Key Trends in the European BNPL Market (2023-2028)

The Buy Now Pay Later (BNPL) phenomenon is sweeping across Europe, capturing the hearts and wallets of Gen Z and millennial shoppers. This payment method has skyrocketed in popularity, becoming one of the fastest-growing trends in the region’s payment landscape. As of 2022, an astounding 360 million users worldwide have embraced BNPL, and the numbers are projected to more than double in the next five years. It’s evident that this payment method has become a global sensation.

Research conducted by Kearney, a prominent global management consultancy firm, highlights the allure of BNPL among younger generations. Gen Z and millennials are particularly drawn to BNPL, especially when seamlessly integrated into their buying journey. To these consumers, BNPL doesn’t carry the same stigma as traditional credit, making it an attractive alternative. However, this surge in BNPL adoption has also attracted regulatory scrutiny and sparked debates about its potential to lead consumers into bad debt.

In this article, we’ll delve into the world of BNPL, examining its growth, operation, and what the future holds for both consumers and merchants in Europe and worldwide.

What is BNPL?

BNPL, short for Buy Now Pay Later, is a payment method that enables consumers to purchase products and defer payment into interest-free installments. The COVID-19 pandemic has accelerated the adoption of BNPL across Europe, with a particularly strong following among individuals aged 18 to 34. For consumers, BNPL offers a convenient way to spread out payments and access credit without the financial burden associated with traditional credit cards. On the other hand, retailers that offer BNPL see increased sales, as customers are more likely to make purchases when they can spread out the cost over time. This payment method’s convenience has made it a compelling option, especially for younger shoppers.

Key BNPL statistics to start with:

- There are approximately 360 million BNPL users worldwide.

- By 2025, the BNPL market is projected to be valued at €300 billion.

- 16% of 18 to 34-year-olds use BNPL service.

- Sweden boasts the largest market share in the BNPL sector.

- Klarna has amassed nearly 150 million active users.

- Clothing stands out as the top category for BNPL transactions.

How does BNPL work?

BNPL services are seamlessly integrated into the payment process, allowing customers to choose this option alongside credit cards and other payment methods. When making a purchase, customers select a BNPL provider, which redirects them to the provider’s site or app to create an account or log in. Customers then choose their preferred repayment plan, often selecting bi-weekly or monthly installments, before completing the purchase.

Merchants receive the full payment upfront, while customers make their installment payments directly to the BNPL provider. Importantly, customers typically face no interest charges or additional fees when they make timely payments.

