How to Open a Payment Account Online in Bulgaria

Opening an account in Bulgaria can be a daunting experience, especially if you do not know what to expect. Luckily, with the advancement of financial technology, it is now easier than ever to open a payment account online in Bulgaria. Whether you are looking to open a personal account, a business account, or even an account for an SMB, the steps required to open a payment account online in Bulgaria are the same. In this article, we will outline how to open a payment account online in Bulgaria.

What are the pitfalls of account opening in Bulgaria?

The process for opening an account in Bulgaria is generally similar to the process for opening a payment account in Germany or France. However, when opening a payment account in Bulgaria, it is important to be aware of some potential pitfalls.

Firstly, some financial institutions may require large deposits before they will open an account, so it is important to research the specific requirements of the financial services provider you are looking to open an account with.

Secondly, some financial institutions may also require additional paperwork or supporting documents, so it is important to make sure you have all the necessary documents when submitting your account opening application.

Lastly, it is also important to note that due to Bulgaria’s stringent regulations, the process of opening a current account can take longer than in other countries.

Therefore, it is important to plan ahead and allow plenty of time for the process to be finalized.

What documents do I need to open a payment account in Bulgaria?

The same list of documents and personal or business data is required by all financial institutions in order to open an account in Bulgaria. Here is what you need to provide:

- A valid passport or national ID card;

- Personal data (mobile phone number, email address);

- An address for correspondence purposes;

- The minimum deposit amount to activate the account;

- A certificate of good standing (only for corporate accounts).

This applies to accounts in Bulgarian leva (BGN), Euro, or other currencies.

How can I open an account in Bulgaria from abroad?

If you are planning to relocate to Bulgaria, it is advisable to take care of opening a payment account before you arrive.

To open an account in Bulgaria from abroad, you’ll need to provide original copies of your ID documents, as well as proof of address and a valid email address. Additionally, some financial institutions may require extra documents depending on the type of account you are opening. In order to ensure that everything goes smoothly, you can use an agency to act on your behalf. They will need a power of attorney document and notarized copies of your passport to submit the documentation. Be sure to check their credentials and know exactly what you are paying for before you proceed.

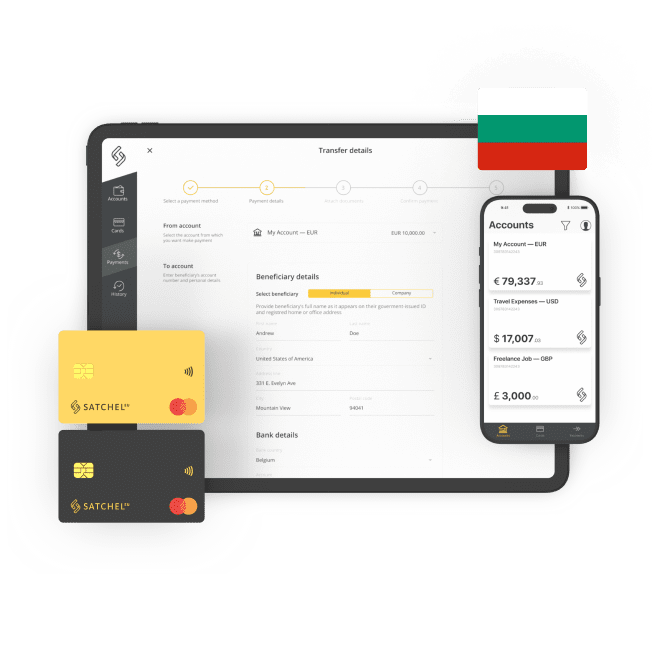

This is a long way. A shorter one is to open an account online with an electronic money institution (EMI). Ultimately, you’ll not only save money but also your precious time. This applies to business, merchant, freelancer, and personal accounts. You can easily submit an account opening application at Satchel.eu without an onboarding fee or deposits.

Can non-residents open an account in Bulgaria?

Yes, a non-resident can open a payment account in Bulgaria. However, you will need to provide your passport, residence permit, proof of address, and other necessary documents to open an account. Additionally, you may be required to provide proof of your financial standing, such as income and financial assets.

Satchel.eu has revolutionized the account opening experience in Bulgaria. In an innovative move, we now accept a utility bill from your home country as valid proof of address, in addition to your international passport. Residency in Bulgaria or the EU is no longer a requirement to obtain an account complete with a unique European IBAN and Mastercard payment cards.

Whether you are looking to open a personal, business, or even a small business account, think about alternative, no-stress, no paperwork with digital banking like Satchel.eu.