Discovering: how Neobanks generate revenue

With finance undergoing a digital revolution, the demand for seamless digital banking experiences is higher than ever. While traditional banks scramble to adapt, neobanks are pioneering a new era of financial accessibility. But what exactly is a neobank? What sets them apart? And what benefits can it offer you? Let’s dive in and explore the ins and outs of neobanking.

Definition of a Neobank

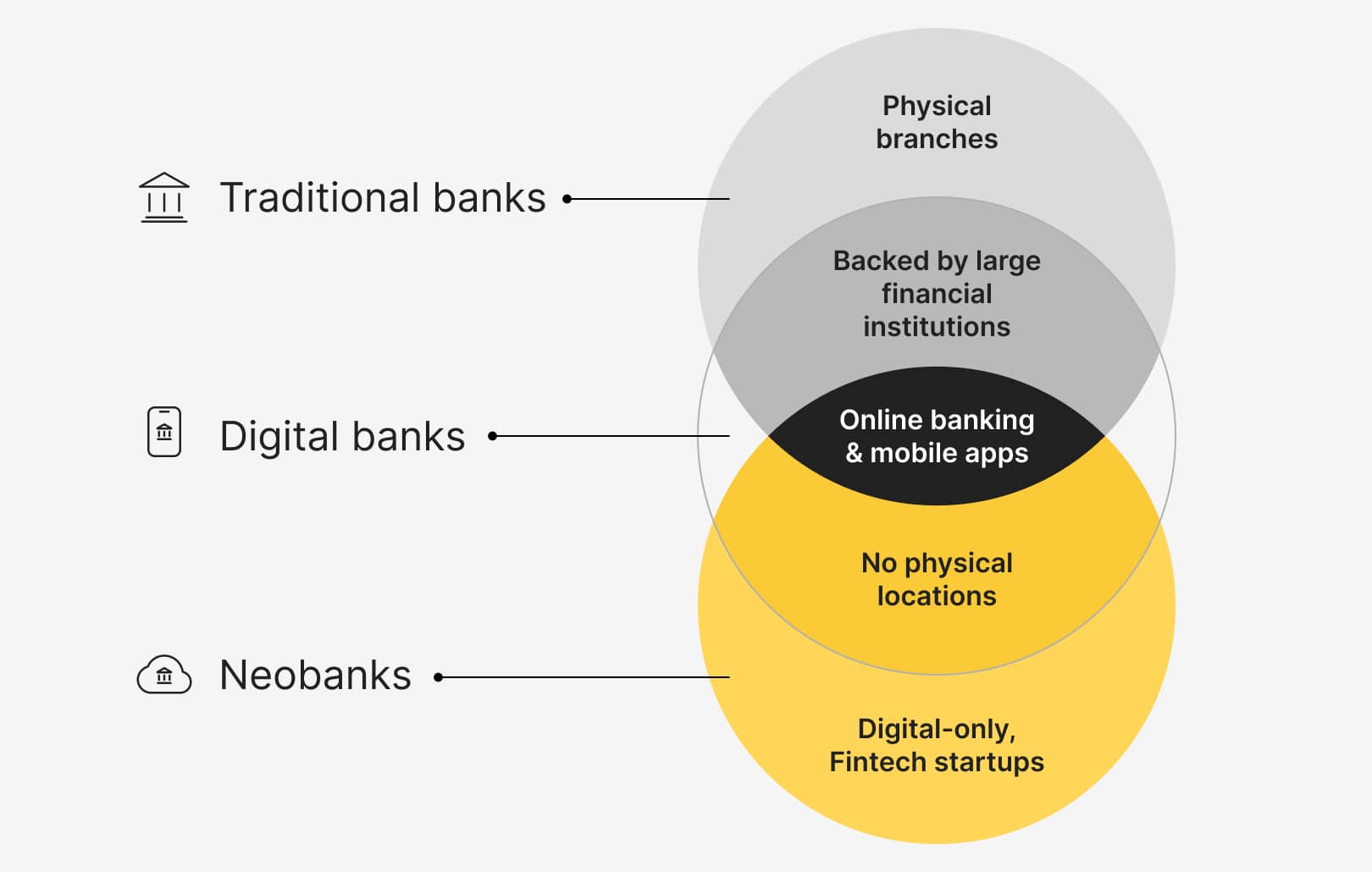

Neobanks represent a category of online fintech institutions at the forefront of banking innovation. They leverage advanced technology to provide essential banking services exclusively through digital channels, such as mobile apps and online platforms. Unlike traditional banks, neobanks do not operate physical branches. Instead, they offer customers digital-only banking solutions like seamless, remote account opening, online money management, and convenient digital payments and transactions.

Traditional Banks vs Neobanks: A Modern Banking Faceoff

In the evolving landscape of finance, neobanks and traditional banks stand as contrasting pillars of banking services. Neobanks, often dubbed digital or challenger banks, epitomize the future with their fully digital, user-centric approach, and sleek mobile apps and online portals.

On the flip side, traditional banks are the stalwarts of the financial world, boasting physical branches and a long-standing legacy. Despite their traditional roots, many have embraced digitalization, offering online and mobile banking options to meet changing customer needs.

