Fees associated with multi-currency accounts

If you were to ask, “What is the best way to pay in different currencies?” the response would undoubtedly be “multi-currency accounts.” A multi-currency account stands out as the optimal choice for handling payments in different currencies, thanks to its versatility and cost-effectiveness.

Unlike traditional accounts that are limited to one currency, multi-currency accounts empower users to maintain balances in multiple currencies simultaneously. This means that when conducting international payments or transactions, users can sidestep the inconvenience and expenses associated with currency conversion fees.

However, it’s important to note that while multi-currency accounts offer potential savings for frequent foreign currency transactions, they do come with fees. Before committing to an account, it’s crucial to carefully review the terms and conditions to gain clarity on the applicable fees and specific details, especially those written in fine print.

Here are some standard fees associated with multi-currency accounts:

- Initial Deposit: Typically charged by traditional banks for processing. E-money institutions are usually more flexible and may not charge this fee.

- Opening Fees: These can vary depending on the policies of the bank or financial provider. They may be higher for high-risk clients.

- Monthly / Annual Maintenance Fee: Most accounts come with recurring fees for maintenance and services.

- Transaction Fees: Charges may apply for day-to-day transactions such as bank transfers, deposits, and cash withdrawals.

- Additional Service Fees: Some banks / financial institutions may charge extra for services like payment reversal, audits, reference letters, or other additional queries.

You might have room to negotiate certain fees. It’s a good idea to ask about the fees upfront and compare different account options carefully, considering the expected costs and benefits of each account before making a decision.

Multi-Сurrency Accounts at Satchel

Satchel simplifies the complexities of managing multiple currencies for businesses. Here’s an in-depth look at some of the features that Satchel multi-currency accounts offer:

- Clear Pricing: Transparency is paramount at Satchel. We’re dedicated to informing our potential clients about all the commissions they may encounter. If you have any further questions, don’t hesitate to contact our sales team via email at [email protected] or call us on +370 5214 22 78.

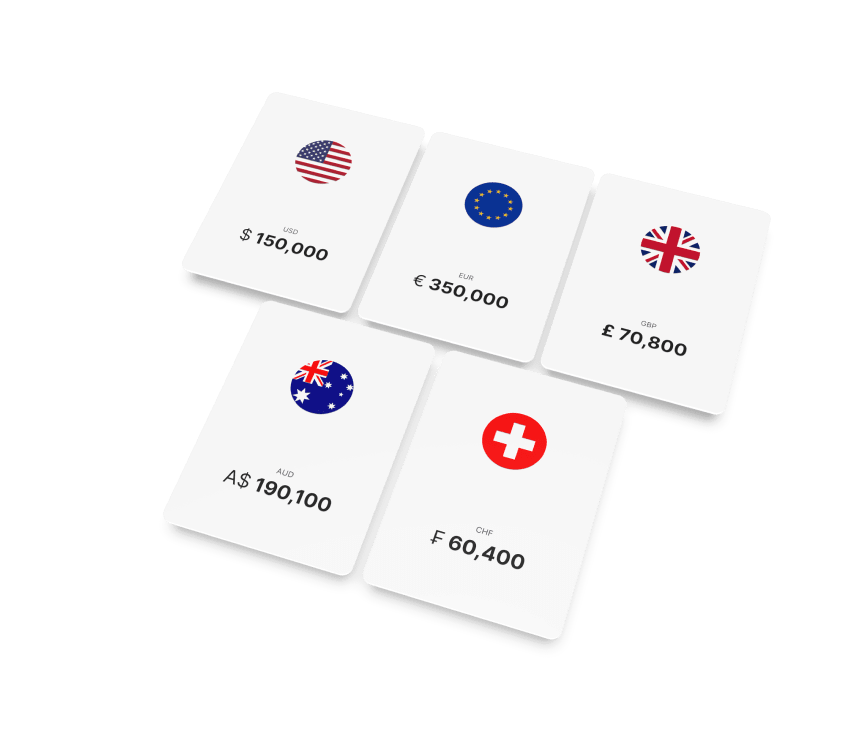

- Broad Range of Supported Currencies: Satchel supports processing payments in 20+ currencies, enabling businesses to operate in diverse markets without the hassle of maintaining separate accounts.

- Global Coverage: Our services span across all continents: Europe (including the UK), Asia, Latin and North America, Australia, and Sub-Saharan Africa.

- Reporting: Satchel provides detailed reporting features such as bank statements and receipts, offering businesses accurate management of their finances in real time.

- Currency Balances: Companies can maintain balances in multiple currencies and choose the preferred currency for payouts. This flexibility simplifies transactions with international suppliers, customers, and employees, minimizing conversion fees.

- Developer-Focused Tools: Satchel’s API supports extensive customization to meet the unique needs of businesses. It accommodates transactions in various currencies, empowering businesses to build custom solutions that seamlessly integrate into their existing financial systems.

Satchel’s multi-currency features are designed to provide businesses with the flexibility, convenience, and compliance necessary to thrive on a global scale. Leveraging these features as part of a comprehensive financial strategy maximizes their effectiveness in addressing the challenges of international trade.

In summary

With a multi-currency account, you are taking advantage of favorable exchange rates, avoiding unnecessary conversion costs. Overall, the flexibility, convenience, and cost-effectiveness of multi-currency accounts make them one of the best financial tools for simplified transactions in different currencies.