How to Open a Payment Account Online in Denmark

Opening a payment account in Denmark is no longer a daunting task. Thanks to the advancements in financial technology, it is now simpler than ever to open one online, hassle-free. Whether you need a personal account or an account for your small or medium-sized business, the steps to open an online account remain the same. In this article, we will guide you through the process of opening an account online in Denmark. By being aware of the potential pitfalls that we will share, you will be able to navigate the process of opening an account in Denmark more effectively.

Navigating the account opening process in Denmark: pitfalls to avoid

While opening an account in Denmark shares similarities with the process in countries like Germany or the Netherlands, there are distinct factors to consider. Being mindful of these potential pitfalls can help ensure a seamless experience when opening a payment account in Denmark. Here are key aspects to be aware of:

- Residency Requirements: Danish financial institutions often have specific residency criteria that must be met. Ensure you have the necessary documents to prove your residency status in Denmark.

- Language Barriers: While some Danish digital banking providers offer services in English, language barriers may arise.

- Identification Procedures: Danish financial providers follow strict identification protocols. Prepare the required identification documents, such as a passport or residence permit, to meet these procedures.

- Minimum Balance Requirements: Occasionally, a minimum balance requirement may affect your account opening. Consider your financial capacity and opt for an account with feasible requirements.

- Fees and Charges: Various fees may occur, including account maintenance fees, transaction fees, or ATM charges. Take your time to understand the fee structure to ultimately choose the one that aligns with your financial needs and expectations.

- Limited Options for Non-Residents. It’s important to note that some Danish institutions may have limited options or stricter requirements for non-residents. Some of them may prioritize serving Danish residents, which makes it essential to research and identify those ones that cater to non-residents’ needs in advance.

Take the necessary steps to meet the requirements, understand the associated fees, and choose a digital banking provider that suits your specific needs, whether you are a resident or a non-resident.

Required documents for non-EU residents opening an account in Denmark

As a non-EU resident looking to open a current account in Denmark, you will need to provide specific documents to meet the requirements. While the exact documentation may vary slightly depending on the digital banking provider, here are the commonly requested documents:

- Valid Passport: A valid passport is essential as proof of your identity and nationality.

- Residence Permit: Non-EU residents typically need to provide a valid residence permit issued by Danish authorities. This document verifies your legal status in Denmark.

- Proof of Address in Denmark: This can be demonstrated through official documents such as utility bills or rental agreements. Make sure the document displays your name and current residential address.

- Personal Identification Number: In Denmark, each resident is assigned a personal identification number known as the CPR number. While this is not always required to open an account, having a CPR number might streamline the process and provide additional benefits.

- Employment Details: At times, you may be asked to provide information regarding your employment, such as proof of employment, a work contract, or paychecks.

- Specific Forms: Each financial institution may have its own specific forms and applications that need to be completed.

How can I open an account in Denmark from abroad?

If you’re planning to relocate to Denmark, it’s wise to arrange your account ahead of time. Depending on the account type, additional documents may be necessary. To make the process smoother, you have the option to utilize a reputable agency that can act on your behalf. They will require a power of attorney document and notarized passport copies to handle the necessary documentation. It’s crucial to research and verify the agency’s credentials and fees before proceeding.

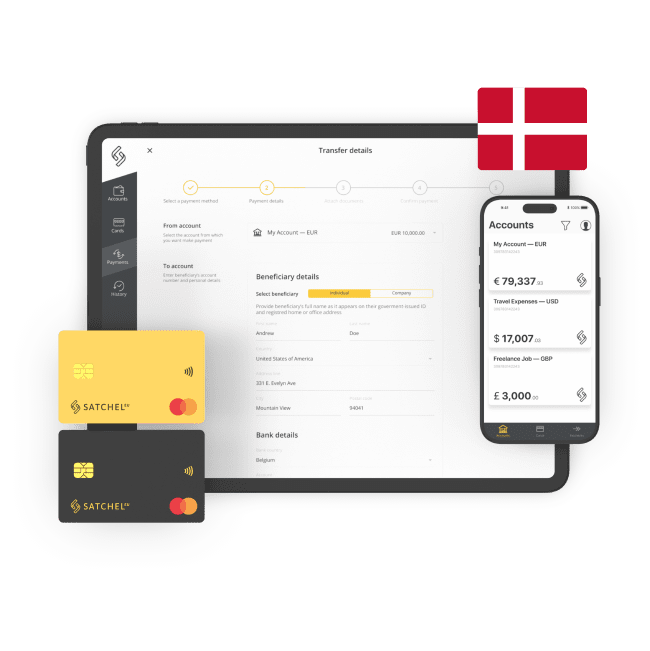

Alternatively, a quicker route is to consider opening an online account with an EMI (electronic money institution). This option not only saves you money but also precious time. E-money service providers cater to various account types, including personal, business, merchant, and freelancer accounts. Satchel.eu, for instance, offers a straightforward account opening process with the submission of an online application and the payment of an onboarding fee or deposit.

By opening an account, you will receive a unique European IBAN along with a Mastercard payment card available in both plastic and digital formats. This will allow you to effortlessly make SEPA, SEPA Instant, and SWIFT payments. Additionally, you will be able to conveniently handle your day-to-day expenses by utilizing Satchel’s contactless payment cards. Whether it’s in-person shopping or online purchases, managing your finances has never been easier.

Can non-EU residents open an account in Denmark?

Yes, non-residents can open an account in Denmark. In addition to essential documents (passport, residence permit, proof of address, and any other necessary paperwork), you may be asked to provide evidence of your financial status, such as income and assets.

If you’re looking for a hassle-free alternative to traditional banking, consider digital banking options like Satchel.eu, offering a convenient, paperwork-free experience for account opening.