It’s worth noting that partnerships between neobanks and traditional institutions aren’t uncommon, as they leverage established infrastructure and regulatory compliance. So, whether you’re drawn to the innovation of neobanks or the familiarity of traditional banking, there’s a banking experience tailored to your preferences.

Neobanks are built on the premise of operating without physical branches, conducting all their operations online. This streamlined approach helps reduce customer expenses. Additionally, neobanks utilize AI-powered technology to gather customer data, enabling them to offer personalized banking services tailored to individual users.

The extensive data amassed from their customers is leveraged to gain deeper insights into user behavior, pinpoint issues, and devise appropriate solutions. With highly automated systems in place, neobanks streamline the process of collecting, analyzing, and interpreting data, facilitating a better understanding of client interactions within the financial landscape.

Neobank Revenue: How Do They Make Money?

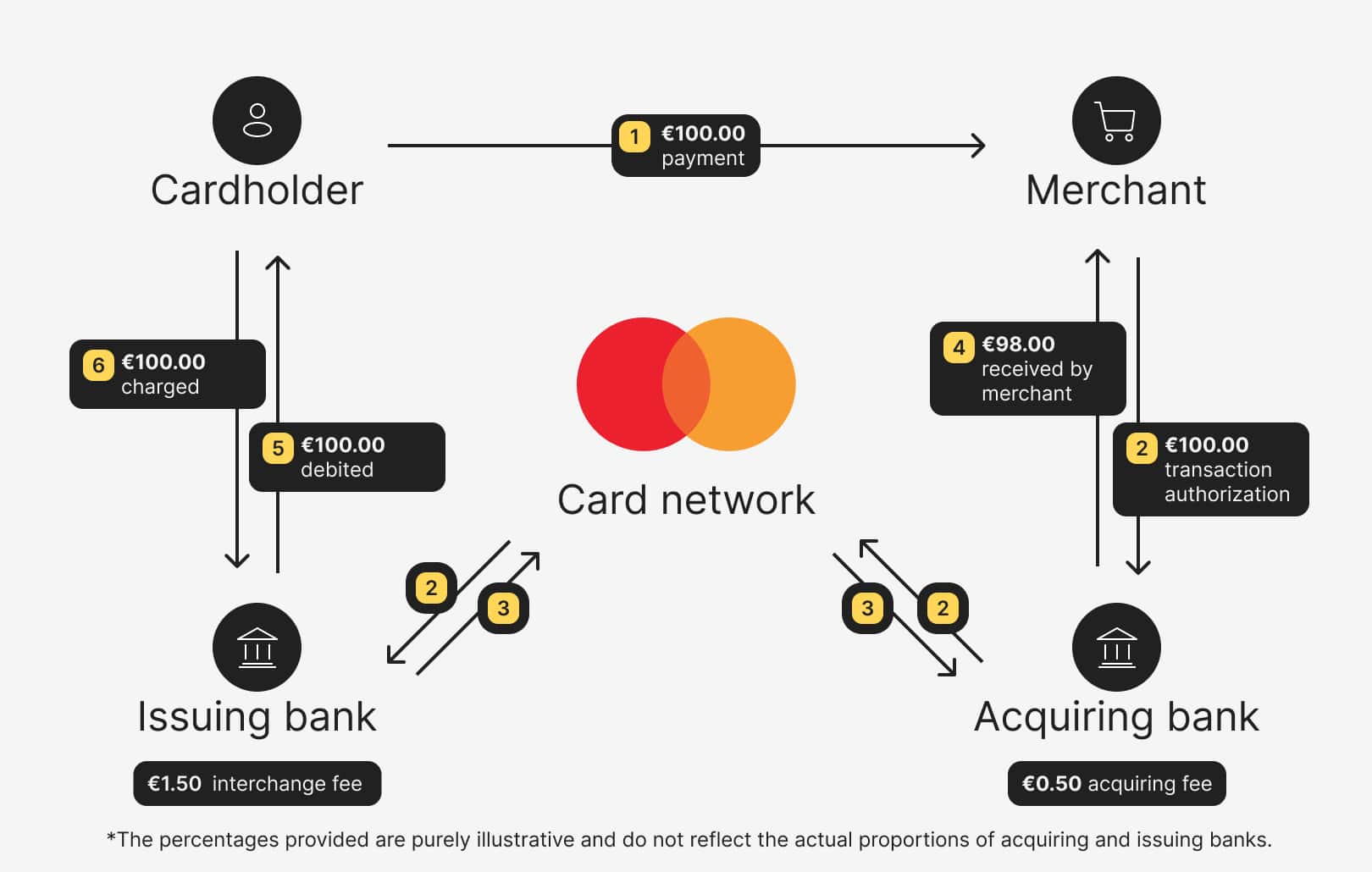

Neobanks, disrupting the traditional banking landscape, generate revenue through various channels. A significant chunk of their income stems from interchange fees, where businesses compensate them each time a customer swipes their payment card. Take YONO SBI, a leading Indian neobank with 50+ million users, for example. Every time a user makes a purchase using their debit card, the card network levies a fee, a fraction of which flows back to the bank.

