Optimal way to pay in multiple currencies

Payment methods for multi-currency transactions

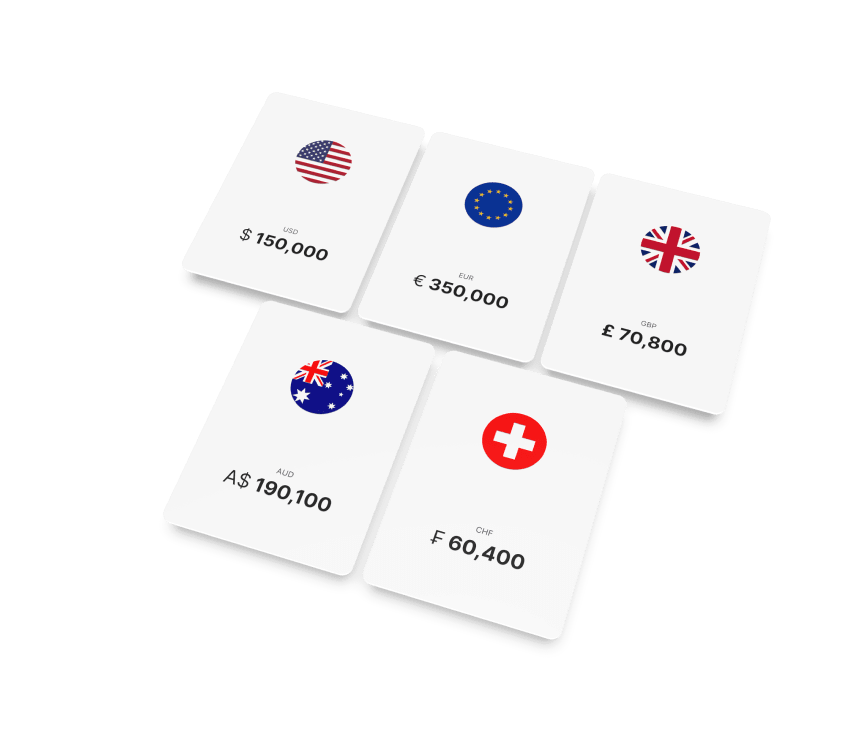

Paying in foreign currencies can often be a hassle due to the exchange fees associated with most payment methods. Luckily, times have changed from 20 years ago when bank transfers were virtually the only option. With the advent of digital banking, anyone—including small businesses, startups, and freelancers—can manage their finances efficiently. Let’s explore the main options available to mitigate associated costs:

- Multi-Currency Accounts: These accounts enable you to hold balances in various currencies simultaneously, simplifying international transactions.

- Digital Wallets and Online Payment Platforms: These platforms often facilitate transactions in multiple currencies, allowing you to pay for goods and services globally.

- Cryptocurrencies: Certain digital currencies like Bitcoin or Ethereum offer an alternative for international transactions, bypassing traditional banking systems.

- International Money Transfer Services: Utilize online platforms or banks to send money internationally, with the flexibility to convert currencies as needed.

- Foreign Exchange Services: Utilize services from banks or currency exchange providers to convert currency at the prevailing exchange rate.

- Credit Cards: Certain credit cards allow purchases in foreign currencies, with the conversion process managed by the card issuer.

By exploring these options, you can effectively manage your foreign currency payments and minimize related costs.

What is the optimal way to pay in multiple currencies?

When navigating the complexities of international transactions, finding the most efficient method for paying in different currencies is crucial. Fortunately, multi-currency accounts provide a comprehensive solution to this challenge. Unlike traditional bank accounts limited to a single currency, multi-currency accounts allow users to hold balances in multiple currencies simultaneously.

The versatility of multi-currency accounts extends beyond mere convenience. By eliminating the need for frequent currency conversions, these accounts help users save significantly on exchange fees, ensuring that each transaction is conducted with utmost efficiency and cost-effectiveness.

Multi-currency accounts streamline payments for businesses and individuals, enabling seamless transactions across borders. They serve as essential tools for large companies, SMEs, and smaller firms, facilitating payments with international contractors and partners. With high transaction volumes, the potential cost savings can be significant. Whether you’re a globetrotter, an international entrepreneur, or a savvy investor, multi-currency accounts offer unparalleled flexibility and accessibility for managing finances in a globalized world.

In summary, multi-currency accounts are the optimal solution for multi-currency payments. By minimizing conversion fees, simplifying international transactions, and accommodating diverse financial needs, these accounts stand out as a great tool for navigating the intricacies of the global economy.

What is the best method for making payments in euros?

When paying in EUR, SEPA transfers are the best option available. SEPA (Single Euro Payments Area) transfers offer a convenient, reliable, and cost-effective method for making payments within the European Union and several other European countries, including the UK. Additionally, SEPA transfers often incur minimal or no fees, particularly for transactions within the Eurozone, making them a cost-effective option for EUR payments.

SEPA Instant Credit Transfers (SEPA Inst) enable nearly instantaneous money transfers, typically processing transactions in under 10 seconds. This makes them an ideal choice for urgent or time-sensitive payments, providing unmatched convenience and flexibility. The European Commission’s adoption of the instant payments legislative proposal in 2024 will bring significant transformation to the payment services industry in Europe.

In summary, for EUR payments, SEPA transfers—particularly SEPA Inst—are widely acknowledged as the best method. The blend of convenience, speed, and cost-effectiveness makes SEPA transfers an excellent solution for both domestic and cross-border payments in euros.