How to Open a Payment Account Online in Italy

Are you a non-EU resident interested in opening an account for online banking in Italy? In this article, we will guide you through the process of opening a European account online, including the required documents, associated fees, processing times, and the best tips for getting started.

Is it hard to open an account in Italy as a non-resident?

Opening an account in Italy as a non-resident is not necessarily difficult, but it does come with certain requirements. While the process may vary slightly from one financial institution to another, most of them have tailored their procedures to accommodate non-residents. With the advent of online banking, the process has become even more accessible, allowing individuals to open accounts from the comfort of their own homes.

What documents are required to open an account in Italy?

When opening a payment account online in Italy, you will need to provide several documents to fulfill the necessary identification and verification requirements. The exact documents may vary depending on the financial services provider, but generally, you can expect to provide the following:

- Proof of identity: A valid passport or government-issued identification document, an international passport for non-EU residents.

- Proof of residence: Some financial institutions may require proof of your address in your home country.

- Tax identification number: Non-residents are typically required to provide a tax identification number from their home country.

- Proof of income: Sometimes, you may need to provide proof of your source of income, such as an employment contract, last few paychecks, or an account statement.

It’s important to check with the financial institution that you wish to open an account with to ensure you have all the necessary documents in order to streamline the account opening process.

What is the cost of opening an account for online banking?

The cost of opening an account in Italy can vary depending on the financial services provider/fintech company and the type of account you choose. Some of them offer basic accounts with no monthly fees, while others may have account maintenance fees or require a minimum deposit. Additionally, there may be charges for specific services, such as international transfers or prepaid / debit card issuance.

Before opening an account, it’s advisable to research different financial institutions and compare their fee structures to find an option that aligns with your financial needs.

How long does it take to open an account in Italy?

The time it takes to open an account in Italy can vary depending on the complexity of the application process. In some cases, all it takes to finalize the account opening is a few days, especially if you have all the required documents readily available. However, it’s important to note that the process may take longer if there are any additional verification or compliance checks required.

To facilitate the account opening process, make sure to have all the necessary documents prepared beforehand and provide accurate information in your application. If anything is unclear, it’s always better to ask questions, as one wrong step can result in significant delays.

What is the best method to open an account in Italy?

With the advancement of technology, opening an account online has become the preferred method for many individuals. It offers convenience, accessibility, and the ability to complete the process from anywhere in the world.

To open a current account online in Italy, visit the website of the financial services provider / EMI (electronic money institution) you wish to open an account with and navigate to their account opening section. Follow the instructions provided, and be prepared to upload/scan the necessary documents for verification. Once your application is submitted, the financial institution will review the information and notify you of the account opening status.

It’s important to choose a reputable financial services provider or an EMI that delivers secure online banking services and has a solid reputation for customer service. Research different options, read reviews, and compare offerings to make an informed decision.

Opening an account online in Italy as a non-resident is a viable option that offers financial flexibility and convenience. By understanding the necessary requirements, associated fees, and processing times, and utilizing online banking services, you can streamline the account opening process and start managing your finances in Italy with ease. Remember to gather all the required documents, compare different options, and choose a reliable institution that suits your needs. Now you’re ready to embark on your digital banking journey in Italy!

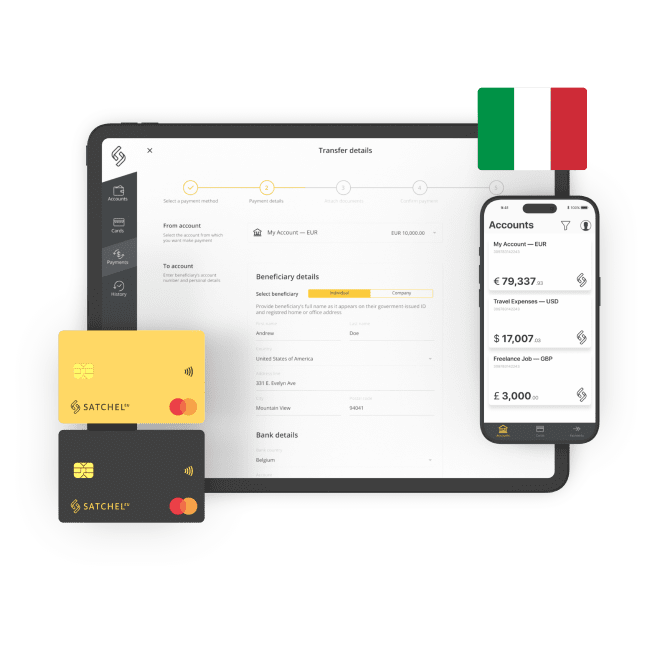

To learn more about opening a European account remotely, visit Satchel.eu. With unique European IBAN and Mastercard payment cards, you’ll get access to a global, borderless payment infrastructure from any corner of the world.