How to Open a Payment Account Online in the Czech Republic

If you’re a non-resident looking to establish a financial foothold in the heart of Europe, Czechia presents an excellent opportunity. With its stable economy, strategic location, and advanced digital banking system, Czechia has become an attractive destination for individuals and businesses seeking seamless and efficient online banking services. In this comprehensive guide, we will walk you through the process of opening an online payment account in Czechia, ensuring you have a smooth and hassle-free experience.

Czechia’s Financial Background

Czechia, officially known as the Czech Republic, boasts a strong and stable economy, making it an enticing option for international investors and businesses alike. Since its establishment as an independent country in 1993, following the peaceful dissolution of Czechoslovakia, the nation has shown remarkable economic growth and development. Its strategic location in Central Europe and membership in the European Union have contributed to the country’s well-established banking infrastructure, adhering to stringent regulations.

The Czech National Bank (Česká národní banka) serves as the central bank and plays a vital role in ensuring financial stability and monetary policy within the country. With a focus on maintaining a stable currency, low inflation, and a robust financial system, Czechia provides a favorable environment for both domestic and foreign investors.

Documents Required for Account Opening in Czechia

Before you embark on the journey of opening an account in Czechia, it’s essential to gather the necessary documents to ensure a smooth application process. While specific requirements may vary between financial institutions, generally, the following documents are required:

- Proof of Identity: A valid passport is usually sufficient to establish your identity. Ensure that your passport is up to date and not close to expiration. Non-EU residents may need to provide additional identification documents, such as a national ID card or a residence permit.

- Proof of Address: Non-residents may face challenges providing proof of their current address in Czechia. However, some digital banking providers may offer accounts without the need for a local address, simplifying the process for international clients. If you do require proof of address, acceptable documents may include a utility bill, a recent bank statement, or a rental agreement in your name.

- Residence Permit (If Applicable): If you are a non-EU resident living in Czechia with a valid residence permit, you will need to present this document during the application process.

- Employment or Income Details: Information regarding your employment status or a source of income to verify your financial stability can also be asked.

- Additional Documentation: Depending on the financial institution, there might be additional paperwork or specific forms to fill out, so it’s advisable to inquire in advance.

How Long Does It Take to Open an Account in Czechia?

The time frame to open an account in Czechia can vary depending on the institution’s internal processes and the completeness of your documentation. Typically, the process of opening an account online is more straightforward and faster than in-person applications. With the advent of digital banking, some providers offer an expedited account opening process, allowing you to access your account within a few business days.

During the application process, occasional background checks and verification procedures may be conducted to ensure regulatory compliance and prevent fraudulent activities. These checks can add some time to the account opening process, but they are essential for maintaining the integrity and security of the financial system.

It’s advisable to do thorough research on different financial services providers and their account opening timelines to choose the one that suits your needs best. Digital banking providers like Satchel.eu, for instance, are known for their efficiency and convenience, making the account opening process quick and seamless.

Are there any Onboarding Charges in Czechia?

While some EMIs in Czechia may charge a fee for opening an account, others may offer this service free of charge. The account fees and charges can vary from one institution to another, so it’s essential to consider this aspect while choosing the right financial services provider for your needs. It’s also a good idea to inquire about any potential monthly maintenance fees, transaction fees, or other charges that may apply to your account.

For international clients, digital banking providers like Satchel.eu often offer transparent and competitive fee structures, making it easier for customers to manage their finances without any hidden costs. These providers understand the unique needs of non-resident clients and strive to offer cost-effective solutions for their banking requirements.

Can I Open a Czech Account Without Proof of Address?

As a non-resident, you might face challenges providing proof of a local address in Czechia. However, the good news is that some digital banking providers cater specifically to non-resident customers. They understand the unique circumstances of international clients and offer accounts without the need for a local address, streamlining the process for those looking to access Czechia’s financial services.

Digital banking providers allow non-resident clients to open accounts remotely, removing the need for physical presence or local proof of address. Instead, they rely on a robust digital onboarding process, ensuring the security and authenticity of the account opening.

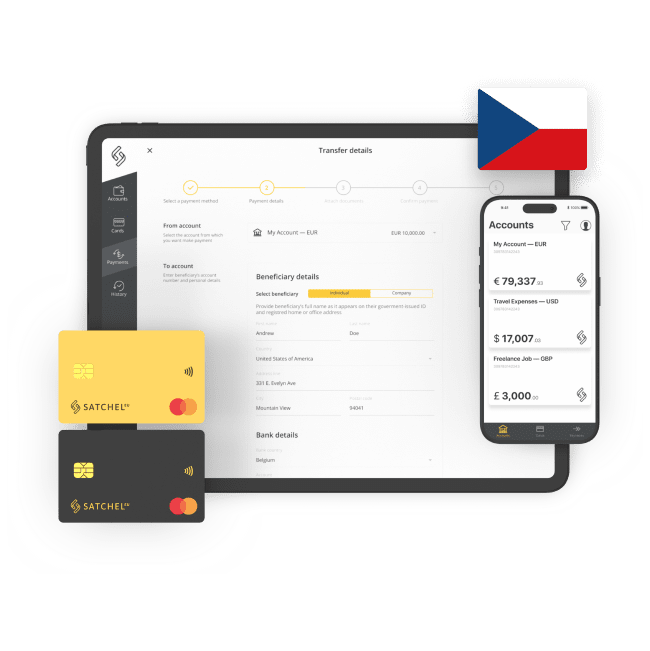

Introducing Satchel.eu: Your Gateway to Czechia’s Financial Services

Satchel.eu is a leading digital banking provider specializing in offering seamless banking services to both EU and non-EU residents. Founded with a vision to provide accessible and efficient banking solutions, Satchel.eu has quickly become a preferred choice for individuals and businesses seeking to open an account in European countries, including Czechia.

By choosing Satchel.eu, you gain access to a European IBAN, a prerequisite for various financial transactions within the European Union. With its user-friendly interface and state-of-the-art security measures, Satchel.eu ensures that your banking experience is secure and straightforward. The streamlined and convenient process allows you to start managing your finances efficiently without unnecessary delays.

Satchel.eu’s commitment to customer satisfaction extends beyond the account opening process. The dedicated customer support team is always ready to assist with any inquiries or concerns, making your banking journey even more comfortable.

Opening an account online in Czechia is an excellent step towards establishing your financial presence in Europe. With its stable economy, strategic location, and advanced banking system, Czechia offers numerous opportunities for international individuals and businesses. By gathering the required documents, choosing the right bank, and considering digital banking options, you can experience seamless banking in Czechia and take advantage of the country’s robust financial services and stability.

As you embark on your journey to open an account in Czechia, it’s crucial to do thorough research and consider the factors that matter most to your specific financial needs. With the right provider, you can navigate the account opening process with ease and gain access to a range of financial services to support your personal or business endeavors.