Moreover, neobanks cash in on interchange fees from credit card transactions. Consider WeBank, a Chinese neobank, boasting an impressive 362 million customers. They rake in revenue by charging a fee for each credit card transaction and collecting interest on users’ overdue balances.

But it doesn’t end there. Neobanks also get interest on deposits and account openings, alongside earnings from ATM fees. With their finger on the pulse of modern banking, neobanks are revolutionizing the financial ecosystem, one digital transaction at a time. Ready to dive deeper into the world of digital banking? Keep reading!

Now that we’ve explored neobanks’ revenue streams, let’s dive into the pros and cons of these digital disruptors.

The Perks of Neobanking

Due to their digital-centric business model and the introduction of innovative tools and strategies like outsourcing, neobanks operate much more efficiently than traditional institutions.

- Seamless Banking Experience. There is no need to visit a physical branch and wait in long queues. Neobanks offer a user-friendly, digital-only experience, allowing you to manage your finances effortlessly directly from your preferred device.

- Lightning-Fast Transactions. Speed is the name of the game with neobanks. From account opening to money transfers and online purchases, neobanks outpace traditional financial institutions, ensuring you get things done in record time.

- Cutting-Edge Technology. Neobanks leverage AI-powered technology to deliver next-level services. By analyzing customer interactions, they tailor their offerings to your unique needs, providing a seamless banking experience.

- Hassle-Free International Payments. When it comes to global transactions, neobanks have you covered. Simply open an account and use your card for international payments—no need for complex upgrades as with traditional banks. Enjoy hassle-free transactions wherever you go.

- Cost Efficiency. Neobanks revolutionize banking by slashing operational costs. With no physical branches to maintain and fewer staff members needed, they pass on the capital savings to customers through competitive rates and zero monthly fees.

Neobanking Challenges

The challenges below underscore the need for continuous innovation and user-centric solutions to overcome barriers and ensure inclusivity.

- Regulatory Hurdles. Many neobanks operate without full-fledged banking licenses, relying on partnerships with established banks to offer their services. To avoid any regulatory issues, users need to exercise caution and ensure their chosen neobank is backed by a reputable licensed institution.

- Lack of Physical Presence. The absence of brick-and-mortar branches can be a drawback for some users, particularly those who prefer face-to-face interactions or feel more secure with a physical presence. This limitation may hinder trust-building efforts, especially among older users who are less familiar with digital banking.

- Technological Barriers. While cutting-edge technology is a hallmark of neobanks, it can also pose challenges for certain user groups, particularly older individuals who may not be as tech-savvy. Navigating complex digital platforms and advanced features may be daunting, emphasizing the importance of user-friendly interfaces and accessible customer support.

- Insufficient Human Support: As neobanks are more focused on catering to tech-savvy Gen Z users, it can be challenging to find a provider that offers human customer support rather than chatbots. This may lead to frustration and dissatisfaction among users seeking personalized assistance.

Neobank Success: 5 Innovative Business Models

In the dynamic world of neobanking, staying ahead of the competition requires a tailored strategic approach that reflects evolving market trends, customer behavior dynamics, and technological developments. Let’s dive into five cutting-edge neobank models reshaping the industry:

- Collaborative Ecosystem Approach. At the vanguard of innovation, the ecosystem-led model thrives on seamless connectivity and collaboration across various financial applications. By leveraging API technology, neobanks like Revolut have expanded their offerings beyond digital payment cards to include cryptocurrency trading, stock trading, and travel insurance. This approach has solidified their position in the neobanking space.

- Transaction-Driven Model. In this model, neobanks generate revenue through transaction fees for every monetary exchange. For example, Chime in the USA capitalizes on Visa fees whenever their cards are swiped, attracting customers with fee-free banking and early direct deposit features.

- Product Expansion Strategy. Breaking barriers to financial services, this approach emphasizes expanding product offerings. For instance, Monzo in the UK combines elements of the ecosystem-led model and product extension-focused approach, offering a range of financial services from budgeting tools to savings accounts and international transfers. Monzo’s vibrant brand and community engagement set it apart in the market.

- Asset-Based Model. Neobanks adopting the asset-led model specialize in offering savings accounts and deposits like high-yield savings and CDs. Marcus by Goldman Sachs is renowned for its high-yield savings accounts and personalized services, carving out a niche in the market.

- Credit-Centric Strategy. Centered on credit card services, the credit-led model focuses on transaction fees and interest earned from carried balances. Nubank, a Brazilian neobank, is a prime example, offering user-friendly apps and transparent services that have made it a popular choice in Brazil.

Neobanking emerged as a response to the transformative digital shifts in the finance sector, and it has certainly delivered on its promises. Today, customers reap the benefits of neobank features, freeing themselves from the cumbersome processes of traditional banks by accessing services that align with their preferences.

For aspiring neobank owners, Satchel provides cutting-edge digital retail white-label banking software tailored to your unique needs. Build and customize your neobank with confidence. Reach out to us for further details: [email protected] or call us at +370 5214 22 78.