Setting up multi-currency accounts

A multi-currency account offers the convenience of managing various currencies within a single banking platform. These types of accounts streamline cross-border transactions, serving as a pivotal resource for individuals and companies aiming to extend their reach beyond local markets. Whether you’re an expat, a frequent traveller, a startup accepting payments from around the world or an established corporation expanding into global investments, a multi-currency account provides the flexibility often missing in traditional banking.

With the growth of digital banking and fintech, multi-currency accounts have evolved to offer more than just currency storage/current accounts for sending or receiving funds. They now include features like real-time exchange rate updates and lower transaction fees, making them a comprehensive solution for diverse personal and business needs. But with these benefits also come challenges that need to be addressed.

In the following sections, we delve into the essential characteristics of multi-currency accounts, highlighting their advantages and the potential hurdles individuals and businesses may encounter when utilizing them.

What Are Multi-Currency Accounts?

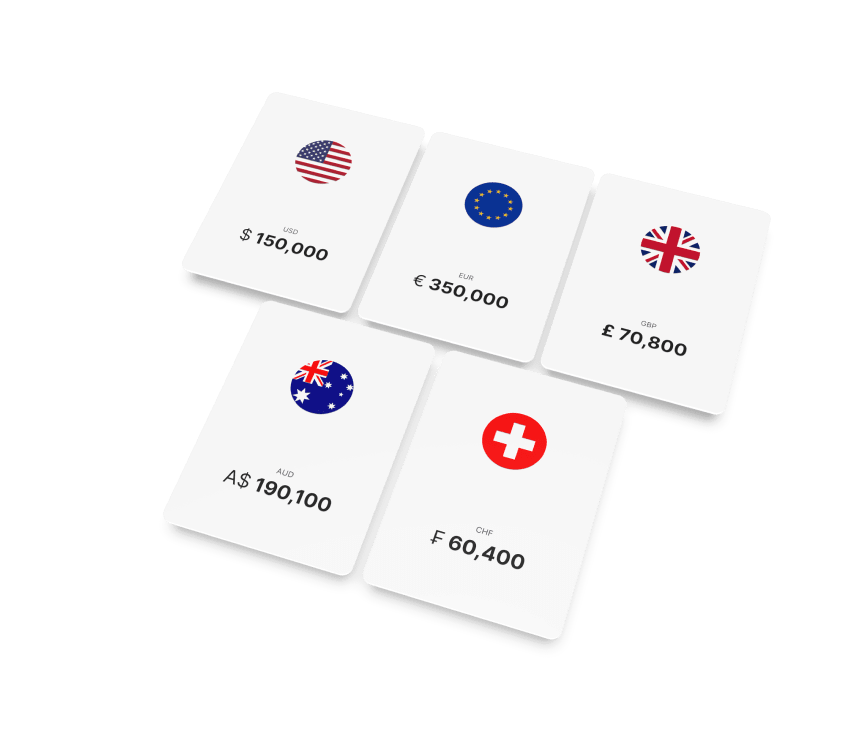

Multicurrency accounts are dedicated banking accounts designed to enable businesses to store, oversee, and conduct transactions in various currencies simultaneously. Unlike conventional bank accounts, which are usually tied to a single currency, multicurrency accounts empower account holders with the freedom to operate with multiple currencies without the need to convert funds.

With this solution, you can conduct transactions in foreign currencies without opening multiple accounts overseas. Designed to simplify your financial operations, multi-currency business accounts support a wide range of currencies, including essential ones like GBP, EUR, USD, JPY, CAD, AUD, HKD, SGD, CNY, and others.

In summary, these account types offer greater convenience and cost-effectiveness and are ideal for those who frequently make international payments.

How to Open a Personal Multi-Currency Account

Opening a personal multi-currency account is similar to the process of setting up a standard bank account. Generally, you’ll be required to provide the following details and documents:

- Personal information like your full name, date of birth, and email address.

- Proof of address, such as a recent utility bill or bank statement to verify your residence and the source of your funds.

Depending on the chosen banking provider, you might have the option to complete the account opening process online. The required amount of the initial deposit can vary, contingent upon the provider and the account’s specific terms and conditions.

Alternatively, you can opt for an Electronic Money Institution (EMI) with online onboarding and no initial deposit requirements, like Satchel. You can initiate the opening of a standard EU IBAN account by filling out an online form and providing just two documents — your international passport and proof of address. Once your standard EU IBAN account is active, you can apply for a multi-currency SWIFT account. For businesses, the process is similar, with the application submission and onboarding conducted remotely. However, the list of documents required is a bit more extensive.

Opening a Multi-Currency Business Account

Opening a multi-currency account for your business can offer several advantages, especially if you frequently deal with international transactions. Here’s a general guide on how to open one:

- Research banks/financial institutions. Look for banking providers offering multi-currency accounts for businesses.

- Check requirements. Prepare necessary documents like proof of identity and business registration.

- Choose an account type. Select an account with features and fees that meet your needs.

- Submit your application. Complete the application process online or in person.

- Verify your identity. Wait for the bank to verify the information you provided.

- Set up your online banking account. Receive login credentials for online banking.

- Deposit funds. Transfer funds in various currencies to your account.

- Start transacting. Use your account for international transactions.

- Uphold compliance requirements. Ensure compliance with regulations regarding international transactions.

We also recommend periodically reviewing your account activity, fees, and exchange rates to ensure that it continues to meet your business needs effectively. Consider switching to a different account or financial institution if better options become available.

Opening a multi-currency business account can pose challenges with traditional banks, not only due to the need for physical presence during the application process but also due to potentially costly initial deposits. E-money institutions offer a savvy alternative: no paperwork and transparent fees. Explore Satchel’s multi-currency business account for seamless global online banking.

Who Is Eligible to Open a Multi-Currency Account?

To qualify for a multi-currency account, individuals typically need to be at least 18 years old, with eligibility subject to residency requirements set by specific banking providers. Moreover, meeting minimum balance requirements may be necessary to initiate the account.

Some accounts are tailored to cater to businesses or individuals with significant assets, often imposing higher minimum balance thresholds. But keep in mind that final approval is subject to review by the compliance department of the financial institution.

Those who can benefit from a multi-currency account include:

- Businesses conducting cross-border trade and accepting payments in multiple currencies;

- Licensed iGaming and betting companies serving customers from various countries worldwide;

- Businesses that engage in international hiring or contracting;

- Expatriates managing financial obligations spanning multiple countries or currencies;

- Individuals involved in frequent international transactions.

For those with occasional or one-time cross-border transactions, alternatives such as standard current accounts, money transfer services, or travel credit cards may suffice, rendering a multi-currency account unnecessary.