How to Open a Payment Account Online in Germany

If you are considering moving to Germany you will need a payment account to, among other things, receive your salary or run your business. As you may have already noticed, there are a lot of German financial institutions. So which one to choose? Expats have been asked about opening an account in Germany. Many want online banking in English. Whereas others prefer to have access to English-speaking financial services providers, especially in the customer service department. Whatever your needs may be, to suit your personal circumstances, this article will help you to decide on the best option to match your particular needs. You will need to have registered your residence in Germany to open a payment account there. If you are not registered in Germany but live in the EU, then you may still be able to open any online account and use it for everyday needs. However, there’s a straightforward and cost-effective alternative for non-EU residents. Let’s discuss it.

How does banking in Germany work?

Once you have opened an account, and this can be done for an account in Germany for foreigners, the financial institution will issue you an “EC-Karte” (Girocard), a type of debit card in Germany. This is invaluable for your personal and business transactions. It can be used to access cash 24/7 from an ATM (Geldautomat), and it is accepted for payments at supermarkets, petrol stations, shops and nearly all retail outlets. It can be used as payment for small transactions and can, normally with authorisation, be used for larger transactions.

What are the types of German payment accounts?

The most common types of accounts are mentioned below.

- Current account (Girokonto) is the standard personal account in Germany.

- Savings account (Sparkonto)

- Non-resident account

- Digital and mobile account

- Offshore account

An international offshore option is chosen by some expats living in Germany. These accounts are not located in the holder’s country of origin and usually offer cross reduced taxation on funds. They are generally considered to be relatively secure, that’s why it is better to have another local / EU account, at least for the period of your stay in Germany.

What do I need to open an account in Germany?

To open a current account in Germany you will need to provide the following.

- A fully completed application form.

- A valid passport / ID.

- A valid, current German residence permit.

- Proof of registration showing address.

- An initial deposit.

- Proof of income and proof of employment.

Regardless of which financial institution you choose to open your account with, you will be required to provide a complete set of documents.

How to open a payment account in Germany for non-residents?

With the advent of digital banking, opening a German payment account has become significantly easier than it used to be. Just a decade ago, this process posed a considerable challenge for foreigners. Today, it is considered almost routine. Back then, options were limited, fees were unclear, and non-German account applicants were met with some scepticism. Although a substantial amount of documentation is still required, provided that the documents are valid and up-to-date, the procedure has now become more standardized.

Although the process is not exactly straightforward, you will have no trouble opening an account in Germany if you follow the precise guidelines. It is, normally, a very quick process with digital banking providers, so be prepared to fill in several forms and provide the documents that are required, e.g. for non-EU residents, opening a private account at Satchel.eu requires just an international passport and a utility bill from your home country dated within the last 3 months.

How to open an account in Germany for students?

To open a student account in Germany, in addition to the standard list of documents you should provide proof that you are a student. SCHUFA credit rating is not required by all banks.

German online account requirements

To open an online account in Germany, you will also be required to verify your identity by standard verification procedure. You can also use PostIdent, an approved alternative to validate your identity. To verify your identity with PostIdent, you are required to download a verification sheet from the financial institution’s website and register at a post office. Take your passport with you for proof of identity. The documents are then mailed to the financial services institution.

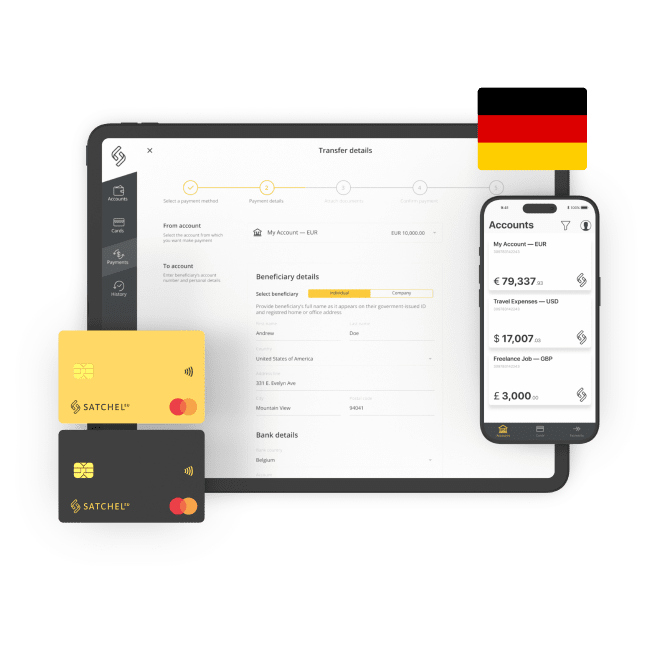

Use alternative digital banking with Satchel

Satchel, one of Europe’s fastest-growing digital banking providers, is extremely useful when considering opening a current account with a unique EU IBAN from abroad without the need to present an Anmeldung (registration in Germany). Compared to some financial services providers in Germany, Satchel charges no fee to open a standard personal account. You can easily open an account online with just two documents. There is no need to stand in line and wait for several weeks. A physical or virtual Mastercard will be more than enough for your everyday needs. Satchel also proposes convenient solutions for businesses, merchants and freelancers with no hidden fees.

What are the things to consider when opening an account in Germany?

Financial services. Before opening an account with a specific financial institution, explore alternative market offerings. Financial services can vary between providers. Additionally, pay attention to licensed EMI (electronic money institutions) that provide a super-convenient, no-paperwork online account opening option.

Customer support. Customer support is vital when it comes to opening an account. Concerning language, if you can’t speak German, it is common sense to register with a financial services provider that has English-speaking customer support. Unlike most providers out there, Satchel has live support, a premium option which is a rarity these days for digital-only banking.

Maintenance and withdrawal fees. Fees can vary, again, from one provider to another and should, obviously, be considered when choosing a financial institution. Inquire about general account fees, especially for withdrawals. Some ATMs can impose significant charges.

Most German banking institutions have a comprehensive network of branches and ATMs. Access to your account and funds is obviously of paramount importance.

Online services. Now, almost all banking services can be done online. It is faster, and in most cases even safer, since most neobanks adhere to the highest security standards to keep your money and personal data safe.

In Conclusion

If you lack prior experience with the German financial system, the prospect of opening a payment account in Germany might initially appear daunting. Fortunately, digital banking providers are here to simplify the process. You can effortlessly initiate online banking, enabling you to open either a business, a private, or a freelancer account from the comfort of your own home, right from your favorite armchair.

Thanks to innovative EMIs that have rapidly gained traction in the global market, you can now open an account remotely, free from any hassle, and take advantage of cutting-edge technological solutions for your day-to-day financial management.