Opening a Business Account in Hungary

- A unique European IBAN for online banking worldwide

- For EU and non-EU residents

- SEPA and SWIFT transfers supported

- 24/7 access to funds via the Satchel app and web Client office

- Funds protected by 3D Secure and 2FA

- No hidden fees

Facilitated by a fully licensed financial organization

Secure funds

All funds are stored in a segregated account in the Bank of Lithuania.

Transact with ease

Manage your daily transactions with clients, partners, and suppliers.

Invest smartly

Invest your dividends or extra earnings to increase corporate capital.

Simplified accounting

Keep track of your account balance and transaction history for efficient and transparent bookkeeping.

Remote business account opening in Hungary

Open your digital business accounts hassle-free

- Free online application submission

- No initial deposit required

- Free SEPA Instant setup

- Transparent pricing with no hidden fees

- Enhanced data protection measures

Payment cards that cover your needs

Physical and virtual cards for daily purchases

Contactless payments

Payroll programs

ATM withdrawals worldwide

Tailor-made pricing

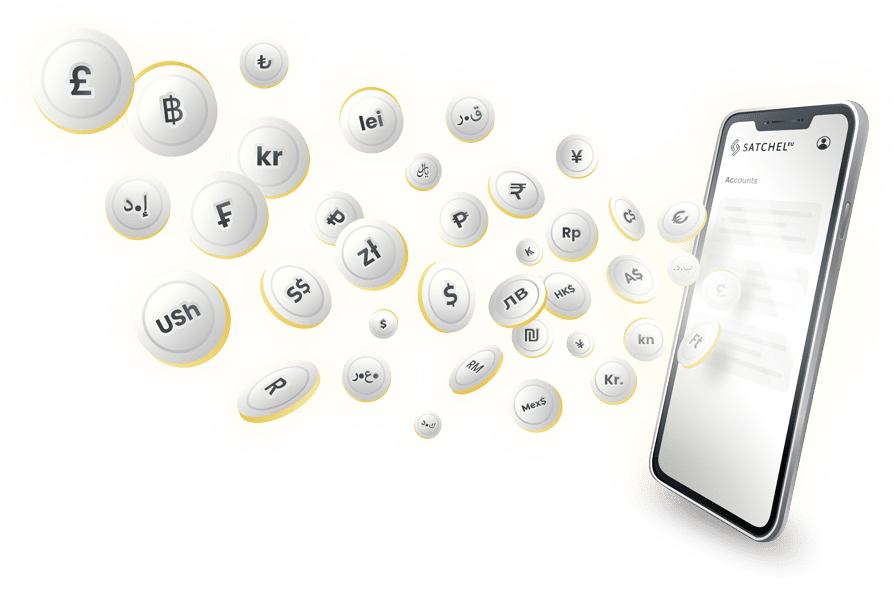

Multiple currencies for cross-border payments

No more separate accounts for each foreign currency. Send and receive money around the world in 38 currencies with a multi-currency IBAN linked to a single account.

Expanding into Europe was a big move, but the paperwork at my old bank was killing me. Then along came Satchel – opening an account with them made so much difference. Their services are more than enough for the daily management of company finances. Plus, their payroll program with Mastercard cards for my employees made everything so much easier. My accountant's loving life now, and I can actually focus on business without all the headaches. Thanks, Satchel! You're a lifesaver.

Emily J.CFO at Crypto Barometer

Payroll program

- Send batch payments using our API

- Issue from 3 to 100 cards

- Transfer funds directly from the Client office or the Satchel app

Switching from regular banks to Satchel's digital platform has been amazing. Opening my account online was super easy. What I really like is how I can always chat with my manager whenever I need help. Handling my payments with Satchel is simple, especially with quick transfers in the EU and abroad. Big thanks to the Satchel team, highly recommended!

Oliver T.CEO at SilverBlue Innovation Ltd.

Payroll program

- Send batch payments using our API

- Issue from 3 to 100 cards

- Transfer funds directly from the Client office or the Satchel app

Discover the EU-China business direction

Make transfers in Chinese Yuan and Hong Kong Dollar and expand your presence in the Hungary, European and Chinese markets. Residents of both Hungary and China are eligible to open an account.

EU-CHINA PAYMENT INFRASTRUCTUREAccounts can be opened for residents of the EU, Hungary, and China

The Satchel Mastercard debit card

Meet the card you’ll love even more.

