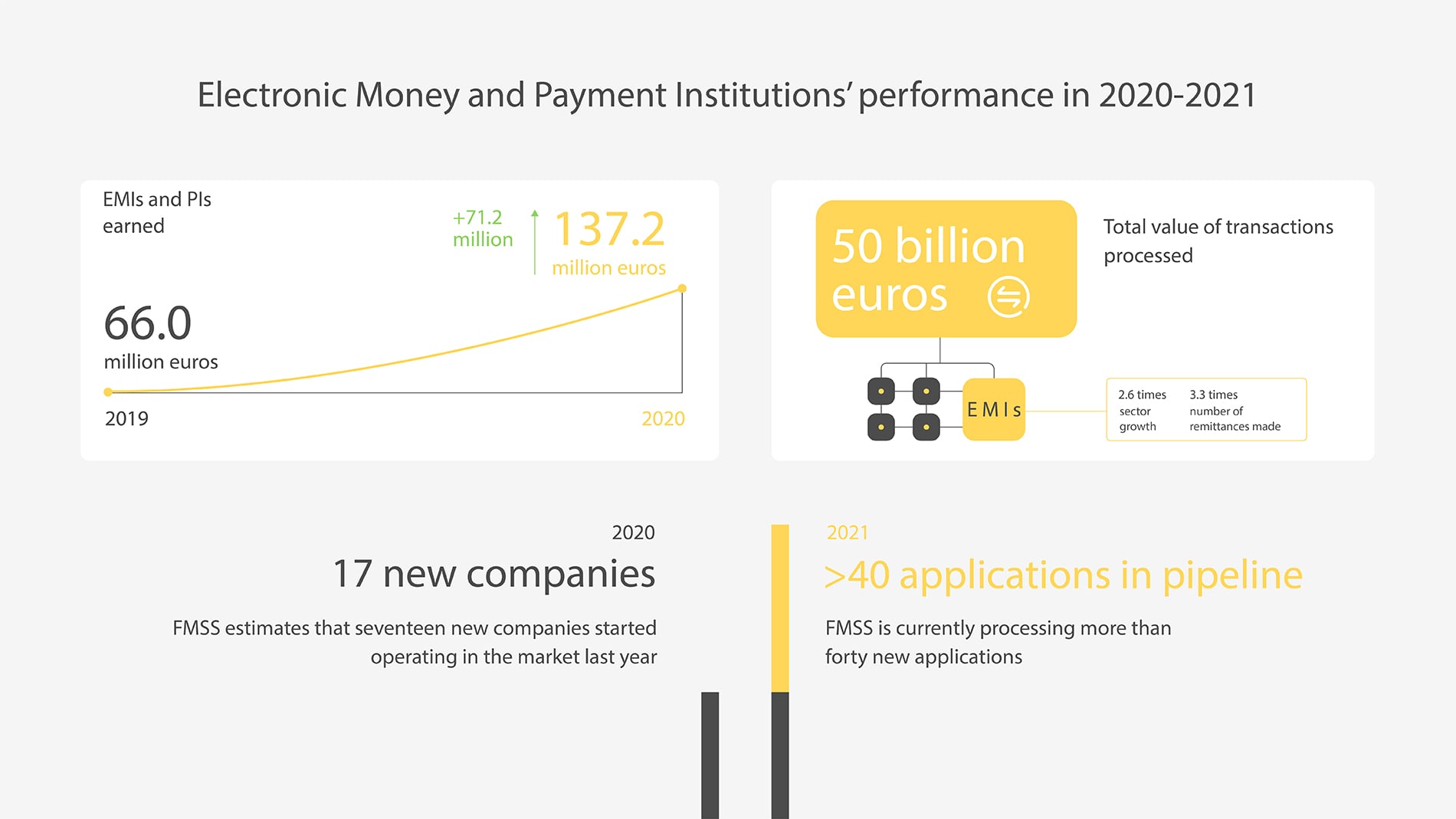

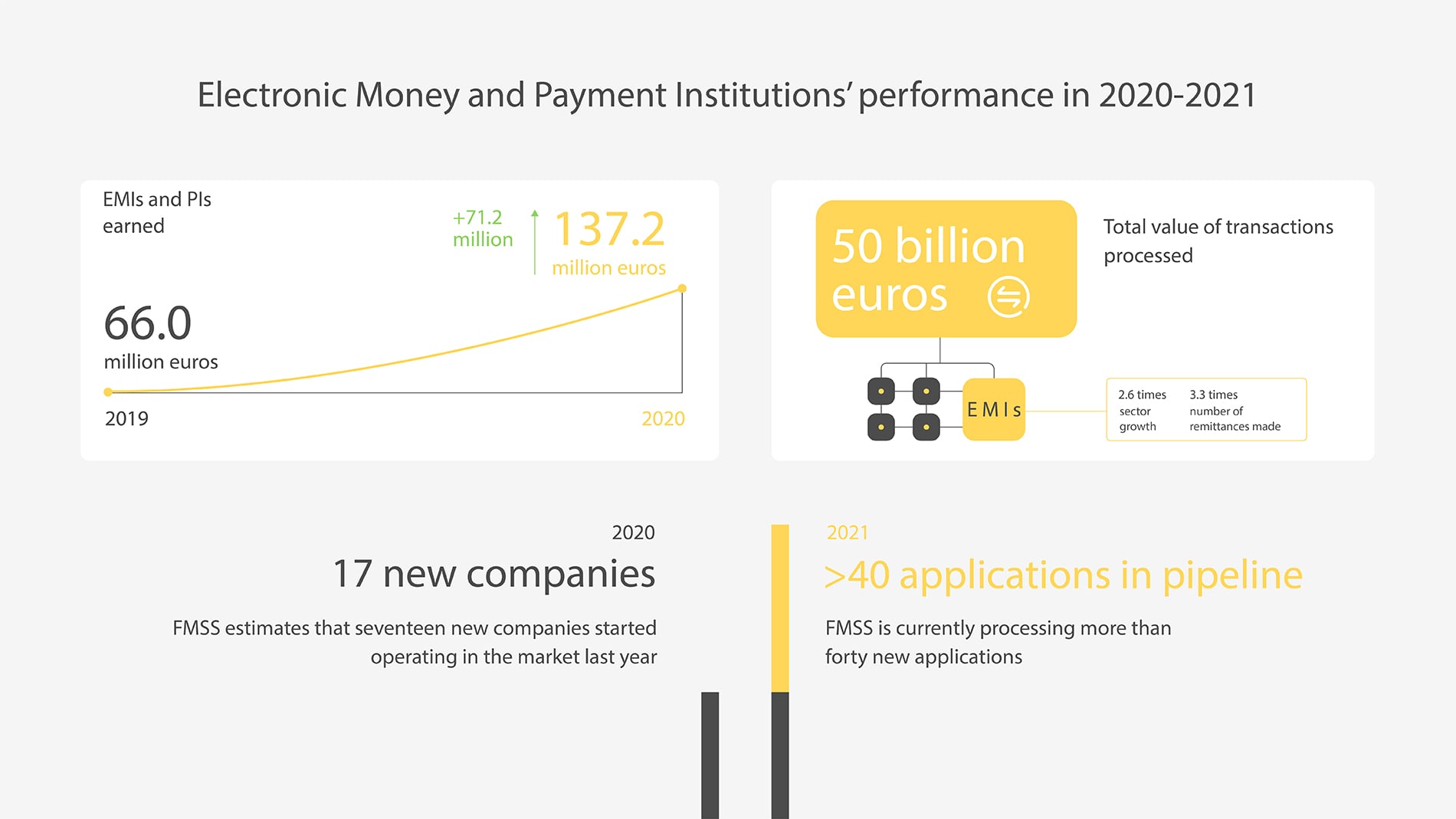

The strategic actions of the FMSS have yielded the desired result. At least that is the conclusion that can be drawn from the 2020 financial market performance. The data shows that the sector has not only successfully met the challenges of Covid-19, but has also experienced a rapid rise. Preliminary data shows that EMIs and PIs earned a total of 137.2 million euros, which is 71.2 million or twice as much as in 2019. In addition, the total value of financial transactions by companies operating in Lithuania amounted to as much as 50 billion euros. Particularly rapid growth was observed in the EMIs. The sector grew 2.6 times, and the number of remittances made – by 3.3 times. The development of stakeholders in the sector is also significant. FMSS estimates that seventeen new companies started operating in the market last year. What’s more, FMSS is currently processing more than forty new applications, so by the end of 2021, the market should definitely expand even further.

FMSS strategic goals 2021-25

For the start of the four-year cycle, the FMSS aims to help the financial market mature even faster. Regulatory and supervisory actions are intended to make the sector more responsive to the needs of a rapidly changing society. The tools themselves should enable consumers to make smarter, more informed decisions. In other words, the challenge is to bring innovative solutions even closer to the mainstream user and add more value to them. Another important aspect of the strategy is sustainability. The regulation and development of the EMIs and PIs will focus more on the issue of climate change. The regulatory framework will be designed in such a way that the financial sector would be enabled to contribute to solving the problem, rather than deepening it. Finally, the market is expected to grow even faster. In particular, by creating and adopting a single regulatory framework. This should be best served by public and centralized access to various data.

FMSS goals for 2021

2021 is the first year of the new strategic period. The aim this year is to provide the framework needed to implement the rest of the strategic plan. During the meeting, the representatives of the FMSS spoke about the fact that financial market supervision must be intelligent, based on insights, and focused not on penalties or fines, but on problem prevention. In other words, priority is given to clear and proactive communication and assistance to the EMIs and PIs. This year, FMSS also intends to invest heavily in both data maintenance and protection, and communication technologies. The hope is that more effective control will contribute to a lower administrative burden for stakeholders themselves, and reduce compliance costs.