Multi-currency accounts: key industries and practical use

Multi-currency accounts: Strategic advantage or extra complexity?

Strategic advantage, for sure. In a rapidly globalizing world, the question of multi-currency accounts is no longer a matter of choice but a necessity. With world trade burgeoning and international commerce giants like Amazon shaping our daily transactions, navigating currencies has become a pivotal aspect of modern finance. While the future may herald the dominance of a select few global currencies, our current reality is marked by a diverse array of 160 currencies, with only a handful commanding global recognition. Join us as we explore the imperative of multi-currency accounts in this ever-evolving financial landscape.

Purposes for opening multi-currency accounts

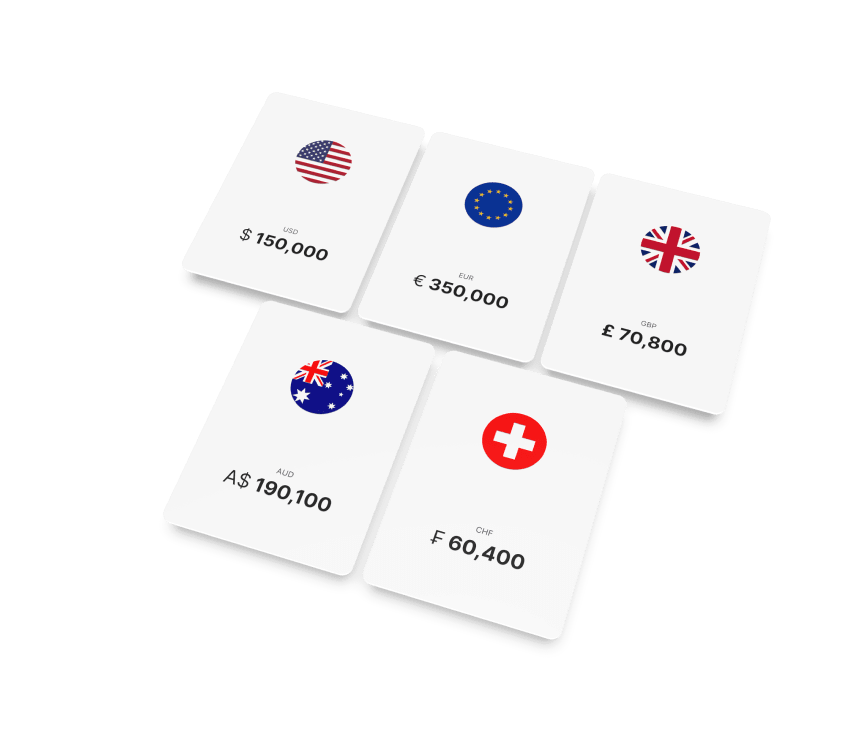

A multi-currency account is a versatile financial tool used for managing transactions in various currencies without the need for frequent conversions. Consolidating multiple currencies into a single, convenient location, it serves several practical purposes across a broad range of scenarios:

- Flexibility in payments. With a multi-currency account, businesses can pay suppliers, vendors, or employees directly in their preferred currency, fostering convenience and strengthening relationships.

- Streamlined revenue management. Multi-currency accounts simplify revenue management for businesses generating income in different currencies, allowing them to retain funds in the original currency until it is most favorable to convert them.

- Effective risk mitigation. Currency volatility poses challenges for international businesses. Multi-currency accounts enable hedging against unfavorable currency exchange rate fluctuations by allowing businesses to hold multiple currencies.

How are multi-currency accounts used?

These versatile accounts for global financial transactions find application across various sectors, each serving unique needs. Let’s explore their significance for both businesses and individuals.

- International businesses. For companies engaged in global trade, multi-currency accounts simplify payments and reduce currency conversion fees. Businesses can receive payments in different currencies directly into their multi-currency account, avoiding the need to manage multiple bank accounts or use currency exchange services.

- iGaming and gambling companies. In the rapidly growing iGaming industry, where transactions often involve various currencies, multi-currency accounts provide a convenient solution for managing funds across various gaming platforms and markets. These accounts allow iGaming companies to process deposits, withdrawals, and winnings in different currencies efficiently, catering to the diverse needs of players and businesses worldwide.

- E-commerce. Online retailers operating in the global marketplace can also benefit from multi-currency accounts. By accepting payments in multiple currencies, e-commerce businesses can attract customers from around the world and expand their international reach. Multi-currency accounts enable seamless payment processing and help e-commerce merchants avoid costly currency conversion fees, enhancing profitability and customer satisfaction.

- Investing in foreign markets. Investors looking to diversify their portfolios by investing in foreign markets can use multi-currency accounts to manage their assets more efficiently. These accounts allow investors to hold and trade different currencies without the need for constant currency conversions, enabling them to capitalize on favorable exchange rates.

- Expatriates and digital nomads: Individuals living and working abroad often face challenges managing finances across multiple countries. Multi-currency accounts provide a centralized solution, allowing them to receive income, pay bills, and make purchases in various currencies with ease.

- Real estate management. Multi-currency accounts facilitate financial management for individuals owning property in different countries, addressing various needs such as receiving rent payments and managing maintenance fees in diverse currencies.

- Travel and tourism: Frequent travelers benefit from multi-currency accounts by avoiding the need to carry multiple currencies or incur hefty exchange fees. With a multi-currency account, travelers can access funds in various local currencies using just one debit card, ensuring seamless and cost-effective purchases while abroad.

- Overseas tuition payments. Parents sending their children abroad for education can leverage multi-currency accounts to make tuition and other fee payments directly in the currency of the host country, ensuring seamless financial transactions.

In summary, multi-currency accounts are a helpful financial tool in today’s interconnected world. They save you from having to frequently exchange money and allow you to manage your funds from a centralized platform. This makes it a lot easier to deal with international transactions. Whether you travel a lot, invest internationally, or run a business outside your home country, having a multi-currency account can make your financial life much simpler and help you make the most of the opportunities offered by modern banking.