The Power of Embedded Finance: A Comprehensive Deep Dive

Embedded Finance: All You Need to Know

We are witnessing a transformative phase in the seamless fusion of financial services with the everyday life routine. Both individuals and businesses now recognize that the true value of financial service offerings lies in a cohesive customer journey rather than in isolated interactions that merely accompany the journey. This paradigm shift signifies a departure from traditional norms, as financial services become an integral thread woven into the fabric of our interconnected experiences.

This transformative approach is gaining immense popularity due to its ability to enhance customer experiences and open up new avenues of growth. As we delve into this evolution, let’s explore the core of embedded banking, its distinctiveness from BaaS (Banking-as-a-Service), and the trends driving its expansion.

What is Embedded Finance?

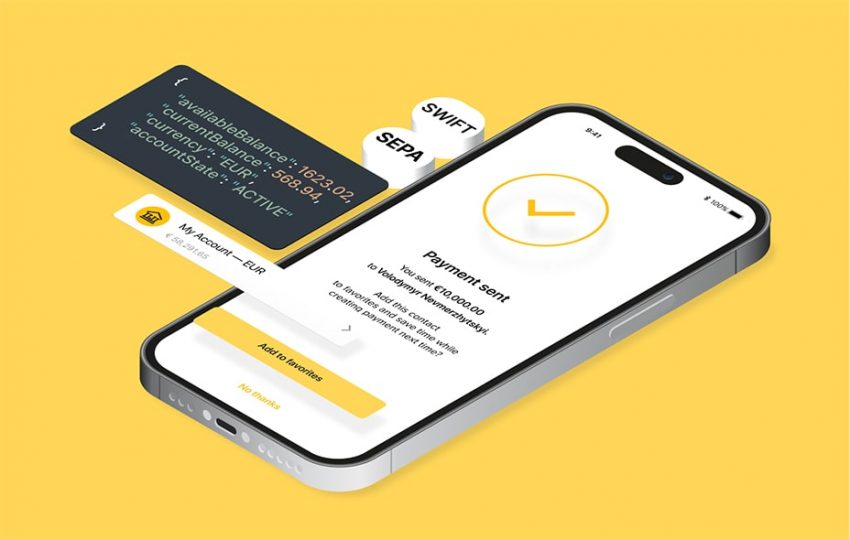

Embedded finance refers to the seamless incorporation of financial services or tools directly into the products or services offered by non-financial entities. This integration spans across various financial functionalities, including payment processing, account management, digital loans, and buy now pay later (BNPL) financing. The significance of embedded finance lies in its capacity to empower any businesses with no financial licenses to offer personalized financial solutions to their customers. This transformative approach leverages existing software, APIs, payment gateways, and other infrastructure, facilitating a frictionless experience for consumers while expanding the potential services offered by non-financial entities.

A recent study done by Ernst & Young asked more than 20 top leaders in fintech around the world for their opinions. An impressive 94% of these leaders think that success comes from providing financial products that match what customers need right away. It’s worth mentioning that lots of current financial products don’t work in real-time situations. This survey also emphasized a big and increasing interest in creating embedded ideas.

The Airbnb case exemplifies the role of embedded finance in elevating services. Hosts can now receive payments directly through Airbnb, simplifying transactions. Airbnb has also introduced insurance and financing options for hosts, enhancing security and support, as well as co-branded credit cards in collaboration with JPMorgan Chase.

Are Embedded Finance and BaaS the Same?

In essence, yes. BaaS (White Label banking) and embedded finance share common ground. BaaS operates as a service model, where banks or financial institutions extend their banking infrastructure and services to third-party businesses. On the other hand, embedded finance focuses on seamlessly integrating financial services into platforms that are not primarily associated with finance in nature. While BaaS is a broader concept, embedded banking falls within its scope as a specific component. BaaS and embedded finance are closely connected. The evolution of White Label banking, which began with co-branded payment cards, has gone through big changes with advanced technology and cloud computing. Banking functionalities are becoming the heart of many important apps,providing a smoother and more satisfying experience.

Why is Embedded Finance So Popular?

BaaS providers utilize modern API platforms to offer adaptable modular banking solutions to non-financial service brands. These solutions harness the structured and regulated infrastructure provided by licensed banks / EMIs. The integration of open API platforms and customized front-end customer journey technologies speeds up collaboration between FinTechs and brands. Cloud solutions, digital architecture, and widespread mobile device use contribute to quick scalability, real-time data exchange, and enhanced connectivity, strengthening the bond between brands and their customers.

According to EY’s 2023 survey, over 70% of respondents foresee a significant portion of financial services being available through non-financial platforms soon. For non-financial companies, owning substantial customer transaction data becomes an asset, enabling deeper insights into individual profiles and tailored offerings based on specific preferences.

Consequently, diverse valuable embedded offerings are emerging. For instance, retailers securely storing customer card information in their apps enables instant, effortless payments with a single click. Likewise, e-commerce platforms enable merchants to establish financial accounts directly in their system, eliminating the need for a separate traditional business bank account.

Key Trends in Embedded Banking for the Next 3 Years

Seamless Integration: Embedded banking aims to create a seamless experience by integrating financial services directly into customers’ in-app routines. This trend eliminates the need for separate financial interactions and makes banking a natural part of daily life.

Customer-Centric Approach: The focus of embedded banking is to tailor financial services according to individual customer needs. By seamlessly integrating financial offerings into existing customer journeys, companies can enhance customer satisfaction and engagement.

Data-Driven Personalization: The integration of financial services within non-financial platforms empowers banks to leverage customer data for personalized solutions. By analyzing customer behavior and preferences, banks can deliver targeted services that resonate with individual needs.

Exploring New Revenue Streams: Collaborative efforts between traditional financial institutions and non-financial businesses open doors to innovative revenue streams. By expanding their offerings beyond traditional products, firms can tap into new avenues for growth and profitability.

The evolution of BaaS / embedded banking is further propelled by the top three most sought-after product offerings anticipated to be in demand for the next three years:

For businesses:

- Embedded Bank Accounts

- Embedded Credit

- Digital Payment Acceptance

For retail customers:

- Digital Payments

- Embedded Bank Accounts

- Card Issuance

In conclusion

Currently, embedded finance and BaaS providers are discovering and presenting new ways to offer valuable services that catch the attention of the users. We are increasingly noticing that potential partners are becoming more prepared and experienced in exploring embedded finance solutions.