European BPNL market volume

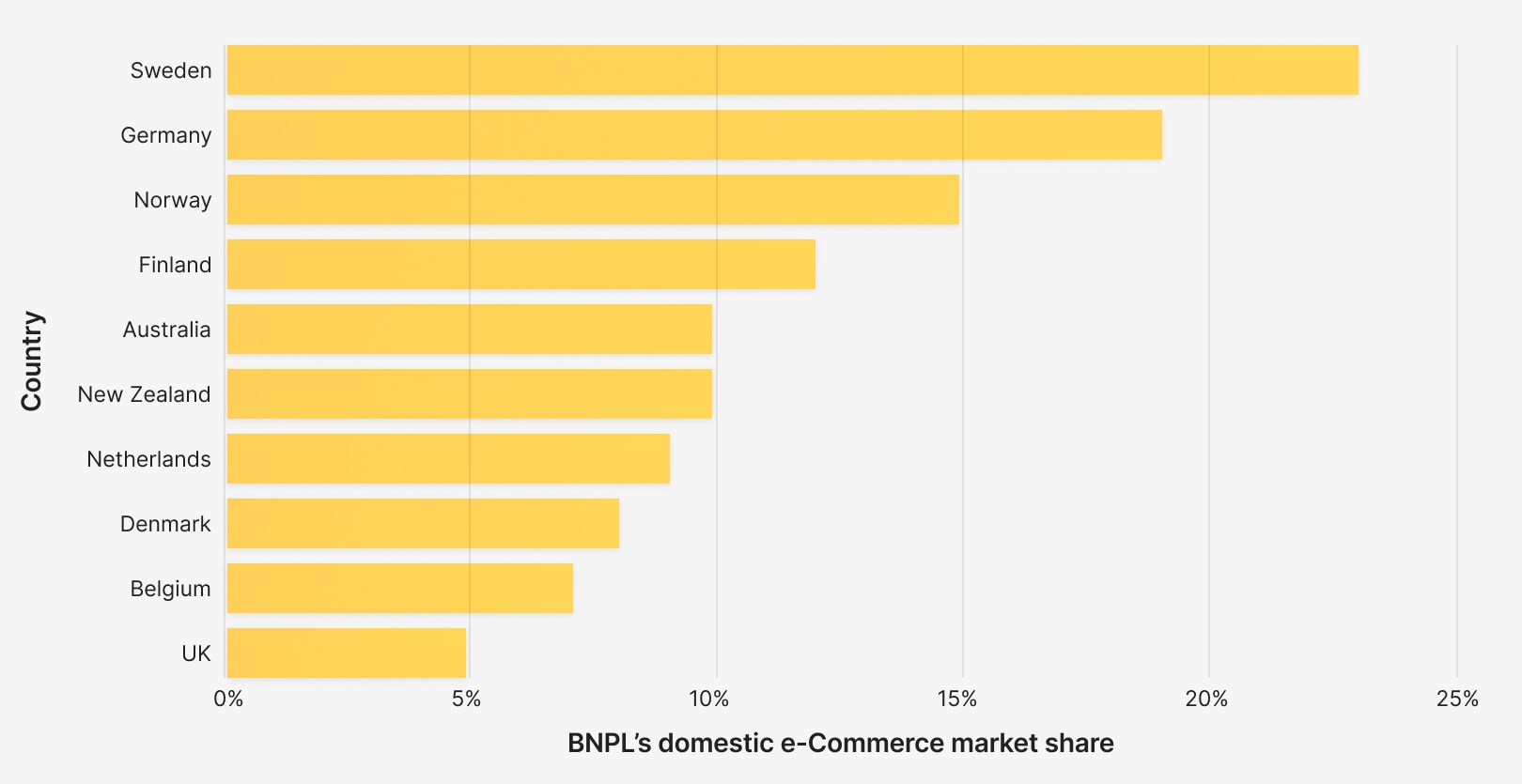

The BNPL industry in Europe is on a meteoric rise, projected to reach a staggering €300 billion by 2025, constituting approximately 11% of the European e-commerce market. Currently, Sweden, Germany, Norway, and Finland dominate the list of top BNPL markets. Additionally, the Netherlands, Denmark, Belgium, and the UK hold prominent positions among the top 10 BNPL markets globally.

The burgeoning popularity of BNPL has led to a surge in market players, spearheaded by Klarna. Other major players include Clearpay, Scalapay, and Alma in the B2C segment, with B2B BNPL players such as Billie and Mondu in Germany and Hokodo in the UK. Notably, major payment giants like Mastercard, Visa, PayPal, and even Apple have introduced their own BNPL offerings, further intensifying competition and innovation within the industry.

While concerns about BNPL leading to bad debt have gained traction, consumers continue to embrace it. In the UK, for instance, 12% of online sales in January 2023 were facilitated through BNPL. Furthermore, a significant 58% of British consumers believe that point-of-sale financing can be a beneficial tool for managing their finances. However, it’s worth noting that B2B BNPL innovation has progressed at a slower pace, largely due to the complexities inherent in B2B payments. Nevertheless, the demand for B2B BNPL solutions is on the rise, particularly in Germany and Switzerland.

Key trends in the European BNPL market

The growth trajectory of the BNPL industry in Europe remains robust in the medium to long term. BNPL payment adoption is projected to grow steadily, with a Compound Annual Growth Rate (CAGR) of 11.4% during 2023-2028.

