How to Open a Payment Account Online in Latvia

Are you looking to open an account in Latvia but don’t know where to start? Opening a payment account online can be a great way to manage your finances in this country. In this article, we’ll provide you with an overview of the available options for opening an account in Latvia online and the steps you need to take to do so. We’ll also discuss the benefits of opening a payment account online in Latvia and the documents you’ll need to provide in order to complete the process.

Can a non-resident open an account in Latvia?

Yes, non-residents may open a payment account in Latvia. To open an account with any of the financial institutions in Latvia, a non-resident will need an international passport, proof of residence/ residence permit / foreign resident card, proof of address (e.g. a utility bill), and a work contract. Generally, financial services providers will require that the account be opened in person, although some of them offer the possibility to open the account remotely.

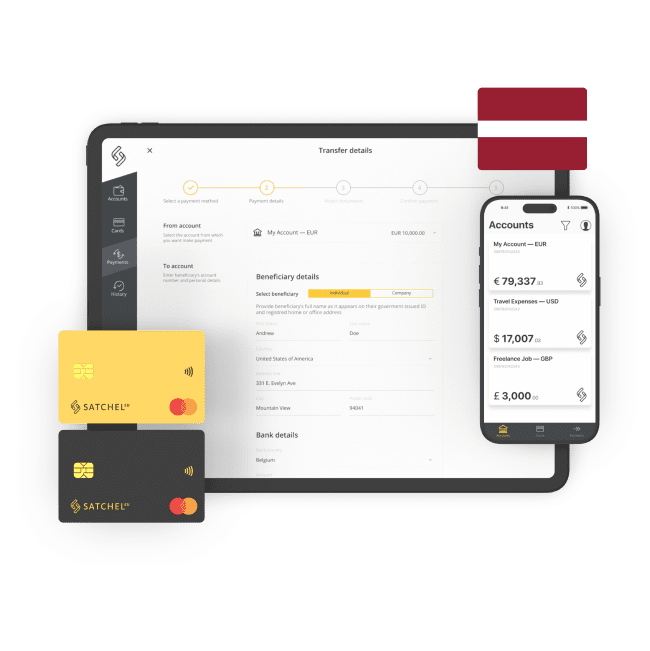

Modern digital banking providers like Satchel.eu have taken a progressive step forward in personal accounts opening. In addition to your international passport, a utility bill from your home country is now accepted as valid proof of address. This means that you no longer need Latvian or EU residency to obtain an account with a unique European IBAN and a Mastercard payment card.

The main pitfall for non-residents opening an account in Latvia is the lack of protection from the Latvian Financial Regulator (FCMC). As a result, there is an increased risk that a non-resident’s funds could be lost if the financial institution fails. Furthermore, customers may not be able to access their funds in the event of a crisis or emergency. Additionally, non-residents may have limited options when it comes to customer service, as financial services institutions may not offer much support to non-residents. Finally, non-residents may also have difficulty understanding the language and regulations that apply to the local financial sector.

To mitigate potential risks, consider opening an account at an EMI (electronic money institution).

How long does it usually take to open an account in Latvia?

It typically takes two to four weeks to open a business account in Latvia and up to one week for a personal one. The time frame can vary depending on the financial institution, the type of account being opened, and the required documentation. To open a business account, the customer will typically need to provide additional documents such as a business plan, financial statements, and a business registration certificate.

What is the fastest way to open a payment account in Latvia?

Digital banking providers are an increasingly popular method, due to their generally flat rates and lower fees compared to those of traditional financial institutions, which apply to both business and personal accounts. When it comes to saving money, the onboarding charges are a key point to consider. Latvian traditional banking institutions typically charge a non-resident account opening fee in the range of 100 to 500 euros. In contrast, submitting an application to most EMIs is usually free. For example, at Satchel.eu, customers only pay after their application has been successfully approved – if the application is refused, no charges will apply.

At the same time, EMIs provide all the necessary banking services: IBAN / account opening (in EUR, USD, GBP, CHF, etc.), plastic or virtual payment cards, SEPA and SWIFT transfers, and convenient mobile apps for seamless money management. For businesses, it is usually also possible to implement a payroll program. International EMIs such as Satchel, Wise, and Revolut are the most commonly chosen ones when opening a current account online in Latvia.