Europe’s Top 10 EMIs in 2024: A Comprehensive Assessment

When it comes to choosing a financial institution, there are an array of factors that will help determine its credibility, risk management capabilities, and overall efficiency. From transaction processing speed to user-friendly interfaces, product diversity, fees, financial stability, customer support quality, and regulatory adherence, every aspect contributes to the institution’s standing. Recognizing the subjectivity inherent in any assessment, it’s advisable to rely on ratings from independent sources for a more accurate evaluation.

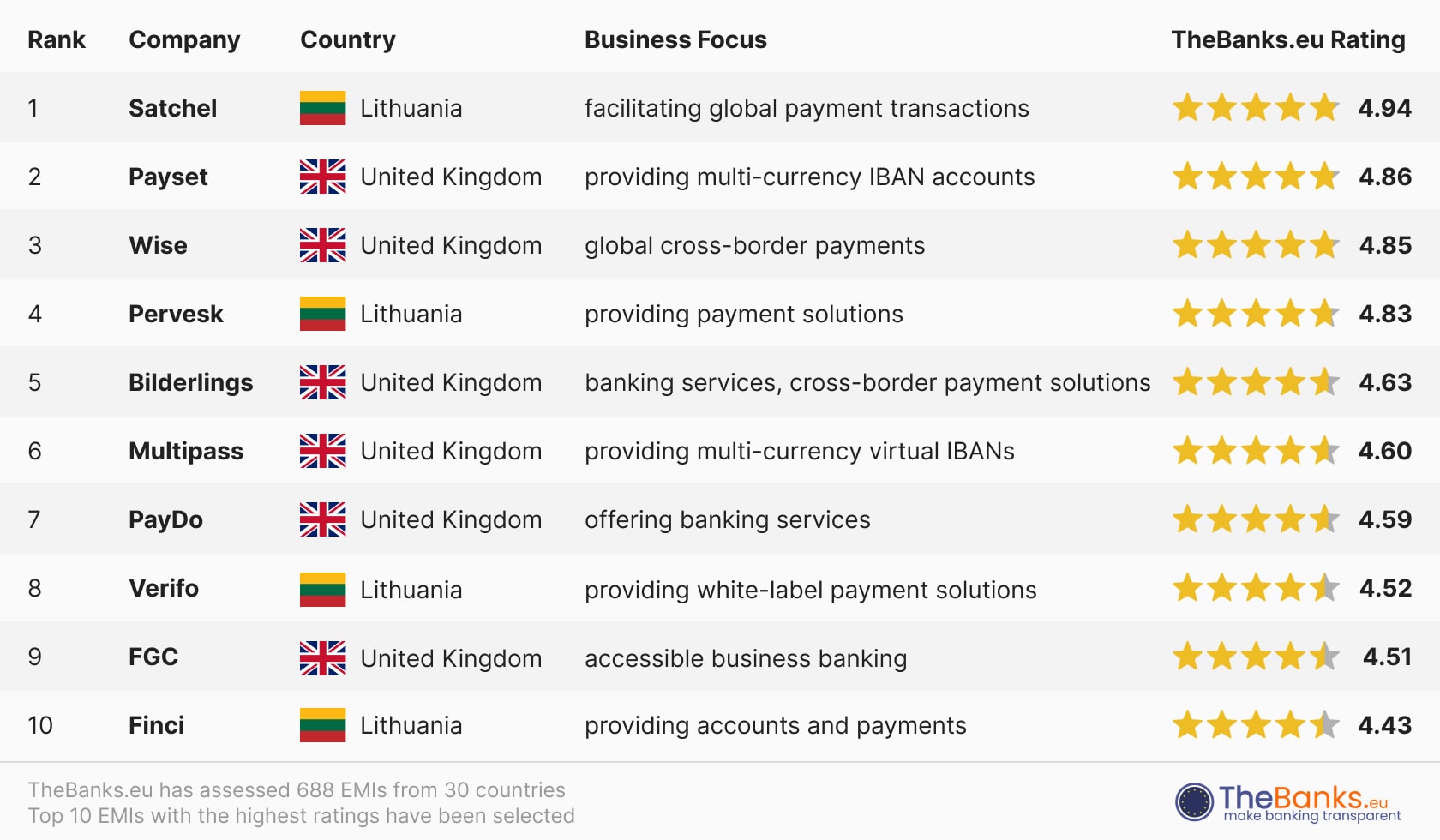

In a meticulous evaluation conducted by TheBanks.eu across 688 Electronic Money Institutions (EMIs) spanning 30 countries, the UK emerges as the leading EMI market, closely followed by Lithuania in second place. Among the top 10 EMIs with the highest ratings, six come from the UK, while four showcase Lithuania’s fintech expertise.

Leading European EMIs in 2024:

- Satchel, Lithuania – top-ranked with 4.94 out of 5.

- Payset, UK – securing the #2 spot, boasting a rating of 4.86.

- Wise, UK – holding the #3 rank with a 4.85 rating.

- Pervesk, Lithuania – securing the #4 spot with a rating of 4.83.

- Bilderlings, UK – claiming the #5 position with a rating of 4.63.

Rounding out the top 10 are MultiPass, PayDo, Verifo, FGS, and Finci (places from #6 to #10 respectively), each contributing to the vibrant landscape of Europe’s thriving neobank sector. Explore the ratings, delve into the details, and make informed choices for your financial needs in 2024.

You can access the comprehensive list below or by following this link.

What is an EMI?

An EMI is a financial entity authorized to provide a range of services, such as issuing IBANs and digital wallets for business and personal accounts, processing e-money transactions, and facilitating cross-border payments (SEPA, SWIFT, CHAPS, EFT, Faster Payments, and ACH). EMIs also offer features like multi-currency accounts and payment cards.

EMIs operate under licenses from their countries’ financial regulatory authorities, similar to traditional banks, ensuring consumer protection. The e-money license is typically granted by the national bank of the respective country, such as the Bank of Lithuania in Lithuania.

For users, digital banking with e-money institutions is as seamless and convenient as conventional banking, featuring user-friendly apps and easily accessible web client offices. Often referred to as neobanks or digital-only banking providers, EMIs enable digital transactions on behalf of customers, with the significant advantage of allowing online account opening without physical branch visits.

While EMIs offer a more limited range of services compared to fully licensed banks, they still enable users to facilitate both local and international payments. It’s important to note that EMIs are not authorized to provide loans, overdrafts, lending or investment services, or deposit rates.

The rise of EMIs in Europe started in 2009 with the introduction of Directive 2009/110/EC, known as the E-Money Directive, authorizing EMI operations. Nowadays, this form of banking is in its prime and will continue to evolve and grow its user base in the upcoming future.