The European BNPL payment industry has witnessed significant growth over the past four quarters, largely supported by the increasing penetration of e-commerce. The escalating competition among BNPL providers is reshaping the industry, with the latter half of 2022 witnessing a substantial uptick in adoption, driven by rising living costs and inflation. The abovementioned Klarna, although experiencing a significant valuation dip, continues to maintain a robust presence in the European BNPL landscape.

Neo-banks, like Monzo and Revolut, have also entered the fiercely competitive European market. With no signs of market slowdown, the soaring popularity of BNPL schemes is expected to continue reshaping the digital payment ecosystem in the short to medium term. The B2B BNPL segment is poised to be a significant driver of growth in the European BNPL industry over the next three to five years, with many leading venture capital and private equity firms recognizing its potential.

Europe-based BNPL startups secure funding

To sustain their growth momentum and expand their presence in the region, Europe-based BNPL providers are actively raising funding rounds. For instance, in December 2022, Bumper, a United Kingdom-based BNPL startup focusing on vehicle repairs, announced a successful extended Series A round, raising £26.1 million. Notable participants included ITOCHU, JLR Investment, and Revo Capital, among others. As the cost of living rises across Europe, an increasing number of vehicle owners are turning to BNPL schemes to finance car repairs. Bumper, which has witnessed strong growth in the UK, is on a similar trajectory in Ireland, Spain, and Germany. In the short to medium term, the automotive-focused BNPL startup plans to expand further across European countries to cater to the growing demand for flexible payment options for vehicle repair services.

B2B BNPL gains momentum across Europe

The macroeconomic environment has presented challenges for businesses across various industries in Europe. Moreover, rising interest rates have made accessing capital more expensive for small and medium-sized enterprises (SMEs). Consequently, businesses are increasingly turning to B2B BNPL platforms to secure working capital for funding inventories and other operational needs.

Billie, Playter, Hokodo, and Mondu are among the B2B BNPL firms that have experienced substantial growth over the past year in Europe. These companies have also secured significant venture capital and private equity funding in 2022, with this trend expected to continue throughout 2023. As central banks continue to raise interest rates, access to capital through traditional means is anticipated to become costlier for SMEs, driving them towards B2B BNPL providers and further fueling the industry’s growth in the short to medium term.

European retailers embrace BNPL to boost sales

Companies are now recognizing BNPL as a potential tool for driving customer engagement, ultimately resulting in increased revenue and sales. Carrefour, the French multinational retailer, announced its intention to launch a BNPL product for in-store transactions as part of its Digital Retail Strategy 2026 aimed at enhancing omnichannel customer engagement across Europe.

As BNPL becomes an integral part of business strategies, more companies are expected to adopt BNPL schemes and embedded BNPL solutions in the coming years. This trend is anticipated to drive the value and volume of in-store BNPL transactions over the next three to four years, further contributing to the overall growth of the BNPL market.

Leading countries in BNPL adoption

According to The Global Payments Report 2023 by Worldpay, Sweden stands as the frontrunner in BNPL market penetration, consistently maintaining the largest market share. As early as 2016, Sweden set the precedent for domestic BNPL e-commerce payments, outpacing even the Netherlands with a two-fold increase.

Following Sweden’s lead, Germany and Norway secured the second and third positions in BNPL adoption.

Interestingly, the list of top 10 BNPL-adopting countries primarily consists of European nations, with Australia and New Zealand being the sole non-European countries among top-ranking nations. This underscores the widespread embrace of BNPL within Northwestern Europe, where it has gained the most traction.

The BNPL revolution is in full swing, with no signs of slowing down. As consumers increasingly adopt BNPL as a convenient and accessible payment method, the industry is experiencing unprecedented growth. With strong adoption rates across various consumer segments and the rising popularity of B2B BNPL solutions, the future appears bright for this payment innovation.

However, it is important to acknowledge the regulatory scrutiny surrounding BNPL and the potential risks associated with its widespread adoption. Striking a balance between convenience and responsible lending will be crucial in shaping the future of BNPL in Europe and beyond. As businesses, consumers, and regulators navigate this evolving landscape, one thing remains certain: BNPL has cemented its place as a major player in the global payments industry.