Mastercard: The Battle for AI Leadership

Artificial intelligence (AI) has permeated every facet of life, and this transformation is irreversible. Despite initial concerns about potential uncontrollability, AI has evolved into a valuable assistant and a potent workflow optimizer, yielding significant benefits for the financial sector. The transformative influence of AI in the operational landscapes of financial institutions is undeniable, emerging as a pivotal asset in the continuous fight against fraudulent activities.

Significant investments in generative AI startups, such as those made by Visa in October 2023 with a substantial $100 million venture fund, underscore the industry’s acknowledgment of AI’s transformative potential. In this evolving landscape, Mastercard, ranked as the third-largest fintech company worldwide by fintechmagazine.com, has recently unveiled a groundbreaking AI instrument, aiming to enhance fraud detection capabilities within its extensive network.

Mastercard has recently unveiled an advanced AI model, Decision Intelligence Pro, designed to revolutionize fraud detection across its network of banks. The proprietary model, developed in-house, employs a recurrent neural network to assess suspicious transactions in real time, showcasing Mastercard’s commitment to staying at the forefront of technological advancements in the financial sector.

Mastercard’s AI innovation is shaping the future of digital payments

In-House Generative AI Model. Mastercard‘s Decision Intelligence Pro leverages a proprietary recurrent neural network, a crucial component of generative AI, developed entirely in-house by the company’s cybersecurity and anti-fraud teams. The technology is designed to enhance fraud detection rates for financial institutions connected to Mastercard’s network.

Transformer Models and In-House Data. The model incorporates transformer models to harness the power of generative AI. Mastercard utilizes a vast amount of data gathered from its ecosystem of approximately 125 billion transactions annually, offering insights into merchant relationships and transaction patterns.

Heat-Sensing Fraud Patterns. Unlike conventional language models, Mastercard’s algorithm focuses on the history of a cardholder’s merchant visits to predict potential fraud. It generates pathways within the network, akin to a heat-sensing radar, providing a rapid response in just 50 milliseconds to determine the legitimacy of a transaction.

Rapid Decisioning Technology. Mastercard asserts that its new transaction decisioning technology can enhance fraud detection rates by an average of 20%, with some cases experiencing improvements of up to 300%. The rapid decisioning process is expected to result in significant cost savings for financial institutions.

Global Data Insights. Mastercard’s extensive ecosystem allows it to gather data globally from all customer transactions, enabling the identification of fraud patterns and trends across the entire payments ecosystem. The company has invested over $7 billion in cybersecurity and AI technologies over the past five years.

Anticipated Cost Savings. Mastercard anticipates that the new algorithm will help banks save up to 20%, eliminating costs associated with assessing illegitimate transactions and positioning itself as a leader in AI-driven fraud prevention.

Future Predictive Capabilities. The true potential of Mastercard’s technology lies in its ability to identify fraudulent patterns and trends, predicting future types of fraud not currently known within the payments ecosystem.

In conclusion

The profound impact of AI on the financial sector is unmistakable, with Mastercard’s unveiling of Decision Intelligence Pro marking a significant leap forward. By harnessing in-house generative AI models, transformer technologies, and vast datasets, Mastercard has positioned itself as a pioneer in fraud detection and prevention. The introduction of rapid decisioning technology and the anticipation of substantial cost savings further underline the transformative power of AI in the financial landscape.

As global fintech leaders continue to invest in and embrace AI, the race for dominance transcends mere innovation; it becomes a strategic pursuit of influential leadership in shaping the future of the financial industry. Mastercard’s foresight and commitment to technological advancements underscore its role as a trailblazer in the evolving realm of AI-driven financial services, setting the stage for a dynamic and competitive future.

The one snagging the top spot in exceptional AI implementation is set to hold significant sway in future leadership. So, who will it be: Mastercard or Visa?

The Market Volume of AI in Finance in 2024

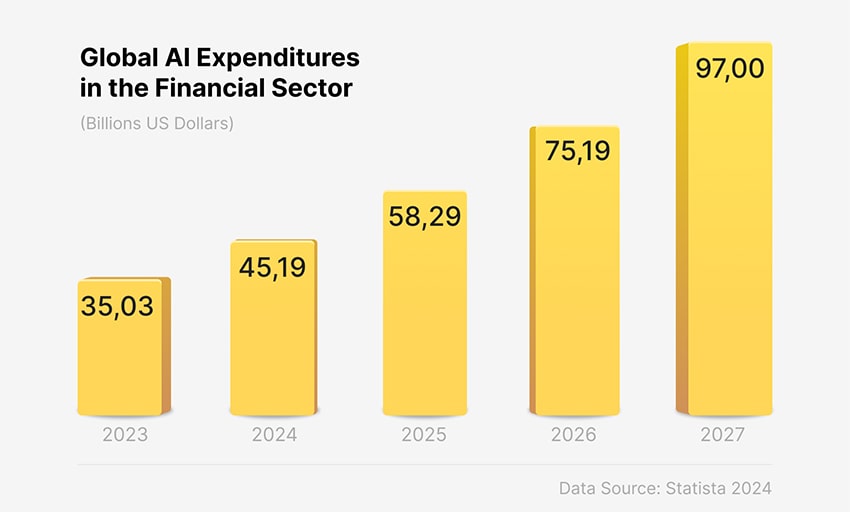

The pervasive integration of AI in the banking sector has ushered in a new era of efficiency and innovation. The AI market displays remarkable dynamism, especially in the financial sector. In 2023, expenditures on AI in finance reached an estimated $35 billion and were projected to rise to $45 billion, as per Statista data. It is noteworthy that the broader AI market is anticipated to skyrocket to an astonishing $97 billion by 2027. This exponential growth highlights the escalating influence of AI technologies within the financial industry.