Fraud Prevention: How To Prevent Risk Costs

With a lot of simplifications, modern banking and fintech can be described as managing the customers’ funds for them by taking all the risks yourself. These risks in form of provided credits, investments, funding, and more, give the value to the bank’s product and allow it to generate profits. In other words, the global banking ecosystem generates profit by risking the funds in their possession.

However, there are considerably more risks that these institutions should avoid as much as possible, as they only harm the value. These are external and internal fraud, employment practices, selection of clients, physical damage to the assets, system operation disruptions, and process management. While most of them have well-developed protocols to avoid any discrepancies, fraud and fraud prevention remain the main issues in the fintech risk management practice.

Why Is Classic Fraud Prevention Obsolete

Throughout the last two decades, the global banking ecosystem has developed a vast set of precautions that allow securing the business operations from any kind of external fraud, from payment card theft to cyberattacks. The preventing measures are often quite simple, but require additional actions and checks to be performed for virtually any kind of operation. For example, a bank can restrict the card to be used only within a country, or for small transactions only. While these fraud prevention measures sound logical, together they make the final product inadequately hard to use.

Another issue, often overlooked by classic fraud prevention protocols, is the internal fraud, coming from within the organization. Employees that have access to valuable fintech assets under management and may use it for their own profit. Banking institutions that employ an obsolete fintech risk management approach, can lose up to 5% of their profits due to intentionally incorrect evaluation of assets, tax evasion, data resale, and bribes. In most cases, the possibility of such fraud is not considered at all, as the management simply doesn’t believe in it, especially in startups and smaller businesses.

What Does Modern Tech Offer

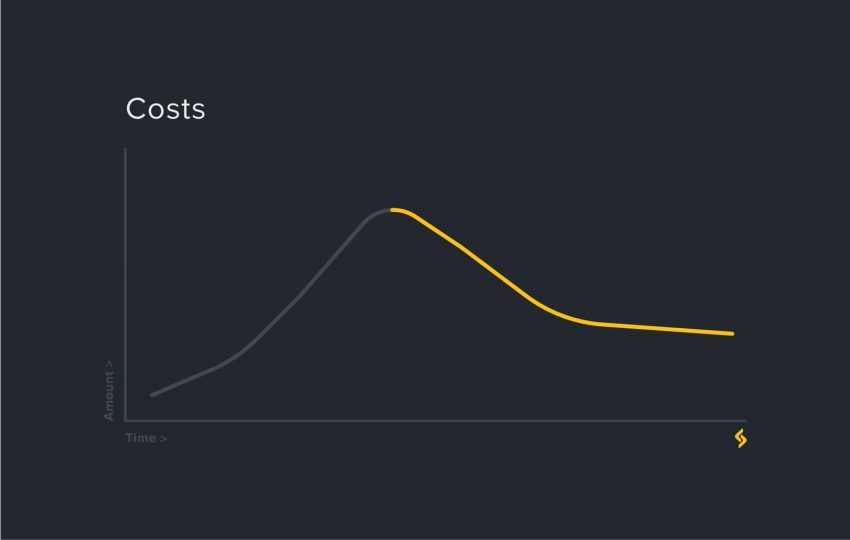

The modern fintech risk management relies on data analytics and automation for both internal and external fraud prevention. Instead of restricting all transactions with any minimal fraud possibility, super-fast and complex monitoring algorithms evaluate every action, and only if a potential threat is flagged, the system takes measures.

This not only applies to simple transactions, but to all customer interactions with the banking systems, starting from background checks during the KYC process, and ending with the affiliation check at the moment of offering a credit or credit card limit.

Fraud prevention algorithms can also evaluate internal fraud by re-checking the asset value mismatches, inappropriate transactions, and suspicious activity in a customer’s account. This way, fraud prevention allows catching any malicious activist before they grow the volumes.

Fraud Prevention Beyond FinTech

The data that fraud prevention algorithms collect and analyze, can be used in further applications in both securely transferred personalized or anonymized form. The current SupTech (Supervisory Technology) is able to match customer’s data from different banking service providers to find financial affiliations and full transacting history to prevent actions such as money laundering or tax evasion.

The RegTech (Regulatory Technology) providers can access quantized user data in order to speed up and make more precise the KYC processes they will need to undergo in the future. For example, while signing up a new customer to their financial product, an institution can check the customer against the RegTech data collected automatically with fraud prevention systems in other banks, instead of taking unnecessary credit risks or asking the customer to provide certification from local tax authorities.

Sustainable Financing with Satchel Corporate Products

We at Satchel made sure to apply the best fintech risk management practices into our operations and products. Being a licensed payment institution that operates under the supervision of the Lithuanian Financial Supervisory and an official MasterCard Europe member, Satchel provides reliable and secure corporate banking tools to scale your business.

If you are searching for a trustworthy fintech partner to handle fraud prevention, KYC/AML processes, and risk control, apply for the corporate account today.