What Is a Profit Margin and How to Calculate It?

To achieve success as a business owner or manager, it is fundamental to track key performance metrics that indicate the financial health of a venture. One such metric is the profit margin.

Profit margin is a financial metric used to measure the profitability of a business. It is a ratio that compares the amount of profit a business earns to the amount of revenue it generates. In this article, we will discuss what a profit margin is, how to calculate it, and what types of profit margins exist. We will also provide examples and show how to calculate profit margin using Excel.

What is a profit margin?

Profit margins are one of the most widely used financial ratios, typically expressed as a percentage, that convey a company’s profitability by accounting for the costs associated with the production and selling of goods. A high profit margin indicates that a business is generating a significant amount of profit relative to its revenue, while a low profit margin suggests that a business is not generating as much profit as it could be.

Types of profit margins

In order to get an insight into how efficient company operations are, you can use three types of profit margins: gross profit margin, operating profit margin, and net profit margin.

Gross profit margin

The gross profit margin is a metric that calculates the profit remaining after accounting for the cost of goods sold (COGS). It does not take into consideration overhead expenses such as utilities or rent. It is a straightforward profitability metric that helps determine the profit generated by individual products or services, providing insight into which items are the most and least profitable. However, it is not typically used to calculate the overall profit margin of a business.

Operating profit margin

Operating profit margin calculates the profitability from the day-to-day operations of a business by considering all expenses associated with running the business such as overhead, operating, administrative, and sales expenses. However, it does not take into account non-operational expenses like debt, taxes, etc. In simpler terms, it provides an understanding of a company’s earnings from its core operations.

Net profit margin

Net profit margin, also known as the bottom line, calculates the overall profitability of a business by considering all expenses and income. It includes costs such as cost of goods sold (COGS), operational expenses, debt payments, taxes, one-time payments, and any income from investments. It provides insight into the business’s ability to convert income into profit and is usually used to determine the overall profitability of the company, measuring the percentage of profit generated from the total revenue.

The formula for profit margin

Below you will find the formulas for calculating the three essential profit margin ratios introduced earlier:

Gross Profit Margin = Gross Profit / Revenue x 100

Operating Profit Margin = Operating Profit / Revenue x 100

Net Profit Margin = Net Income / Revenue x 100

Profit margin formula in Excel

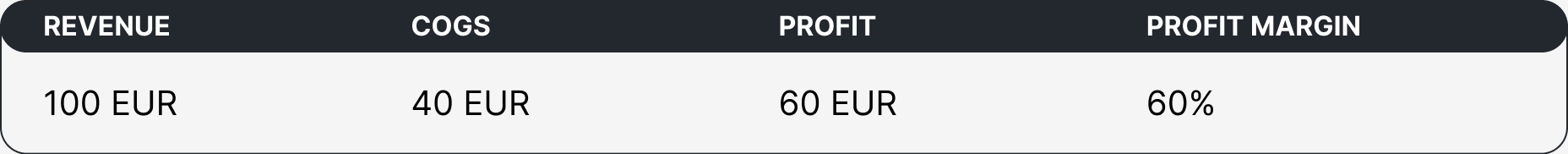

Calculating gross profit margin can be simplified by using computer software, such as Microsoft Excel. Knowing some essential information, like revenue and the cost of goods sold, you can use a spreadsheet to make the calculation process more manageable.

You will need four columns to make the calculation work:

- Insert your revenue figures in the first column.

- Use the second column to input the COGS.

- The third column is the place for the overall profit formula, which is the difference between columns one and two.

- Finally, in the fourth column, you will have to insert the profit margin formula: Overall profit (column three) / revenue (column one) x 100.

For easier visualization, here is what your final result should look like:

Example of profit margin calculation

Let’s look at one of the biggest multinational corporations with a 123.08 billion market capitalization – Starbucks (SBUX). The company closed its 2021 fiscal year with the following indicators:

- $29.06 billion in revenue

- $20.32 billion in gross profit

- $4.87 billion in operating profit, and

- $4.2 billion in net profit.

Below, you can find a calculation of Starbucks’s profit margins, based on the aforementioned input:

- Gross profit margin: ($20.32 billion / $29.06 billion) × 100 = 69.92%

- Operating profit margin: ($4.87 billion / $29.06 billion) × 100 = 16.76%

- Net profit margin: ($4.2 billion / $29.06 billion) × 100 = 14.45%

This example calculation highlights the importance of gross and operating profit margins, as weak figures at these levels suggest that funds are being lost on basic operations, making it more complicated to cover tax and debt payments.

What is a good profit margin?

A good profit margin varies considerably depending on the industry. What is considered good for one company may be critically bad for another. Among the factors that determine whether a profit margin is healthy or otherwise are the number of employees, business size and location, operating systems, and inventory management practices.

To give a better example, grocery stores typically have a profit margin of around 1-2%, while technology companies may have a profit margin of 20% or higher. As a general rule of thumb though, a net profit margin of 10% is considered healthy for most businesses, while a 20% margin is high, and a 5% margin is a reason for concern.

To wrap things up

Profitability metrics are crucial for business owners as they identify areas of weakness in the operational model and enable consistent performance tracking in comparison to previously achieved results. For investors, a company’s profitability has significant implications for its future growth and investment potential. Furthermore, this type of financial analysis allows both management and investors to gauge the company’s performance relative to its competitors.

A business account is an essential tool that will allow you to keep your finger on the pulse of your business’s cash flow and identify any potential issues in a timely manner. With a Satchel business account, you can leverage efficient and easy-to-use tools for corporate money management to always make sure your key financial metrics are in great shape.

What you get:

- Remote account opening

- Multi-currency IBAN

- Mastercard cards for business expenses

- SEPA & SWIFT transactions in 38 currencies

- Currency exchange at market-beating rates

- Intuitive mobile app

- Personalized support

- A range of API integrations

- Protection with smart security features