Link it to several accounts in different currencies

Pay in the currency of the transaction

Avoid currency exchange fees

Direct access to your funds 24/7

Safe & Sound

Experience streamlined daily banking with our top-notch security standards that keep your money and personal data safe.

- Regulated by the same supervisory authority as traditional banks

- Licensed as an electronic money institution in 2018

- Funds safeguarded by the Bank of Lithuania

- Enhanced security with 3D Secure and 2FA

Choose the option that suits you best

|

Local

LT residents |

European

EU residents |

International

non-EU residents |

|

|---|---|---|---|

| Monthly maintenance fee | € 4 | € 35 | € 50 |

| Additional account opening (sub-account) | € 50 | € 50 | € 150 |

| Instant transfers between Satchel users | Free | Free | Free |

| SEPA transfers (incoming) | Free | Free | Free |

| SEPA Instant transfers (incoming) | Free | ||

| SEPA transfers (outgoing) | |||

| SEPA Instant transfers (outgoing) | |||

| SWIFT transfers (incoming/outgoing) | |||

| Mastercard physical card | |||

| Virtual cards | |||

| Cash withdrawals across the globe | |||

| Mobile banking APP | |||

| In-app live chat support | |||

| All your money is protected by the Bank of Lithuania | 100% Secure | 100% Secure | 100% Secure |

FAQ

A business bank account is designed to help legal entities, including companies, limited liability partnerships, sole proprietorships, and startups, manage their financial operations. These accounts are essential for streamlined business transactions with suppliers, partners, customers, employees, and other stakeholders.

Business bank accounts offered by traditional banks provide a range of services, including domestic and international payments, currency exchange, debit/credit/prepaid cards, overdraft facilities, payroll processing, and deposit/savings accounts, alongside loans. On the other hand, business accounts with electronic money institutions (EMIs) offer simple and secure remote account opening and a variety of payment operations, omitting interest, loans, or savings options.

Opening a business account in Hungary is straightforward.

You have two provider options: traditional banks or neobanks/EMIs like Satchel. The accounts available in both options offer the same functionality and come with a unique IBAN for conducting essential financial operations.

The main difference between the two is the speed, convenience, and ease of account opening. With an EMI, the entire process is done online, from submitting the form to scanning documents and completing the onboarding.

At Satchel, business account options are available to both EU and non-EU residents, so you won’t need to make a trip abroad to open an account in person.

You will need to provide the following documents to open a business account with Satchel:

1. The online application form.

2. Copy of the business owner’s passport or ID (only for citizens or residents of the EU or the EEA).

3. Proof of address.

4. A detailed description of the business.

5. Corporate documents.

6. Supporting documents on clients/suppliers.

7. Documents providing information about initial funding.

8. Verification through the Ondato solution.

You can find more information here.

Opening business accounts in Hungary remotely involves several stages:

- Application Form Submission: Begin by clicking on "Open business account", where you'll fill out the application form and upload all required documents.

- Onboarding: Your application form will undergo review by our Compliance department.

- Password Creation: Once your application is submitted, you'll receive an email containing a link to create a password for logging into your Client office. This link remains valid for 24 hours.

- Notification: Following the review of your application, you'll receive an email notifying you of the outcome of the onboarding process.

It's worth noting that unlike many traditional banks, we do not charge any fees before your application is approved. Fees are only applicable upon successful onboarding, in accordance with our fee structure.

Satchel provides digital finance solutions to customers of various nationalities, located all over the world. However, there are certain countries from which we do not onboard clients. Please consult our Blacklisted jurisdictions page to make sure your country is not on the list before submitting your application.

While it is possible to open a European bank account without EU residency through traditional banks, this often entails visiting a physical branch to provide the necessary documentation. Moreover, non-residents may encounter higher fees and more service restrictions compared to residents.

Digital-only banking providers offer a more convenient option. Non-residents can open a business account online in Europe without the need for physical presence in the region. Satchel offers special non-EU tariffs for business accounts for non-residents. All you need to submit your application is proof of address from your home country (any utility bill issued not earlier than 90 days prior to the application form submission), and a bank reference letter or a bank statement translated into English or Lithuanian. Please check the prohibited countries and activities page before applying.

Latest news

SEE ALL Virtual business payment cards: 5 myths standing between you and smarter payments

Virtual business payment cards: 5 myths standing between you and smarter payments

Shortcut to becoming a fintech pro

Shortcut to becoming a fintech pro

What do You Need to Open a Business Bank Account

What do You Need to Open a Business Bank Account

Online Bank Account for Your Business – The Future is Now

Online Bank Account for Your Business – The Future is Now