How to Open a Payment Account Online in Croatia

If you are a non-EU resident looking to open an account for digital banking in Croatia, you’re in luck. Croatia offers tons of convenient options for individuals who want to open an account online. In this article, we will provide answers to the most popular questions regarding account opening in Croatia and explore the intricacies of the process, providing you with the information you need to get started.

Can a non-resident open an account in Croatia?

Yes, non-residents can open an account in Croatia for online banking. Whether you are an individual or a business owner, you can take advantage of the digital banking services offered by various financial institutions in the country. This means that you don’t have to be physically present in Croatia to open an account.

How long does it usually take to open an account in Croatia?

The time it takes to open an account in Croatia can vary depending on the financial institution and the specific requirements. However, in general, the process is relatively quick and straightforward. With online banking providers like Satchel.eu, you can expect a streamlined experience that allows you to open an account within a few business days.

What should I choose: a traditional financial institution or a digital banking provider?

When it comes to choosing between a traditional financial institution and an EMI (electronic money institution), it depends on your preferences and requirements. Traditional financial institutions have a long-standing reputation and offer a comprehensive range of financial products and services. However, they may have higher fees and charges compared to digital-only banking providers.

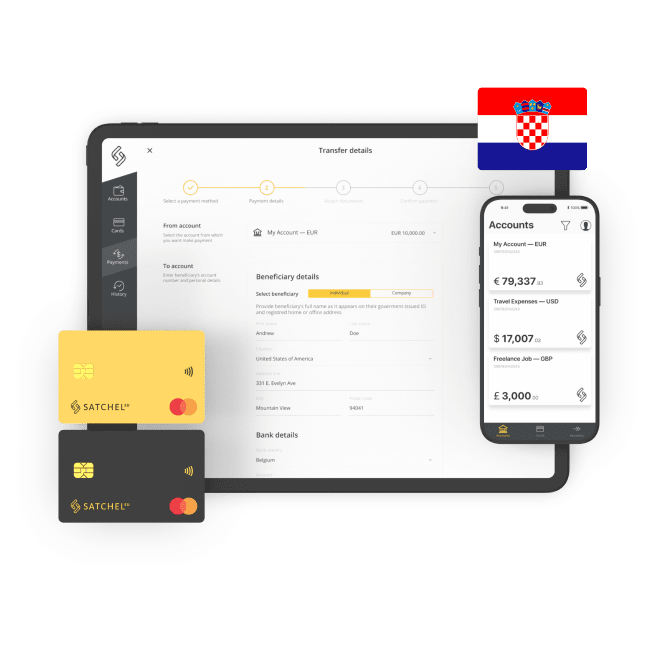

E-money institutions, on the other hand, are digital banking providers that operate entirely online. They offer competitive rates, lower fees, and a user-friendly experience. These digital banking providers, such as Satchel.eu, provide all the essential money management services you need, including account opening (in EUR, USD, GBP, CHF, etc.), payment cards, international transfers, and mobile apps for convenient money management.

Most traditional financial institutions in Croatia allow online account opening without the need to visit a physical branch office. However, if you prefer a more streamlined and cost-effective approach, EMIs can be a great choice.

In conclusion, opening an account online in Croatia as a non-resident is a viable and convenient option. With the availability of modern digital banking providers, you have the flexibility to choose the financial institution that best suits your needs. When making your decision, consider factors such as fees, services, and ease of use. Opting for an EMI like Satchel.eu allows you to enjoy the benefits of digital banking and easily manage your finances in Croatia.