How to Open a Payment Account Online in Estonia

Are you looking to embrace the digital age of financial services and experience the convenience of managing your finances online? Estonia, a forward-thinking European country and the champion in the online provision of public services offers an effortless way to open an account from the comfort of your home. In this article, we will guide you through the hassle-free process of opening an account online in Estonia, where you can access a wide range of financial services in a secure financial services environment. Let’s explore the possibilities that exist in Estonia today!

How to Open an Account in Estonia?

Gone are the days when you had to wait in long queues to open a new account. Estonia has revolutionized financial services by providing a seamless online process that allows you to open a current account swiftly and conveniently. Here’s a step-by-step guide to help you through the process:

- Choose a Financial Services Provider: Estonia has plenty of reputable financial institutions that offer online account opening services. Research different options and find one that best suits your needs, whether it’s for personal or business use.

- Visit the Website: Once you’ve selected a financial institution, visit their official website to begin the account opening process. Most of them have user-friendly interfaces that make it easy to navigate through the application.

- Fill out the Application: You will be required to provide personal information such as your name, address, date of birth, and nationality. Additionally, you might need to provide details about your source of income and the purpose of opening the account.

- Identity Verification: Estonian institutions follow strict Know Your Customer (KYC) procedures to ensure the security of their financial services. You’ll need to verify your identity using an electronic identification method by scanning a national ID card or an e-residency card if you are a non-resident.

- Wait for Approval: Once you’ve submitted the application and completed the identity verification process, the financial services provider will review your information. Approval times may vary, but you can typically expect a response within a few business days.

- Receive Account Details: Upon successful verification and approval, you will receive your account details, allowing you to start managing your finances online immediately.

Who Can Open an Account in Estonia?

Estonia’s banking system is open to both residents and non-residents, making it an attractive destination for individuals and businesses worldwide. Whether you are an Estonian resident, an EU resident, or a non-EU resident, you can open a payment account in Estonia with relative ease.

For Estonian residents, opening an account is straightforward, and they can access the full suite of financial services available to local citizens. For EU residents, the process is just as simple, thanks to Estonia’s commitment to fostering a unified banking environment within the European Union.

Non-EU residents can also take advantage of Estonia’s digital infrastructure to open an account remotely. Thanks to the e-residency program, launched by the Estonian government, non-residents can establish a digital identity, allowing them to access various online services, including opening an account. This program has been a game-changer for entrepreneurs and digital nomads worldwide, providing them with the same banking services and convenience as Estonian residents.

What is Needed to Open an Account in Estonia?

To open an account in Estonia, you will need to provide the following documents and information:

- Personal Information: Your full name, date of birth, nationality, and contact details will be required during the application process.

- Proof of Identity: Estonian citizens can use their national ID cards, while non-residents can utilize an e-residency card for identity verification. EU residents can use their EU-issued identification documents.

- Proof of Address: Estonian residents can provide a utility bill or a lease agreement as proof of address. Non-residents, including EU residents and non-EU residents, might be required to show proof of address from their home country.

- Source of Income: Some financial institutions may request information about your source of income or the nature of your business if you are opening a business account.

It’s important to note that while Estonia has made the process of opening an account online relatively straightforward, the specific requirements may vary slightly from one financial institution to another. It’s a good idea to check with the chosen financial services provider to ensure you have all the necessary documents and information before starting the application process.

Can Non-EU Residents Open an Account Without Proof of Address in Estonia?

Yes, non-EU residents can open an account in Estonia even if they don’t have local proof of address thanks to the e-residency program, launched by the Estonian government. With e-residency, non-EU residents can enjoy the same banking services and convenience as Estonian residents, making it an excellent option for entrepreneurs and digital nomads worldwide.

E-residency has become increasingly popular among international entrepreneurs who wish to operate their businesses remotely and have access to the European market. By obtaining e-residency, non-EU residents can conduct business with ease and tap into the advantages of Estonia’s favorable business environment.

Embrace Efficient Banking in Estonia

Opening an account online in Estonia is a game-changer for those seeking efficient and accessible financial services services. The country’s commitment to digital innovation and secure banking practices has attracted individuals and businesses from around the world.

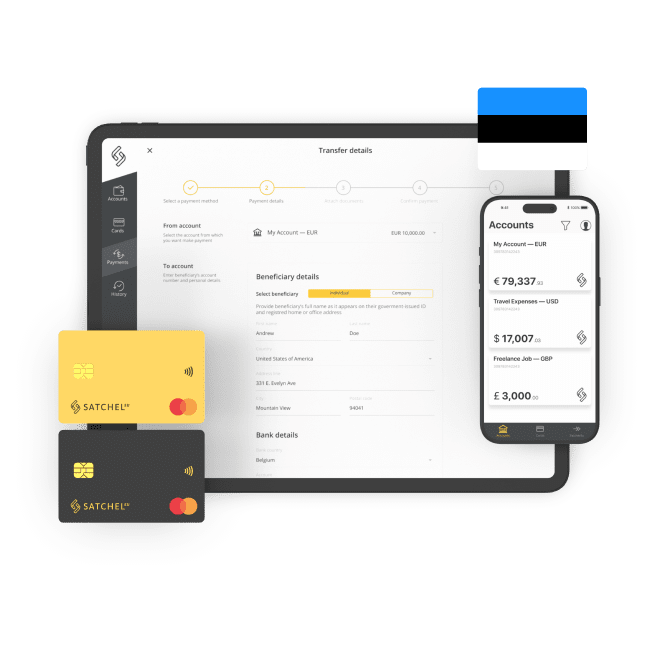

Whether you are an Estonian resident, an EU resident, or a non-EU resident, Estonia’s online banking system welcomes you with open arms. Embrace the future of banking and take advantage of the ease and convenience offered by Estonian banks, as well as European neobanks and EMIs. Explore the possibilities of opening an account in Estonia today through Satchel.eu and enjoy the benefits of efficient money management in a country that values technological progress and inclusivity.